Who is America’s Moriarity?

The Illuminati Zionist Denver Connection

By Stew Webb and Bret Landrith

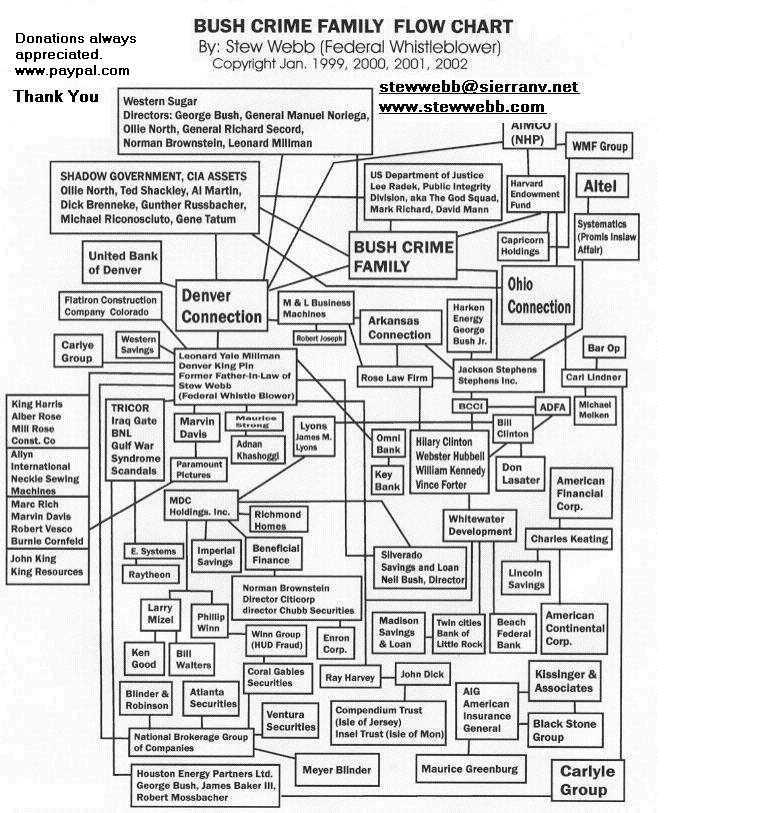

Leonard Yale Millman, (NYSEBAC ) , American International Group (NYSE AIG )and publicly traded residential construction companies including M.D.C. Holdings (NYSE MDC ) have caused the financial collapse of America’s leading banks and forced the Federal Reserve to prop up the derivatives market with funds it does not have?

PART I

On this day when stocks have experienced a triple digit fall in value, the world is in its Fifth year of an economic depression, the US Treasury has falsified its report of the total national debt for the 87th day, and it is clear that the jobless recovery did not even last as long as the Federal Reserve’s pumping schemes, it is time to ask. Who is to blame?

Sir Arthur Conan Doyle’s fictional detective, Sherlock Holmes knew Professor James Moriarty was the criminal mastermind behind every racket in Nineteenth Century England. A case is now being made that one unscrupulous American businessman named Leonard Yale Millman, the founder of National Acceptance Company, First National Acceptance Company, and countless subsidiaries and bank holding companies, ran all the banking and insurance scams that caused the global financial collapse and that he is still controlling the institutions, regulators and law enforcement agencies that failed our nation. Even after his reported death.

In 2006, I briefly met Millman’s former son in law Stew Webb then visited him at length on several occasions during a series of articles by the investigative journalist Tom Flocco who was interviewing me about the Medical Supply Chain antitrust litigation against the Novation LLC hospital supply cartel in 2007. Stew Webb had an interesting story about how Millman utilized massive fraud through National Acceptance Corporation’s origination of loans to non-creditworthy borrowers, often rounded up off the streets of Denver, Colorado and other cities for a cash kickback for which Millman could utilize their Social Security numbers to falsify loan applications and procure for himself the loan proceeds, while reselling the doomed notes to financial institutions.

While such a scheme would seem to have a short life span before National Acceptance ran out of buyers for its notes, Millman also provided dubious reinsurance services for investment bankers reselling the notes to package them as more marketable assets. This early business morphed into what became the modern AIG and its critical role in the marketing of fraudulent derivatives based on the sham mortgages. Despite obligating itself to back securities many thousand times in excess of AIG’s assets.

