M.D.C. Holdings Announces 2013 Second Quarter Results

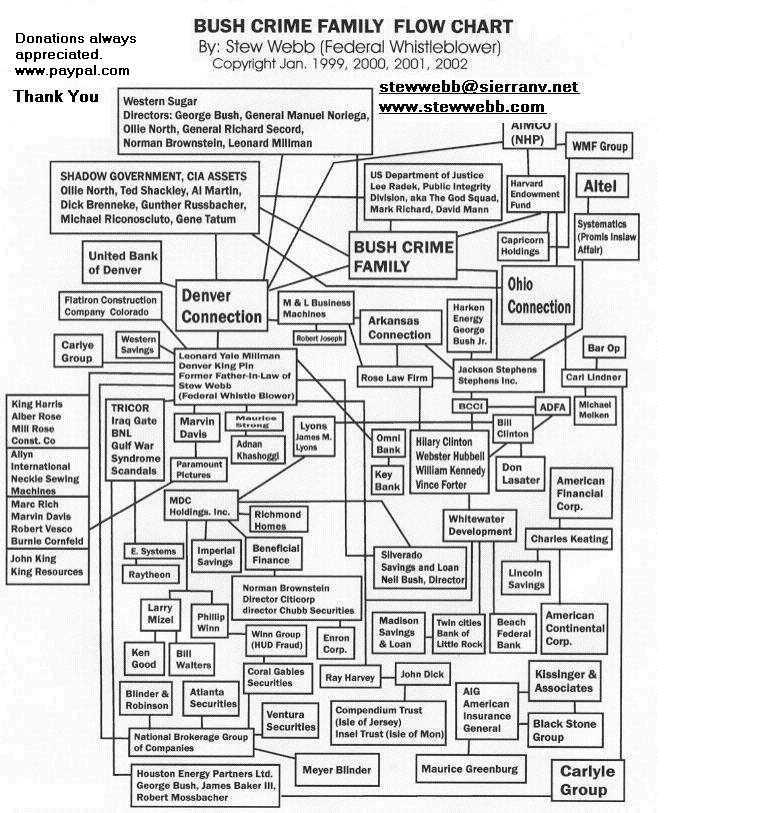

Satanist-Illuminati-Baby Killer Larry Mizel

Satanist-Illuminati-Baby Killer Larry Mizel

DENVER, July 30, 2013 /PRNewswire/ — M.D.C. Holdings, Inc. (NYSE: MDC) announced results for the quarter ended June 30, 2013.

2013 Second Quarter Highlights and Comparisons to 2012 Second Quarter

— Net income of $224.9 million, or $4.56 per diluted share vs. net income

of $10.6 million, or $0.22 per diluted share

— Net income included a $187.6 million, or $3.80 per diluted share,

tax benefit related to the reversal of a substantial portion of

the deferred tax asset valuation allowance

— Excluding the impact of the reversal of the deferred tax asset

valuation allowance, net income was $37.3 million*, or $0.76* per

diluted share

— Pretax income of $38.0 million, up 292% from $9.7 million

— Homebuilding pretax income of $29.8 million vs. $3.0 million

— Home sale revenues of $400.3 million, up 56%

— Homes delivered of 1,183, up 37%

— Average selling price of $338,400, up 14%

— Gross margin from home sales of 18.1% vs. 14.2%, a 390 basis point

increase

— 70 basis point improvement vs. 17.4% in 2013 first quarter

— SG&A expenses as a percentage of home sale revenues of 13.0% vs. 15.3%, a

230 basis point improvement

— Monthly net home order absorption pace of 3.2 homes per active community,

up 23%

— Net new orders of 1,351 homes, down 4%; dollar value up 12% to

$485.5 million

— Backlog dollar value of $784.2 million, up 19%; units up 3% to 2,095

homes

— Acquired 2,776 lots in 69 communities, including 32 new communities

— Total land acquisition spend of $185.1 million

Larry A. Mizel, MDC’s Chairman and Chief Executive Officer, stated, “I am pleased to announce a second quarter profit of $4.56 per diluted share, our sixth consecutive quarterly operating profit, with net income improving by $214.3 million over the prior year. Our favorable results were significantly impacted by a $187.6 million tax benefit related to the reversal of a portion of our deferred tax asset valuation allowance, stemming from our return to consistent profitability and an improving housing market. Additionally, our homebuilding results again improved significantly, as volume and gross margin gains drove both year-over-year and sequential improvements in our homebuilding pretax operating margin to 7.4%.”

