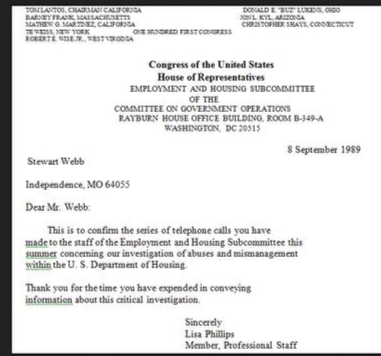

Filed March 12, 2012

Stew Webb Official SEC Whistle blower Complaint Mortgage Backed Securities Fraud

Letter to NY Attorney General, US Attorney New York, SEC Attorneys

and filed online to sec.gov

http://www.stewwebb.com

(L to R) Leonard Millman, Larry Mizel and Norman Brownstein

America’s Illuminati Zionist Jewish Organized Crime Syndicate:

October 5, 2012

18 U.S.C 4 The Federal Reporting Crime Act

Re: MDC Holdings, Inc. (MDC-NYSE)

To the Following:

nyag.pressoffice@ag.ny.gov

ago@state.ma.us;

sansonj@sec.gov;

Michael.Levy@usdoj.gov;

WADHWAS@sec.gov;

I filed an Official SEC Whistleblower Complaint below that has been ignored.

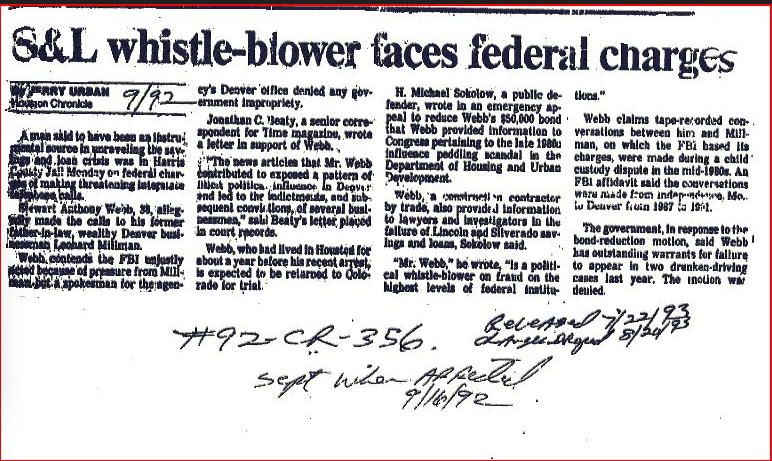

I filed in U.S. District Court Kansas City, Kansas September 5, 2012

I am being Obstructed from proceeding with my Open and active Grand Jury

Case Number 95-Y-107 10th District to prosecute the Mortgage Back

Securities Fraudsters

Larry Mizel and Leonard Millman, Millman Organized Crime Syndicate.

October 5, 2012 MOTION TO REVIEW MAGISTRATES ORDER OF DISMISSAL

Stew Webb Filed U.S. District Court Today

U.S. Magistrate Judge Gerald L. Rushfelt appears to be a felony violation

of 18 U.S.C. § 241

http://www.stewwebb.com/MOTION_TO_REVIEW_MAGISTRATES_ORDER_OF_DISMISSAL_20121005.pdf

Stew Webb Official SEC Whistleblower Complaint Mortgage Backed Securities Fraud

Enclosed below names of entities used: Assett Investors et al:

I am not an attorney but I am writing to you to inform you that the order

by Magistrate Judge Gerald L. Rushfelt appears to be a felony violation of

18 U.S.C. § 241 in Magistrate Rushfelt’s knowing furtherance of the

conduct by state of Kansas officials in trafficking children to defraud

the federal government out of US Treasury Medicare and Health and Human

Services funds through false claims and to protect the order made by Hon.

Judge Carlos Murguia that was used to obstruct Bret Landrith’s US District Court

reciprocal disbarment proceeding and hearing.

Magistrate Rushfelt was the magistrate in Hon. Judge Carlos Murguia

Novation Cartel case where the two Assistant US Attorney died. First

Assitant US Attorney Thelma Quince Colbert who brought the sealed False

Claims act proceeding against Novation with testimony of a Novation

medical supply purchasing executive verifying the nationwide restraint of

trade in hospital supplies that Bret Landrith had alleged in the private civil action

Med. Supply Chain, Inc. v. Neoforma, Inc., 419 F. Supp. 2d 1316 (D. Kan.

2006) against Novation for violations of 15 U.S.C. §§ 1,2 (Sherman

Antitrust Act) and for predicate acts of 18 U.S.C. § 1962 (Racketeer

Influenced and Corrupt Organizations Act ) that are also grave felonies.

Assistant US Attorney Shannon Ross, who supervised 70 US Justice

Department prosecutors and who signed the criminal subpoenas against

Novation was found dead in her home just before Bret Landrith’s expert testified in

the US Senate antitrust hearing on Novation’s conduct to restrain trade in

hospitals, and mere days after she signed the criminal subpoenas.

Hon. Judge Carlos Murguia’s sanctioned Bret Landrith for asserting there was a

private right of action under the USA PATRIOT Act (Public Law 107–56—OCT.

26, 2001) which had been used by the Novation cartel members to keep Bret Landrith’s

client out of the nationwide hospital supply market they monopolized. It

is beyond dispute that expressly creates several new private rights of

action by modifying existing statutes to create liability from private

actions for damages. Specifically the USA PATRIOT Act expressly recognizes

private liability related to Suspicious Activity Reports made with

malicious intent:

‘‘(3) MALICIOUS INTENT.—Notwithstanding any other provi- sion of this

subsection, voluntary disclosure made by an insured depository

institution, and any director, officer, employee, or agent of such

institution under this subsection concerning potentially unlawful activity

that is made with malicious intent, shall not be shielded from liability

from the person identified in the disclosure. “

Magistrate Rushfelt, knowing the misconduct of Hon. Judge Carlos Murguia

in ordering that Bret Landrith be sanctioned over $20, 000.00 for lawfully reporting

the commission of federal felonies under 15 U.S.C. §§ 1,2 and 18 U.S.C. §

1962 in Med. Supply Chain, Inc. v. Neoforma, Inc., 419 F. Supp. 2d 1316

(D. Kan. 2006) had a duty to report Hon. Judge Carlos Murguia. Which to everyone’s

knowledge he did not. See Abramson, Leslie W., The Judge’s Ethical Duty to

Report Misconduct By Other Judges and Lawyers and its Effect on Judicial

Independence. Hofstra Law Review, Vol. 25, No. 751, 1997.