Webb pointed out that Leonard Millman generously contributed to both political parties and had been a close confidant of President George H.W. Bush since their college days. And just as importantly, Millman reinvested the profits of his scheme into running drugs and guns on a massive scale. Not only was he able to remain untouchable by law enforcement agencies, he was able to obtain the largest federal construction contracts including the Denver International Airport and capital for the construction of hundreds of thousands of HUD residential units through his front companies during the very investigations that targeted him.

I became intrigued with this story after having encountering pieces of information starting in 2001 that connected the Farm Foreclosure Crisis of the 1980’s and 1990’s, the Iran-Contra era back channel financing of anticommunist forces in Central America, the Savings and Loan scandals with the development of the electronic mortgage trading platform known as M.E.R.S. which enabled the bundling of counterfeit mortgages and misrepresented credit risks into “insured” securities that were sold to foreign pension funds, institutional, and individual investors.

From many oral histories of farmers including Darwin Rice of Iowa and their advocates like Frank Williams of Kansas, I sat through in the late 1990′s while going to law school, I knew that much of the violence associated with farm foreclosures resulted from the little known fact that most of the family farms taken by the federal government farm credit entities were actually current on their loans. This is one reason the Farmers Service Administration (then known as the Farm Home Administration) quickly developed SWAT teams to conduct the foreclosures. Principles in the agency had continuously run a scheme in the farm states where a local banker would be brought into the conspiracy and two fraudulent guaranteed loans would be issued for each real loan and the hapless farmer, often a Vietnam War veteran and his wife were deceived into signing multiple documents without realizing they were creating duplicate mortgages on a farm that had been in their family for generations. The only way the scheme could succeed without detection was for the farm to be foreclosed on. The part where the veteran is holding the USDA guaranteed note with the cherry red paid in full stamp when the sheriff’s deputies overpowered him never was shown on the evening news.

At the zenith of the corrupt scheme, President Clinton ordered his Agriculture Secretary Mike Espy to investigate the 500 farmer suicides in Oklahoma. Sidney Perceful, a former federal mediator that volunteered her time during that crisis told me that she had copied the autopsy reports and that the actual number of known farmer “suicides” reported was closer to 900 and that many had multiple gun shots to the head, sometimes from different caliber weapons. She said that the corrupt FSA officials had sped up their scheme to increase the cash flow and were foreclosing on farms even before the first annual payment was due by altering the property values so that the farmer would be under collateralized.

Leonard Millman and George H.W. partnered in farming by forming the Clark Land Company, named after their friend Judge Glen Edward Clark, referred to as “The Judge” or “Mr. Fixit”because of his important role in assigning farm foreclosure cases to other judges, eventually making Millman and Bush two of the largest owners of American farmland.

In the Summer of 2010, I traveled down to Tampa, Florida to witness the epicenter of the housing foreclosure crisis. Some of the attorneys, paralegals, and researchers organizing fledgling foreclosure defense efforts were using the strategies I had researched from the farm crisis, and like the farmers in the previous decades, they were also considering moving their causes to federal court. From what I knew of farmer’s experiences in Kansas federal courts, I didn’t have much to offer to the debate that gave hope for protecting a homeowner’s rights. However, I did find strong evidence that multiple notes on the same property had been issued and each note was purportedly insured by the federal home loan guarantee agencies, just as the farm loans were duplicated.

I tried to explain that the electronic mortgage platform appeared to be an apparatus or instrumentality to conceal the repeated bundling of multiple notes into securities for resale. Just as the FSA operatives had co-opted the local banker in each rural community to do a decade earlier. But, attorneys representing clients desperate to save their homes could not afford to investigate the injuries to the investors and banks who were being sold the notes by Countrywide and other dishonest loan originators.

The most difficult part for me to understand was who would have the motive and opportunity to do such destructive crimes that threatened our nation’s institutions and even its treasury and central bank, the Federal Reserve, and get away with it ? That is why I started to look more closely at Stew Webb’s father in law, Leonard Millman. Millman had the modus operendi and the political connections, coupled with from all accounts, a supernatural greed that could not be stopped.