Mr. Mizel continued, “During the second quarter of 2013, the pace of our new home sales remained strong. Our monthly absorption rate of 3.2 net new home orders per active community was up 23% year-over-year and at our highest level since 2006, even as we increased prices in most of our subdivisions to regulate the pace of sales and maximize profitability. And although interest rates rose significantly toward the end of the quarter, we believe that the impact of increasing interest rates on new homes sales can be offset by the positive influence of other factors impacting new home demand, including low existing home inventories, attractive levels of overall affordability, and continued improvements in employment levels and consumer confidence.”

Mr. Mizel concluded, “Our active community count steadied in the second quarter, increasing slightly after five consecutive sequential quarterly declines. We continue to believe that we are poised to increase our active community count by at least 10% from current levels by the end of the year. Our confidence in achieving this goal is rooted in the success we have experienced in acquiring new land over the past year. During the 2013 second quarter alone, we purchased approximately 2,800 lots, our highest level of land acquisition activity since 2006. We ended the quarter with more than 14,700 lots controlled, an increase of 16% from the end of the 2013 first quarter and 44% year-over-year. We believe that we control enough lots to drive meaningful gains in both net orders and closings volume for 2014, provided that market conditions remain favorable for the industry.”

Homebuilding

Home sale revenues for the 2013 second quarter increased 56% to $400.3 million compared to $256.5 million for the prior year period. The increase in revenues resulted from a 37% increase in homes delivered to 1,183 homes as compared to 861 in the prior year and a 14% increase in the Company’s average selling price to $338,400. The increase in average selling price was largely due to price appreciation and lower incentives in many of our markets.

Gross margin from home sales for the 2013 second quarter increased to 18.1% from 14.2% for the year-earlier period. On a sequential basis, our 2013 second quarter gross margin from home sales was up 70 basis points as compared to 17.4% for the 2013 first quarter. The increase was attributable to the Company’s continued focus on increasing pricing and decreasing incentives as its markets improved since the start of 2012.

SG&A expenses as a percentage of home sales revenues decreased by 230 basis points to 13.0% for the 2013 second quarter versus 15.3% for the same period in 2012. The improvement was the result of operating leverage created by the Company’s 56% year-over-year increase in home sale revenues, which far outpaced a year-over-year increase in the Company’s absolute level of SG&A expenses, and was slightly offset by a year-over-year increase in legal expenses driven by various significant legal recoveries in the 2012 second quarter which did not recur in the 2013 second quarter.

Net new orders for the 2013 second quarter decreased 4% to 1,351 homes, compared to 1,402 homes during the same period in 2012, largely due to a 21% decrease in the Company’s active average community count. However, the Company’s monthly sales absorption rate for the 2013 second quarter rose 23% to 3.2 per community, compared to 2.6 per community for the 2012 second quarter and 3.0 for the 2013 first quarter. The Company’s cancellation rate for the 2013 second quarter was 19% versus 20% in the prior year second quarter and 18% in the 2013 first quarter.

The Company ended the 2013 second quarter with 2,095 homes in backlog, with an estimated sales value of $784.2 million, compared with a backlog of 2,028 homes with an estimated sales value of $657.5 million at June 30, 2012, a 19% increase in dollar value.

At June 30, 2013, the Company had 140 active subdivisions, which was up slightly from 139 at March 31, 2013, and represented a reversal of its previous trend of sequential quarterly decreases in community count. In addition, as a result of the significant increase in our land acquisition activity in the latter half of 2012 and the first half of 2013, the Company’s lots owned and under option increased by 44% year-over-year and 16% since March 31, 2013 to more than 14,700 lots. The Company believes that these significant increases in lots owned and under option will further increase its active community count during the second half of 2013.

Financial Services

Income before taxes from our financial services operations for the 2013 second quarter was $8.2 million, compared to $6.7 million for the 2012 second quarter. The increase in pretax income primarily reflected a $1.1 million increase in our mortgage operations pretax income to $6.9 million for the 2013 second quarter, compared to $5.8 million in the 2012 second quarter. The improvement in our mortgage profitability was driven primarily by year-over-year increases in the volume of loans locked and originated due to increases in new home deliveries from our homebuilding operations.