Clearly I Stewart Webb went to court to obtain injunctive relief under federal law to

protect my Constitutional rights. I respectfully do not believe

Magistrate’s Rushfelt’s dismissal of my action before it is served is a

trial on the merits or anything other than a continuation of a conspiracy

among some state and federal officials to prevent me from having federal Constitutional

rights. I have laid out my reasons for this belief below.

Please review and give advice.

Thank You

Stew Webb

Federal Whistleblower

stewwebb@stewwebb.com

816 478-3267

http://www.stewwebb.com

Oct 5, 2012 Stew Webb Whistleblower new Filing U.S. District Court today:

Stew Webb Vs. Millman-Bush Crime Syndicate Bankers who robbed America

MOTION TO REVIEW MAGISTRATES ORDER OF DISMISSAL

U.S. Magistrate Judge Gerald L. Rushfelt appears to be a felony violation of 18 U.S.C. § 241

http://www.stewwebb.com/MOTION_TO_REVIEW_MAGISTRATES_ORDER_OF_DISMISSAL_20121005.pdf

Letter to NY Attorney General US Attorney SEC Attorneys

http://www.stewwebb.com/EX_PARTE_MOTION_FOR_PRELIMINARY_INJUNCTIVE_RELIEF.pdf

http://www.stewwebb.com/COMPLAINT_FOR_INJUNCTIVE_RELIEF_20120905.htm

http://www.stewwebb.com/NOTICE_TO_COURT_THREAT_FIRST_AMENDMENT_VIOLATIONS_20120907.htm

http://www.stewwebb.com/Stew_Webb_Whistleblower_Witness_Al_Martin_Whistleblower.htm

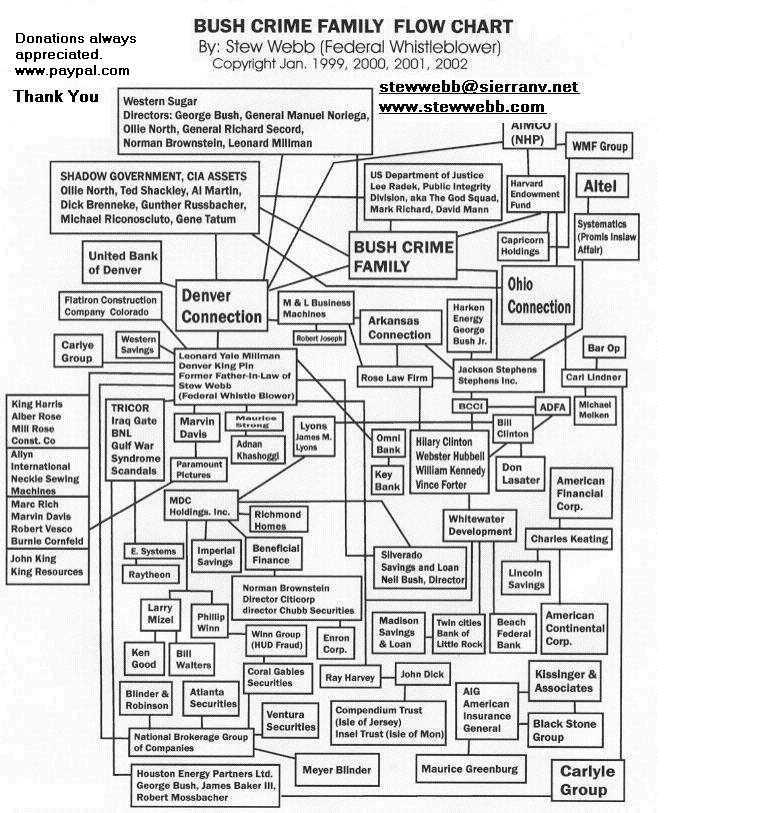

http://www.stewwebb.com/Bush_Millman_Clinton_Lindner_Crime_Family_Flow_Chart1.jpg

+++++++++++++++++++++++++++++++++++++++++++++

RFC822 Message body

Received: from 69.242.139.39 (SquirrelMail authenticated user stewwebb@sierranv.net) by mail.spacestar.net with HTTP; Fri, 5 Oct 2012 03:15:19 -0500 (CDT) Message-ID: <57972.69.242.139.39.1349424919.squirrel@mail.spacestar.net> Date: Fri, 5 Oct 2012 03:15:19 -0500 (CDT) Subject: RE: Whistleblower Mortgage Backed Securities Frauds From: “Stew Webb” <stewwebb@sierranv.net> To: nyag.pressoffice@ag.ny.gov Cc: ago@state.ma.us, sansonj@sec.gov, Michael.Levy@usdoj.gov, WADHWAS@sec.gov Reply-To: stewwebb@stewwebb.com Bcc: stewwebb@stewwebb.com User-Agent: SquirrelMail/1.4.6 MIME-Version: 1.0 Content-Type: text/plain;charset=iso-8859-1 Content-Transfer-Encoding: 8bit X-Priority: 3 (Normal) Importance: Normal

October 5, 2012 18 U.S.C 4 The Federal Reporting Crime Act To the Following:

nyag.pressoffice@ag.ny.gov

ago@state.ma.us ; sansonj@sec.gov ; Michael.Levy@usdoj.gov ; WADHWAS@sec.gov ;

I filed an Official SEC Whistleblower Complaint below that has been ignored. I filed in U.S. District Court Kansas City, Kansas September 5, 2012 I am being Obstructed from proceeding with my Open and active Grand Jury Case Number 95-Y-107 10th District to prosecute the Mortgage Back Securities Fraudsters Larry Mizel and Leonard Millman, Millman Organized Crime Syndicate.