But was I too late? This was 2010 and even though Millman’s empire was all around me, once my eyes had been opened to how to follow the money and common names he utilized for his front companies and cut outs. Leonard Millman had reportedly died in Arizona in 2004. Yet his lieutenants were still holding their interlocking directorships, the assets were still being controlled by the same holding companies and the destruction to America’s financial system was still proceeding ton Millman’s order.

In 2012, while Bank of America and its trustee for securitized mortgage backed loan trusts, Bank of New York Mellon were in New York State Court trying to force their investors to take $8.5 Billion dollars as a settlement for not having actually transferred the thousands of former Countrywide mortgages into the state investment trusts that were resold on Wall Street as safe, secured investments guaranteed with a 100% buy back agreement that neither Bank of America or Bank of New York Mellon haave the assets to honor, I filed a Racketeering complaint in Kansas District court against Countrywide’s successor in interest and willing participant in the Leonard Millman mortgage fraud scheme. The case is captioned Landrith v. Bank of New York Mellon, et al. KS Dist. Court Case No. 12-CV-02352-EFM-EJW, now on appeal in the Tenth Circuit as case no. 13-3080 over whether State of Kansas law or federal law applies to previous state court decisions.

A simple way to look at the common thread in the radical and transformative economic events starting with the farm crisis and proceeding through the housing foreclosure crisis and the subsequent collapse of the American banking system is that they were a way to create rapid growth in the money supply outside of the U.S. Treasury ‘s issuance of debt and the way banks leverage those debt instruments and the assets of their depositors and investors. As alternative wealth creation systems, they escaped the regulatory control and law enforcement oversight of the nation’s commercial and investment banking systems and therefore were vulnerable to organized crime.

Stew Webb related that Leonard Millman had a strong background in organized crime from the romanticized glory days and Bugsy Siegel’s founding of Las Vegas. Yet, the organized crime we think of in our popular culture does not explain the failure of federal government agencies to regulate or enforce the laws in commercial and investment banking when these instruments became securitized and sold to investors around the world through Wall Street. Hollywood films and television dramas have familiarized viewers with mafia families and battles among gangs for territories, invariably ending in the destruction of the criminal enterprise, the arrest of the wrong doers and the message that crime does not pay. All to meet industry standards, government broadcasting license requirements, and the propaganda placement objectives of various federal funding programs.

Except for Congressional hearings and the prosecution of a few token fall guys in the Savings and Loan failures, the Securities and Exchange Commission, the Office of the Comptroller of the Currency, the Federal Bureau of Investigation, and the US Department of Justice all failed to act. Even when the nation’s bank and mortgage guarantee funds including FSLIC, Fannie Mae, Freddie Mac, and the FDIC were being bankrupted by the crimes.

The force behind what has happened to our nation clearly had power over both major political parties and the bureaucracies in our nation’s regulatory and law enforcement agencies. Could Leonard Millman control such a large network of persons in competing groups and ensure the agencies and institutions consistently acted counter to the public policy?

A possible indicator of Millman’s power and audacity has recently been shared with Stew Webb from informed sources. Webb states that he has been definitively told that Leonard Yale Millman is still alive and resides in Cuba. Reportedly, Millman was forced to leave his wife Elaine Millman and fake his own death in the wake of an $80,000,000.00 fine and judgment against him in 1997 for his operation of National Acceptance Corporation, followed by a sealed indictment for espionage against America by Carol Lam, the first US Attorney targeted for unlawful firing by George W. Bush ( a subject I became too familiar with).

Related Cases:

In 2009 and 2013, Stew Webb attempted to obtain my legal representation of him in Kansas District Court through injunctive relief in order to investigate and prosecute claims approved for submission to a Colorado Federal Grand Jury. The actions were captioned Webb v. Hon. Judge Kathyrn H. Vratil, Case No. 09-2603 and 12-2588. He was unsuccessful.

Related articles:

Democratic Underground: The Motherlode – Down a dark hole in the US Attorney purge scandal

Bret D. Landrith served honorably in Army National Guard for 18 years and was prevented from retiring in the Guard and from working in the private sector by the joint state/federal task force use of threat fusion center databases for having successfully brought a civil rights case to federal court on behalf of an African American against the City of Topeka.

https://sites.google.com/site/bretdlandrith/

More to come on The Illuminati Zionist Denver Connection stay tuned….

Stew Webb Whistle blower

.jpg)