Income Taxes

During the 2013 second quarter, we realized a $187.6 million income tax benefit related to the reversal of a substantial portion of the Company’s deferred tax asset valuation allowance. Our remaining deferred tax asset valuation allowance at June 30, 2013 was $39.7 million and related to (1) the remaining interim periods of 2013 during which a portion of the remaining valuation allowance will be reversed as pretax income is realized as required by U.S. GAAP and (2) various state net operating loss carryforwards where realization is more uncertain at this time due to the more limited carryforward periods that exist in certain states.

About MDC

Since 1972, MDC’s subsidiary companies have built and financed the American dream for more than 170,000 homebuyers. MDC’s commitment to customer satisfaction, quality and value is reflected in each home its subsidiaries build. MDC is one of the largest homebuilders in the United States. Its subsidiaries have homebuilding operations across the country, including the metropolitan areas of Denver, Colorado Springs, Salt Lake City, Las Vegas, Phoenix, Tucson, Riverside-San Bernardino, Los Angeles, San Francisco Bay Area, Washington D.C., Baltimore, Philadelphia, Jacksonville, Orlando, South Florida and Seattle. The Company’s subsidiaries also provide mortgage financing, insurance and title services, primarily for Richmond American homebuyers, through HomeAmerican Mortgage Corporation, American Home Insurance Agency, Inc. and American Home Title and Escrow Company, respectively. M.D.C. Holdings, Inc. is traded on the New York Stock Exchange under the symbol “MDC.” For more information, visit www.mdcholdings.com.

Forward-Looking Statements

Certain statements in this release, including statements regarding our business, financial condition, results of operation, cash flows, strategies and prospects, constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such factors include, among other things, (1) general economic conditions, including changes in consumer confidence, inflation or deflation and employment levels; (2) changes in business conditions experienced by the Company, including cancellation rates, net home orders, home gross margins, land and home values and subdivision counts; (3) changes in interest rates, mortgage lending programs and the availability of credit; (4) changes in the market value of the Company’s investments in marketable securities; (5) uncertainty in the mortgage lending industry, including repurchase requirements associated with HomeAmerican’s sale of mortgage loans (6) the relative stability of debt and equity markets; (7) competition; (8) the availability and cost of land and other raw materials used by the Company in its homebuilding operations; (9) the availability and cost of performance bonds and insurance covering risks associated with our business; (10) shortages and the cost of labor; (11) weather related slowdowns; (12) slow growth initiatives; (13) building moratoria; (14) governmental regulation, including the interpretation of tax, labor and environmental laws; (15) terrorist acts and other acts of war; and (16) other factors over which the Company has little or no control. Additional information about the risks and uncertainties applicable to the Company’s business is contained in the Company’s Form 10-Q for the quarter ended June 30, 2013, which is scheduled to be filed with the Securities and Exchange Commission today. All forward-looking statements made in this press release are made as of the date hereof, and the risk that actual results will differ materially from expectations expressed in this press release will increase with the passage of time. The Company undertakes no duty to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise. However, any further disclosures made on related subjects in our subsequent filings, releases or webcasts should be consulted.

* Please see “Reconciliation of Non-GAAP Financial Measures” at the end of this release.

M.D.C. HOLDINGS, INC.

Consolidated Statements of Operations and Comprehensive Income

Click on link below to read full report:

http://online.wsj.com/article/PR-CO-20130730-905702.html?mod=googlenews_wsj

Related:

Larry Mizel Mortgage Backed Securities Frauds

Stew Webb SEC Whistleblower Filing against Larry Mizel and Len Millman M.D.C. Holdings, Inc. MDC-NYSE who created mortgages on house never built and duplicated mortgages and sold them worldwide that lead to bank bailout and tarp bail out. Then derivative those mortgage backed securities using Norman Brownstein as Vice President at Deutouch Bank of Canada. U.S. Attorney Eric Holder and new strike force including Denver US Attorney know this and are covering it up. $100 Trillion of fake mortgages were created. 12.5 million People have had their home stolen from them who were paying their mortgages to xyz mortgage co. and they sent their dirty attorneys in claiming they owned the mortgages to steal Peoples equity. Kentucky’s Attorney General is going after them right now for this illegal theft. They also sole over 5,000 Trillion worth of derivatives that have caused the worldwide financial meltdown.

Illuminati Human Sacrifice Busted

Letter to NY Attorney General US Attorney SEC Attorneys (Stew Webb Official Whistleblower Filing)

http://www.stewwebb.com/Letter_to_NY_Attorney_General_US_Attorney_SEC_Attorneys_20121005.htm

Whistle blowers US Intel Breaking News

http://www.stewwebb.com

.jpg)