October 5, 2012 MOTION TO REVIEW MAGISTRATES ORDER OF DISMISSAL Stew Webb Filed U.S. District Court Today U.S. Magistrate Judge Gerald L. Rushfelt appears to be a felony violation of 18 U.S.C. § 241 http://www.stewwebb.com/MOTION_TO_REVIEW_MAGISTRATES_ORDER_OF_DISMISSAL_20121005.pdf

Stew Webb Official SEC Whistleblower Complaint Mortgage Backed Securities Fraud

Filed March 12, 2012

Larry Mizel Mortgage Backed Securities Frauds and Bank Bailout Frauds

MDC Holding, Inc. (MDC NYSE)

Official SEC Whistleblower Complaint Securities Frauds

Breaking News March 12, 2012

http://www.stewwebb.com

MDC Holding, Inc. (MDC NYSE)

$100 Trillion In illegal Mortgage Back Securities created on house that were never built and duplicated on houses MDC purchase from Mortgage Bankers around the USA. MDC Asset Investors Colorado’s largest Financial Institution that was traded on the NYSE until 2008 when the Bank Bailout occurred.

These illegal Mortgage Backed Securities were then bundled and sold as Derivatives that went from $100 Trillion to $1500 Trillion Dollars that has lead to the current world wide economic collapse and Bailouts.

These same Criminals Leonard Millman (Whistleblower Stew Webb’s ex-in-law), Larry Mizel and Norman Brownstein to date have not been prosecuted.

This has lead to World Wide Financial Collapse and Bailouts

Here are the Entities Larry Mizel used to Bundle the Fraudulent Mortgage Backed Securities

Official SEC Whistleblower Complaint

False Claims-Whistleblower Act

By Stewart Webb Federal Whistleblower

Filed March 12, 2012 online after a call from Tim Casey

http://www.sec.gov/whistleblower

Email sent this same date and submitted online to SEC see bottom of this page:

WADHWAS@sec.gov

Michael.Levy@usdoj.gov

sansonj@sec.gov

ago@state.ma.us

oig@sec.gov

http://www.sec.gov/whistleblower

False Claims-Whistle blower Act

Welcome to the Office of the Whistle blower

Assistance and information from a whistle blower who knows of possible securities law violations can be among the most powerful weapons in the law enforcement arsenal of the Securities and Exchange Commission. Through their knowledge of the circumstances and individuals involved, whistleblowers can help the Commission identify possible fraud and other Violations much earlier than might otherwise have been possible. That allows the Commission to minimize the harm to Investors better preserve the integrity of the United States’ capital markets, and more swiftly hold accountable those responsible for unlawful conduct.

The Commission is authorized by Congress to provide monetary awards to eligible individuals who come forward with High-quality original information that leads to a Commission enforcement action in which over $1,000,000 in sanctions Is ordered. The range for awards is between 10% and 30% of the money collected.

The Office of the Whistle blower was established to administer the SEC’s whistle blower program. We greatly appreciate your interest and we hope that this website answers any questions you may have.

We understand that the decision to come forward with information about securities fraud or other wrongdoing is not one taken lightly and we are here to answer any questions you may have. You can reach the Office of the Whistle blower at (202) 551-4790.

Larry Mizel Bank Bailout Criminal

1% Illuminati Bankers

Get the Money Back

Solve the World Financial Crisis

The American Revolution Continues in 2012

Larry Mizel Bank Fraudster (NYSE: MDC)

One of the 100 Illuminati Bankers that control 95% of the Worlds wealth illegally gained.

Larry Mizel created Mortgages through MDC Asset Investors on houses that were never built in southern California (Richmond Homes) and other states, including duplicating Mortgages up to 9 times by bundling and selling then in Billion Dollar Bundles to Banks and Pension Funds to steal your money then after the temporary 2008 Bail Out by U.S. Citizens they start robbing people who had been paying their Mortgage to their legal Mortgage holders and came in and stole 3.5 million homes from Mortgage paying Americans.

These are Larry Mizel Entities that were used by Larry A. Mizel aka Larry Mizell aka Larry Mizei

To commit Frauds and False Claims against the United States of America and the American People including Securities Frauds and Frauds against Investors and Foreign Banks.

Other Culprits include Norman Phillip Brownstein Former Director MDC NYSE Mizel’s attorney and partner in crime who is Managing Director of DEUTSCHE BANK AG-REGISTERED (DBK:Xetra) Runs a team of sales and marketing professionals responsible for bringing HSBC’s global derivative capabilities to Canadian clients. Product coverage includes rates, credit, equity, funds and emerging market derivatives. Team is divided into retail and institutional coverage. Retail team is responsible for all structured notes issues by HSBC Bank Canada (all asset classes) as well as Structured GICs. Products are sold through the private bank, HSBC securities as well as mutiple third party distributors. Institutional team covers clients ranging from mid-market to multi-national to provide financial solutions on both the asset side and liability side of the balance sheet.

Here are the Criminals who caused the World Wide Economic Collapse and the Entities used the U.S. Government has 53 Attorneys and 200 agents on a Special Task Force and they claim they cannot figure it out.

Other Culprits are named in the Documents herein below:

Original Letter to SEC Attorneys

February 6, 2012

WADHWAS@sec.gov

Michael.Levy@usdoj.gov

sansonj@sec.gov

ago@state.ma.us

oig@sec.gov

Filed online March 13, 2012

RE: After call from Tim Casey

http://www.sec.gov/whistleblower

Welcome to the Office of the Whistle blower

Note: The U.S. Government never has Paid this Whistle blower a dime only tried to Murder me many time…Stew Webb

Companies responsible for Mortgage Securities frauds

Houses that were never built and Duplicated Mortgages

Not to be published.

Let me know.

Stew Webb Federal Whistle blower

stewwebb@stewwebb.com

816 478 3267

Companies responsible for Mortgage Securities Frauds

Houses that were never built and Duplicated Mortgages

The below are the Buffers used to pass the Illegal Mortgage Securities in Bundles

that has lead to the Illegal Bank Bailout and World Financial Collapse

These are Trillions of Dollars Stole my the Persons herein the Filings.

