Denver foreclosure lawyer faces federal sanctions

A foreclosure lawyer whose firm is under state investigation for alleged bill-padding also faces federal discipline for misrepresenting documents she used to take someone’s Colorado Springs home.

Attorney Toni M.N. Dale of Medved Dale Decker & Deere in Lakewood was referred for discipline last month by a federal judge for wrongly certifying that copies of a bank’s promissory note — required for any foreclosure in Colorado — were “true and correct” when, in fact, she had never seen the originals at all.

Additionally, U.S. Bankruptcy Court Judge A. Bruce Campbell said in a written order that not only was Dale’s certification in 2011 to the El Paso County public trustee — the overseer of foreclosures in that county — untrue, but so was her verification to the bankruptcy court about the same records.

Campbell on June 25 reported Dale to the federal court’s committee on conduct, a body of 12 attorneys that investigates allegations of lawyer misconduct. That body reports to a disciplinary panel of three federal judges who ultimately determine what sanctions, if any, are merited, including disbarment.

By rule, committee proceedings are confidential.

Dale and her attorney did not immediately respond to efforts by The Denver Post to reach them.

At issue are differing copies of a loan Anthony Semadeni signed with First Magnus Financial in 2007, specifically the endorsement page where a lender transfers ownership with a signature.

The copies show different or missing signatures, and two key signatures purportedly by the same bank official are markedly dissimilar.

Dale filed a foreclosure case in 2011 against Semadeni on behalf of Aurora Loan Services, which claimed to be the new holder of the note, and provided a copy of the document — without the endorsement page proving ownership — along with a certification that it was a “true and correct” copy of the original.

Semadeni filed for bankruptcy protection later that year, essentially freezing the foreclosure process. As is allowed, Dale formally requested that the stay be lifted, filing a copy that she verified was Semadeni’s note — this time with the endorsement page showing a pair of stamps and signatures transferring ownership, first from First Magnus to Lehman Brothers Bank, then from Lehman to Aurora.

A bankruptcy judge granted Dale’s request and lifted the stay, and Semadeni’s house sold at the trustee’s public auction in August 2011 to Aurora Loan Services for $620,000, records show. Semadeni abandoned his bankruptcy case.

ALS began eviction proceedings on Semadeni in September 2011 in state court. In that proceeding, a different lawyer representing ALS filed copies of Semadeni’s note, this time with an endorsement page showing only a single stamp and signature.

Semadeni filed for bankruptcy again, hoping the automatic stay would help explain the mess. The ALS lawyer, Jamie Siler, filed the same note.

“Isn’t that an admission that it was a dummy note that was submitted to the court (in Semadeni’s first bankruptcy)?” Campbell asked Siler in a hearing, referring to the document Dale had used.

Though Semadeni was eventually evicted last November, he filed a federal lawsuit challenging the validity of the lien.

It is through that case that Campbell asked Dale to give reason why she shouldn’t be held in contempt and sanctioned for allegedly misrepresenting the validity of the documents she used to foreclose.

More than two years later, Dale says she can’t unravel the discrepancy.

Dale’s attorney, Lisa Lee, told Campbell that regardless of the “unquestionably” different signatures on copies of the note, “the time for awarding sanctions … has passed.”

The Colorado attorney general’s office is investigating whether foreclosure lawyers pad the bills they submit for reimbursement from homeowners. Dale’s former law firm, Dale & Decker, is under scrutiny for allegedly overcharging its costs to post legal notices that advise homeowners of their rights.

Click on link to read full report:

http://www.denverpost.com/business/ci_23771515/denver-foreclosure-lawyer-faces-federal-sanctions

Related Links by Stew Webb:

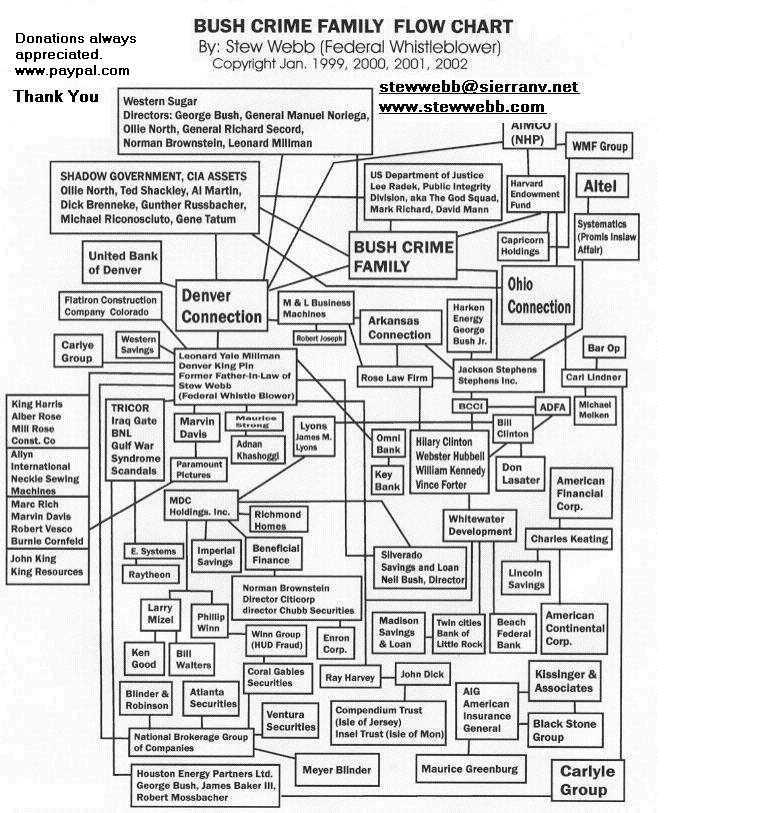

Stew Webb SEC Whistleblower Filing against Larry Mizel and Len Millman M.D.C. Holdings, Inc. MDC-NYSE who created mortgages on house never built and duplicated mortgages and sold them worldwide that lead to bank bailout and tarp bail out. Then derivative those mortgage backed securities using Norman Brownstein as Vice President at Deutouch Bank of Canada. U.S. Attorney Eric Holder and new strike force including Denver US Attorney know this and are covering it up. $100 Trillion of fake mortgages were created. 12.5 million People have had their home stolen from them who were paying their mortgages to xyz mortgage co. and they sent their dirty attorneys in claiming they owned the mortgages to steal Peoples equity. Kentucky’s Attorney General is going after them right now for this illegal theft. They also sole over 5,000 Trillion worth of derivatives that have caused the worldwide financial meltdown.

http://www.stewwebb.com/Letter_to_NY_Attorney_General_US_Attorney_SEC_Attorneys_20121005.htm

Satanist Bank Scamster Larry Mizel

Satanist Bank Scamster Larry Mizel

Larry Mizel, Illuminati Council of 13 Busted Human Sacrifice Denver June 21 Witching Hour (update)

Whistleblowers US Intel Breaking News

Now on Computers, Mobile and Tablets

http://www.veteranstoday.com/author/swebb

Stew Webb Founder:

You did not Vote them in but you can remove them!

http://www.recallpetitions.com

Now you can leak it

July 2013 Fund Raiser

https://fundrazr.com/campaigns/fXc61

Also contribute through

http://www.stewwebb.com

All logos and trademarks in this site are property of their respective owner. FAIR USE NOTICE: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. For more information go to: www.law.cornell.edu/uscode/17/107.shtml

.jpg)