Home America Mortgage

http://www.stewwebb.com/ASSET_INVESTORS_ACCEPTANCE_INC.htm

http://www.stewwebb.com/Asset_Investors_Corporation.htm

http://www.stewwebb.com/ASSET_INVESTORS_EQUITY_INC.htm

http://www.stewwebb.com/ASSET_INVESTORS_FINANCE_CORPORATION.htm

http://www.stewwebb.com/ASSET_INVESTORS_FUNDING_CORPORATION.htm

http://www.stewwebb.com/ASSET_INVESTORS_LLC.htm

http://www.stewwebb.com/ASSET_INVESTORS_MORTGAGE_FUNDING_CORPORATION.htm

http://www.stewwebb.com/ASSET_INVESTORS_OPERATING_PARTNERSHIP_LP.htm

http://www.stewwebb.com/B_R_ASSET_INVESTORS_LIMITED.htm

http://www.stewwebb.com/B_R_ASSET_INVESTORS_LLC.htm

http://www.stewwebb.com/D_&_R_Asset_Investors.htm

http://www.stewwebb.com/GREENWOOD_ASSET_INVESTORS_LLC_02052012.htm

http://www.stewwebb.com/INVESTORS_ASSET_MANAGEMENT_GROUP_LLC_02052012.htm

http://www.stewwebb.com/INVESTORS_ASSET_MANAGEMENT_LTD.htm

http://www.stewwebb.com/MDC_Asset_Investors_38_Found.htm

http://www.stewwebb.com/MDC_ASSET_INVESTORS_INC_02052012.htm

Note 50 South Steel Denver, Colorado

Is nothing more than a RICO Securities Headquarters?

Below

Aka MDC Janus Funds

and other

Len Millman-Larry Mizel-

Norman Brownstein Entities

Foreign Limited Partnership

Jurisdiction: British Virgin Islands

http://www.stewwebb.com/Palm_Structured_Asset_Investors_02052012.htm

http://www.stewwebb.com/20041257435.pdf

http://www.stewwebb.com/20051281539.pdf

http://www.stewwebb.com/20111385721.pdf

http://www.stewwebb.com/PRINCIPAL_ASSET_INVESTORS_02052012.htm

http://www.stewwebb.com/Real_Asset_Investors_LLC_02052012.htm

http://www.stewwebb.com/ServiceStar_Asset_Investors_02052012.htm

http://www.stewwebb.com/SKB_ASSET_INVESTORS_02052012.htm

http://www.stewwebb.com/TECH_ASSET_GROUP_INVESTORS_LLC_02052012.htm

Note: Len Millman’s National Acceptance Company

Aka National Brokerage as in

AIG Maurice Hank Greenburg and Meyer Blinder

Aka First National Acceptance Company

Aka First National Banks

50 South Steel Denver, Colorado

lots of Securities Frauds

Stew Webb Federal Whistleblower

stewwebb@stewwebb.com

816 478 3267

DEUTSCHE BANK AG-REGISTERED Norman Brownstein Director

http://investing.businessweek.com/research/stocks/people/person.asp?personId=741455&ticker=DBK:GR&previousCapId=23893&previousTitle=Welsh%2C%20Carson%2C%20Anderson%20%26%20Stowe

DEUTSCHE BANK AG-REGISTERED (DBK:Xetra)

LAST €33.21 EUR

CHANGE TODAY -0.035 -0.11%

VOLUME 7.8M

DBK On Other Exchanges

As of 2:01 PM 01/27/12 All times are local (Market data is delayed by at least 15 minutes).

SnapshotNewsChartsFinancialsEarningsPeopleTransactions

OverviewBoard MembersCommittees

Managing Director, Deutsche Bank AG

66

66

Norman Brownstein, Esq. serves as Managing Director of Deutsche Bank AG. Mr. Brownstein is nationally recognized for his extensive experience in real estate law and commercial transactions. He serves as Manager of Ardent Health Services LLC. He has been the Chairman of the Board of Brownstein Hyatt & Farber, P.C. since 1986. He serves as the Chairman of Brownstein Hyatt Farber Schreck, LLP. He has been a Director of National Jewish Health (formerly known as National …

Read Full Background

*Data is at least as current as the most recent Definitive Proxy.

http://investing.businessweek.com/research/stocks/snapshot/snapshot.asp?ticker=DBK:GR

http://investing.businessweek.com/research/stocks/private/snapshot.asp?privcapId=23893

http://www.yatedo.com/p/Norman+Brownstein/normal/30b427ddc8477537f0f5926b31cfe345

Brownstein Financial,… – President, Managing Director – Head…

Professional Experience

2008

President – Brownstein Financial

Financial Services

2002

Managing Director – Head of Derivative Products Group Canada – HSBC Bank

Financial Services

Run a team of sales and marketing professionals responsible for bringings HSBC’s global derivative capabilities to Canadian clients. Product coverage includes rates, credit, equity, funds and emerging market derivatives. Team is divided into retail and institutional coverage. Retail team is responsible for all structured notes issues by HSBC Bank Canada (all asset classes) as well as Structured GICs. Products are sold through the private bank, HSBC securities as well as mutiple third party distributors. Institutional team covers clients ranging from mid-market to multi-national to provide financial solutions on both the asset side and liability side of the balance sheet.

2000

VP – Fixed Income Derivatives Sales – RBC Capital Markets

Public Company; RY; Investment Banking

Coverage of Non-Bank financial companies and sovereigns (Crown corps, Provinces and Municipalities) on Rates Derivative products. Also responsible for all Institutional Structured Notes (callable, puttable, exchangeable, etc)

1997

VP – Interest Rate Derivative Trading – RBC Capital Markets

Public Company; RY; Investment Banking

Tokyo, Japan Trader all Interest rate swaps (yen, Dollar, STG and Euro) during Asian time zone. Predominantly Yen swaps and options. Also managed Canadian dollar bond portfolio (market maker) during Asian trading hours.

1995

Interest Rate Derivatives Trader – RBC Capital Markets

Public Company; RY; Investment Banking

Traded CAD and USD options, as well as short dated USD and CAD swaps.

Educational Background

1989 – 1991

MBA Finance – York University – Schulich School of Business

1985 – 1989

Royal Military College of Canada/Collège militaire royal du Canada

Web Search Results (14)

Norman Brownstein | LinkedIn

Managing Director – Head of Derivative Products Group Canada at HSBC Bank VP – Fixed Income Derivatives Sales … Get introduced to Norman Brownstein;

http://www.linkedin.com/pub/norman-brownstein/7/b24/240

At HSBC Group – Professional Experience,Email,Phone numbers …

Norman Brownstein Norman … Brownstein Financial, HSBC Bank, RBC Capital Markets, York University – Schulich School of Business, Royal Military College of…

http://www.yatedo.com/s/tags%3A%28at+HSBC+Group%29

David J. LeClaire | LinkedIn

… HSBC Bank USA, and Dundee Securities. … Norman Brownstein Global Markets Professional; Emily Robinson Student at Fanshawe College; François Helou

http://www.linkedin.com/pub/david-j-leclaire/11/710/97

Fixed Income Derivatives Trader Profiles Board – Professional …

Norman Brownstein Norman … Brownstein Financial, HSBC Bank, RBC Capital Markets, York University – Schulich School of Business, Royal Military College of…

http://www.yatedo.com/s/jobtitle%3A%28Fixed+Income+Derivatives+Trader%29

Show all Web search results related to Norman Brownstein

http://www.yatedo.com/p/Norman+Brownstein/normal/30b427ddc8477537f0f5926b31cfe345#

Norman Brownstein | LinkedIn

Managing Director – Head of Derivative Products Group Canada at HSBC Bank VP – Fixed Income Derivatives Sales … Get introduced to Norman Brownstein;

http://www.linkedin.com/pub/norman-brownstein/7/b24/240

At HSBC Group – Professional Experience,Email,Phone numbers …

Norman Brownstein Norman … Brownstein Financial, HSBC Bank, RBC Capital Markets, York University – Schulich School of Business, Royal Military College of…

http://www.yatedo.com/s/tags%3A%28at+HSBC+Group%29

David J. LeClaire | LinkedIn

… HSBC Bank USA, and Dundee Securities. … Norman Brownstein Global Markets Professional; Emily Robinson Student at Fanshawe College; François Helou

http://www.linkedin.com/pub/david-j-leclaire/11/710/97

Fixed Income Derivatives Trader Profiles Board – Professional …

Norman Brownstein Norman … Brownstein Financial, HSBC Bank, RBC Capital Markets, York University – Schulich School of Business, Royal Military College of…

http://www.yatedo.com/s/jobtitle%3A%28Fixed+Income+Derivatives+Trader%29

Trader Interest Rate Derivatives Trombinoscope – Experience …

Norman Brownstein Norman … Brownstein Financial, HSBC Bank, RBC Capital Markets, York University – Schulich School of Business, Royal Military College of…

http://www.yatedo.fr/s/jobtitle%3A(Trader+(interest+rate+derivatives))

America’s Housing and Financial Frauds. – Scribd

America’s Housing and Financial Frauds. …

http://www.scribd.com/doc/22577017/America-s-Housing-and-Financial-Frauds

Capital IQ Power Moves » Deutsche Bank Announces New Hires

Norman Brownstein joined as a managing … Merrill Lynch Moelis & Company Morgan Joseph & Co. Morgan Stanley Nomura Holdings Northern Trust Corporation Oppenheimer & Co. RBC Capital Markets …

http://powermoves.capitaliq.com/index.php/2009/09/23/deutsche-bank-ag-announces-new-hires/

ENGLEWOOD, Colorado (CO) Political Contributions by Individuals …

norman brownstein (brownstein hyatt farber/attorney), … (rbc capital markets/executive), (zip code: 80111) $500 to lisa murkowski for us senate on 01/01/10.

http://www.city-data.com/elec2/10/elec-ENGLEWOOD-CO-10-part1.html

DENVER, Colorado (CO) Political Contributions by Individuals …

NORMAN BROWNSTEIN, (Zip code: 80202) $1000 to MIKE CRAPO FOR US SENATE on 06/07/10. … David Parker (RBC Capital Markets/Investment Bank), (Zip code: 80206) …

http://www.city-data.com/elec2/10/elec-DENVER-CO-10-part3.html

Brownstein, Norman – Brownstein Hyatt Farber Schreck, LLP …

A founding member and Chairman of the Board of Brownstein Hyatt Farber Schreck, Mr. Brownstein is nationally recognized for his extensive experience in real estate …

http://www.bhfs.com/People/nbrownstein

Norm Brownstein is a founding member and Chairman of the Board of Brownstein Hyatt & Farber P.C. Mr. Brownstein is nationally recognized for his experience in real estate law, commercial transactions and legislative law.

He holds bachelor of science and juris doctorate degrees from the University of Colorado at Boulder.

Mr. Brownstein is a Trustee of the Simon Wiesenthal Center, Vice President of the American Israel Public Affairs Committee (AIPAC), was a Presidential appointee to the U.S. Holocaust Memorial Council and was named by the National Journal as one of the 100 most influential lawyers in America.

Mr. Brownstein is married to Sunny Brownstein.

http://www.nationaljewish.org/about/whynjh/leadership/board/norm-brownstein/

http://www.yatedo.com/p/Norman+Brownstein/normal/30b427ddc8477537f0f5926b31cfe345

The S&L scandal is the vehicle for telling the story about these leading American politicians and businessmen. But the relationships between these individuals and how they control and manipulate public and private institutions is the bigger story. Unless we know who these people are and understand how they operate, we can all look forward to more S&L-type debacles to come.

The S&L scandal was almost the perfect crime. The layers of protection and insulation between what the public discovered was going on at the savings and loans and what actually happened with the money were so many and so thick that the crimes and theft would never be completely figured out. And even if the truth were ultimately unearthed, there were additional layers between that revelation and the bringing of those responsible to the bar of justice and recovering the money.

The first and foremost layer of protection is the difficulty in tracking the money from the savings and loans to its ultimate destination. That is why almost no FBI agent, federal prosecutor, S&L regulator, congressional committee or journalist has been able to track the money. Yet where the money went is really the only thing that matters. The rest of the “facts” that, typically, got investigated, prosecuted and written about were mostly smoke and mirrors, set up to shield who really got the hundreds of billions of dollars that taxpayers must pay back and to hide what the money was used for.[1] —– [1]–A notable exception is the book Inside Job, by Stephen Pizzo, Mary Fricker and Paul Muolo, which nailed down the fact that the savings-and-loan debacle was caused primarily by fraud. —- The five years that went into this book represent my efforts to peel back all the layers of insulation and protection to get to the real culprits. I have organized this book with that process in mind, to help the reader understand a complicated and confusing subject.

In general, the bulk of the money lost in the S&L crisis that American citizens must now pay for went to the owners of the property and assets that the more notorious borrowers purchased with money from S&Ls run by equally infamous owners. This seems to be obvious, yet it somehow got lost in all the hype and hysteria. While Congress, the Justice Department and the press concentrated on the flamboyant borrowers and managers of the S&Ls, the big recipients of the money — the wealthy, powerful landowners and property owners — crept off quietly with their profits.

In the second half of this book, a number of examples will be detailed to show how this happened, and who got the money. For example, one later chapter deals with a $200 million, 21,000-acre land transaction in Florida in which much of the borrowed S&L money went to a paper company owned by the Du Pont empire, one of the oldest, richest, most powerful bastions of wealth in this country.

We know this because many of the lending documents were pursued by a lone, shrewd, tenacious federal regulator named Kenneth Cureton. However, the unraveling of this transaction was a rare and exceptional event. But even it could not be called a complete victory. The Department of Justice’s International Division, the government body through which subpoenas to offshore banks must pass, inexplicably became a brick wall for Cureton’s efforts to obtain records on the Isle of Jersey in the English Channel, where a big chunk of the money went — possibly to buy weapons for Iraq.

Since so many of the crucial documents in this scandal are not available, we are left with the second-best avenue of investigation: finding out who the original property owners were and everything we can about them, and then doing the same thing for the S&L proprietors and borrowers. The bulk of this book consists of that enterprise.

The evidence uncovered is clear, convincing, and compelling: Members and associates of the Mafia and the United States Central Intelligence Agency were key participants in our nation’s savings-and-loan debacle, and some of the richest, most powerful people in the country did business with these participants and profited from the S&L crisis.

That members of the Mafia and the CIA, two organizations that operate in secrecy and whose members take sacred oaths — one supposedly dedicated to national security, the other simply to their organizations’ security — may have been working together is not unprecedented in this country. But that fact doesn’t make their cooperation any less outrageous.

It is well known that members of the Mafia and the CIA conspired to try to assassinate Fidel Castro. There are other, less substantiated, although credible, allegations regarding the two groups’ involvement together in drug smuggling and money laundering in Southeast Asia, Australia and the Caribbean.[2] —- [2]–The Politics of Heroin in Southeast Asia, by Alfred W. McCoy (New York: Harper and Row, 1972); The Crimes of Patriots, by Jonathan Kwimy (New York: Norton, 1987); and In Banks We Trust, by Penny Lernoux (Penguin Books, 1986). —- There are also some curious, ominous connections between members of these groups and JFK-assassination figures Lee Harvey Oswald and Jack Ruby.

Drawing a straight, direct line from the CIA operatives discussed in this book to the top officials of the CIA and on to the President is extremely difficult because of the way the CIA works. Most of the characters in this book are not the card-carrying bureaucrats and bean counters at CIA headquarters in Langley, Virginia. They are what are called CIA “assets,” who can be someone who turns over an occasional piece of information to the CIA, without even knowing it is for the CIA, all the way up to someone who is continually working for the CIA in covert operations.

A similar and, likewise, important cog in CIA operations is what is known as a cutout. A cutout is a front man or middle man set up to protect the identities of the primary participants. Like an asset, a cutout may or may not know for whom he is working and the actual purpose of his work. (The Mafia also makes use of such cutouts, except they call them “mustaches” or “beards.”)

The CIA uses assets and cutouts to maintain one of its prime directives: plausible deniability, or, in other words, “Don’t get caught embarrassing the President.” (The CIA is the intelligence-gathering and covert-action arm of the President. Perhaps that is the definition journalists should always refer to, rather than just throwing the general term “CIA” around as if it were some sort of independently run mythical loose cannon.) So . . . if an asset or cutout is caught breaking the law, the CIA can deny that its operative was working for it at that particular time.

This leads to one difference between the Mafia and the CIA, particularly in this story. Once it is established that members and associates of the Mafia are involved in a failed savings and loan, that is usually enough to establish, prima facie, the involvement of the Mafia. Members and associates of the Mafia don’t do such things without the knowledge, permission and the sharing of the spoils, with their superiors.

The destruction of the savings and loan industry in Texas, and in some other parts of the country, worked basically like an organized-crime bustout or burnout. This is a mob scam in which a failing company is taken over, built up on credit, then drained of all its assets and purposely put into bankruptcy, leaving the creditors holding the bag.

CAST OF PRINCIPAL CHARACTERS

(IN ALPHABETICAL ORDER)

WILLIAM MICHAEL “MIKE” ADKINSON, con man and good old boy from the Florida panhandle; built houses in Houston and sold arms with some Kuwaitis to Iraq; borrowed close to $200 million from a half-dozen dirty S&Ls; convicted for fraud in a $200 million S&L land deal in Florida and sentenced to 11 years in prison; associate of Robert Corson.

ROBERT O. ANDERSON, former chairman of Atlantic Richfield; land-owner with Walter Mischer; borrowed from Hill Financial Savings with Richard Rossmiller.

GEORGE AUBIN, Kappa Sigma frat rat who named most of his companies after his fraternity; took E. F. Hutton for $48 million and several Texas S&Ls for more; always just hanging around Louisiana mobster Herman K. Beebe; one place he never hung around was the inside of a jail, despite vow by several FBI agents to put him there.

FARHAD AZIMA, Iranian native close to Pahlavi family; Kansas city airline owner; board member and stockholder of Kansas City bank controlled by the mob; CIA asset protected by CIA from criminal prosecution.

JAMES A. BAKER, III, White House chief of Staff, former Secretary of the Treasury and Secretary of State; former partner at Andrews & Kurth, which investigated Raymond Hill and Mainland Savings and then did nothing; longtime good friend of Raymond Hill.

JOHN BALLIS, Beaumont dentist who moved to Houston and married a rich man’s daughter; developer; associate of John Riddle; pleaded guilty to savings-and-loan fraud and turned state’s evidence against Roy Dailey.

BEN BARNES, former Texas lieutenant governor; business associate of Herman K. Beebe, Walter Mischer and John Connally.

JIM BATH, Houston airplane company owner; CIA asset, front man for rich Saudis; associated with Reza Pahlavi, the Shah’s son, and business partner with Lan Bentsen, the senator’s son, and George W. Bush, the President’s son; borrowed from Lamar Savings and Mainland Savings.

CHARLES BAZARIAN, Oklahoma con man, convicted felon and associate of numerous S&L crooks and mobsters, including Morris Shenker, Mario Renda and Don Dixon.

HERMAN K. BEEBE, SR., Louisian financier, convicted felon and Mafia associate; many connections to the intelligence community; godfather of the dirty Texas S&Ls; did nine months in Club Fed.

JAKE BELIN, former head of the largest private landowner in Florida, St. Joe Paper Co., which is owned by the A. I. DuPont Trust; protegé of Ed Ball, right-wing fanatic [sic!] and most powerful man Florida has ever known; Belin liked doing business with fellow Florida redneck Mike Adkinson; he also liked the $80 million St. Joe got from Hill Financial Savings.

LLOYD BENTSEN, senior Democratic senator from Texas; an owner of three Texas S&Ls that later ended up in the hands of CIA or Mafia associates; close to Walter Mischer.

FERNANDO BIRBRAGHER, convicted drug-money launderer at Marvin Warner’s Great American Bank; got probation amid rumors of connections to a higher authority (CIA); helped Jack DeVoe launder his drug money; now building hush kits for DC-8s; bought Farhad Azima’s interest in two DC-8s in Spain; business partner with Miguel Acosta, a former associate of Ron Martin.

WILLIAM BLAKEMORE, Midland oilman and fierce Contra supporter; head of Gulf & Caribbean Foundation, set up to lobby Congress for aid to Contras; good friend of George Bush; his Iron Mountain ranch the site of paramilitary training and alleged transshipment of weapons.

ROBERT BOBB and DOUGLAS CROCKER, Chicago businessmen who worked for Gouletas family; bought Bellamah Associates from Gouletases; had business dealings with Robert Corson, Larry Mizel’s MDC Corp., Silverado Savings and Key Savings.

RICHARD BRENNEKE, renegade intelligence operative and gun dealer; told press about Iran-Contra deals and S&L deals; worked for CIA, Israeli intelligence, Customs and others; acquitted of perjury charge for claiming to work for the CIA; laundered Mafia and CIA money with Robert Corson.

NORMAN BROWNSTEIN, Denver attorney; “Mr. Fix-it”; worked with Kenneth Good, Bill Walters, Larry Mizel, Marvin Davis, Michael Milken, Burton Kanter, Neil Bush and the Gouletas family; good friend of Senator Ted Kennedy, who called him this country’s one hundred and first senator.

GEORGE BUSH, President of the United States.

JOHN ELLIS “JEB” BUSH, the President’s son; Contra supporter; business associate of Camilo Padreda, who escaped S&L conviction (with Guillermo Hernandez-Cartaya) with possible help from the CIA.

NEIL BUSH, the President’s son; director of Silverado Savings; partner with Bill Walters and Ken Good; friend of Walt Mischer, Jr.

LEONARD CAPALDI, reputed Detroit Mafia associate; borrower at Mainland Savings and Hill Financial Savings.

EULALIO FRANCISCO “FRANK” CASTRO, Cuban exile and Bay of Pigs veteran; CIA operative who helped train and supply Contras; part of drug-smuggling ring that bought Sunshine State Bank.

JACK CHAPMAN, Omaha lawyer and former CIA operative, represented Mario Renda; took half a million in cash from CIA-connected Haitian, Clemard Joseph Charles, for Renda to bribe union officials.

CLEMARD JOSEPH CHARLES, Haitian exile who laundered money for Mario Renda to bribe union officials; CIA asset; mob money launderer; associate of Miami lawyer who represented Lawrence Freeman.

ROBERT CLARKE, former U.S. Comptroller of the Currency; lawyer with Houston firm Bracewell and Patterson; involved with Walter Mischer and Mischer’s Allied Bank; associated with Louisiana bank connected to Herman K. Beebe; helped charter West Belt National Bank, where Mike Adkinson and E. Trine Starnes, Jr., were stockholders.

JOHN CONNALLY, former Texas governor; Charles Keating worked on his 1980 Republican presidential race; he and his partner, Ben Barnes, borrowed tens of millions of dollars from dirty S&Ls.

RAY CORONA, former head of “Mafia” bank – Sunshine State Bank in Miami, which he fronted for drug smugglers; convicted felon; borrower from Peoples Savings in Llano, Texas; associate of mobsters and CIA operatives, including Leonard Pelullo, Frank Castro, Guillermo Hernandez-Cartaya and Steve Samos.

ROBERT L. CORSON, Houston good old boy and developer who owned Vision Banc Savings in Kingsville; Walter Mischer’s former son-in-law; CIA mule; indicted along with Mike Adkinson for $200 million S&L land deal in Florida.

ROY DAILEY, Robert Corson’s first cousin; former business associate of Walter Mischer; convicted for fraud at First Savings of East Texas, which he owned with money borrowed from Herman K. Beebe.

MARVIN DAVIS, Denver and Beverly Hills oil billionaire; neighbor of Norman Brownstein; did business with John Dick; his daughter was in the cookie business with Neil Bush’s wife, Sharon.

JACK DEVOE, convicted cocaine trafficker and CIA-connected arms smuggler; used Lawrence Freeman to launder money, which went to same trust in Isle of Jersey that was used by Robert Corson and Mike Adkinson; involved in drug-smuggling and money-laundering operation that included Fernando Birbragher and Marvin Warner’s Great American Bank.

JOHN DICK, who lives on a manor on the Isle of Jersey; Denver attorney by way of Russia and Canada; business partner with Silverado borrower Bill Walters; associate of Marvin Davis and Robert O. Anderson; borrowed from Hill Financial Savings; involved in Isle of Jersey trust company that was laundering drug money for Jack DeVoe and Lawrence Freeman and S&L money for Robert Corson and Mike Adkinson; sells wheat to the Russians; uses Youth for Christ as cover.

DON DIXON, former head of Vernon Savings, which he bought with a little help from his friend Herman K. Beebe; associate of John Riddle.

LAWRENCE FREEMAN, disbarred Miami attorney and convicted money launderer for cocaine smuggle Jack DeVoe; set up $200 million S&L land deal for Jake Belin and Mike Adkinson; former law partner of CIA super-operative Paul Helliwell and alleged money launderer for Mafia boss Santo Trafficante.

BILLIE JEAN GARMAN, Robert Corson’s mother and business partner; indicted along with her son in $200 million S&L land deal in Florida; first person publicly banned by feds from S&Ls.

THOMAS GAUBERT, big Democratic fundraiser from Dallas; former head of Independent American Savings; owned a piece of Sandia Federal Savings in Albuquerque; head of Telecom.

KENNETH GOOD, developer in Texas, Colorado and florida; borrower at Silverado Savings and Jarrett Wood’s Western Savings; helped set up Neil Bush in business.

GOULETAS FAMILY – NICHOLAS, EVANGELINE GOULETAS-CAREY and VICTOR GOULET – condo developers from Chicago; have alleged organized crime ties; owned Imperial Savings in San Diego; sold Bellamah Associates to Robert Bobb and Douglas Crocker.

JOSEPH GROSZ, Chicago mob associate; worked for Gouletas family; ran Southmark’s San Jacinto Savings; director of Thomas Gaubert’s Telecom.

MARVIN HAASS, San Antonio contractor; co-owner of Peoples Savings in Llano, Texas; associate of Morris Jaffe.

JAMES HAGUE, former owner of Liberty Federal Savings, Leesvile, Louisiana, which lent to Morris Shenker; associate of George Aubin and John Riddle.

STEFAN HALPER, co-founder with fellow George Bush supporter Harvey McLean of Palmer National Bank, which was financed by Herman K. Beebe and funneled private donations to the Contras; former son-in-law of past CIA deputy director Ray Cline; helped set up legal defense fund for Oliver North.

J. B. HARALSON, former head of Mercury Savings and Ben Milan Savings, where he was fronting for his close associate George Aubin; old Surety Savings hand and managing officer of two other Texas S&Ls that later failed.

RAYMOND SIDNEY RICHARD HARVEY, Isle of Jersey money manager; handled drug money for Jack DeVoe and Lawrence Freeman and S&L money for Mike Adkinson and Robert Corson; associate of John Dick.

GUILLERMO HERNANDEZ-CARTAYA[1], Cuban exile and Bay of Pigs veteran; convicted of fraud at Texas S&L he bought from Lloyd Bentsen’s father; CIA and Mafia money launderer; protected by CIA from certain criminal charges. — [1] Many hispanics are characters in this book. For those who are citizens of Spanish-speaking nations, the editors have maintained the Spanish accent marks in their names. For names of American hispanics, the accents have not been retained since for American usage they are customarily omitted. —-

RAYMOND HILL, Houston attorney and scion of old, rich Houston family; owner of Mainland Savings, which lent money to Mafia associates and CIA operatives; did business with Walter Mischer, “his mentor”; close friend of James A. Baker III.

JERRY HOLLEY, Waco contractor; co-owner with Marvin Haass of Peoples Savings; convicted for perjury involving S&L.

K. C. HOOD, Western Savings officer; convicted felon; associate of Herman K. Beebe; House Speaker Jim Wright rode in his plane.

MONZER HOURANI, Lebanese native and Houston businessman; close friend of U.S. Senator Orrin Hatch (Republican-Utah); did business with Robert Corson; borrowed from Lamar Savings and Mainland Savings.

MORRIS and DOUG JAFFE, father-and-son businessmen from San Antonio, Morris is an associate of Marvin Haass and Carlos Marcello, the New Orleans Mafia boss. Doug borrowed from Ed McBirney’s Sunbelt Savings and provided jet airplane noise-limitation equipment for Farhad Azima and others.

BURTON KANTER, Chicago tax attorney and reputed organized crime associate; founded Castle Bank & Trust with CIA mastermind Paul Helliwell; close associate of Lawrence Freeman; his law firm set up trusts for Larry Mizel.

CHARLES KEATING, S&L looter; spawned by Carl Lindner; worked on John Connally’s 1980 presidential campaign; controlled Lincoln Savings (the first big deal Lincoln Savings did was with John Connally); Lincoln involved in daisy chain with Larry Mizel’s M.D.C. Holdings, Silverado Savings and San Jacinto Savings (Joseph Grosz); lent more than $30 million to Father Ritter’s Covenant House; his chief pilot in 1979 was CIA operative Ken Qualls.

CARROLL KELLY, who epitomized his Kappa Sigma fraternity; owner of Continental Savings and associate of Herman K. Beebe (“I’m Beebe’s man in Texas,” he bragged to S&L regulators).

ADNAN KHASHOGGI, Saudi Arabian arms dealer, Iran-Contra middleman and borrower at Raymond Hill’s Mainland Savings and Lamar Savings.

ART LEISER, chief examiner for Texas S&L Department; discovered S&L daisy chains with Herman K. Beebe at center in 1983; challenged Guillermo Hernandez-Cartaya to a tennis match to try to get him out of Texas S&Ls.

CARL LINDNER, Cincinnati conglomerateer; gave Charles Keating his start; associate of Michael Milken and Marvin Warner; business ties to Walter Mischer; owns Ocean Reef club on Key Largo where Jack DeVoe would bring in his cocaine from Columbia; Florida police report said Lindner would not be happy with DeVoe’s income tax problems.

JON LINDSAY, county judge of Harris County; top Republican figure in Houston; close friend of George Bush; helped Robert Corson get his savings and loan and got $10,000 campaign contribution from Corson.

DONALD LUNA, convicted S&L looter and union pension fund scam artist; caught at Flushing Federal S&L with mobsters; worked loan brokerage deal with Herman K. Beebe, Ben Barnes and Richard Rossmiller.

CARLOS MARCELLO, New Orleans Mafia boss, who also ruled over the Texas underworld; recently returned from a seven-year vacation at Club Fed; close associate of Santo Trafficante.

RONALD J. MARTIN, Miami gun dealer who provided arms to the Contras for the CIA; alleged business partner with Robert Corson in a casino in Grand Canary Island.

ED MCBIRNEY, “Fast Eddie” from Dallas; former head of Sunbelt Savings; associate of Jarrett Woods and George Aubin.

JOE MCDERMOTT, Houston developer; protegé of Walter Mischer; business partner of John Connally; borrower at Robert Corson’s Vision Banc Savings.

HARVEY MCLEAN, Shreveport, Louisiana, businessman and close associate of Herman K. Beebe; owned Paris (Texas) Savings and Loan; founded Palmer National Bank with Stefan Halper and Beebe’s money.

JOHN MECOM, SR. AND JR., Houston oilmen; Sr. organized a charitable foundation that laundered money for the CIA; Jr. allegedly associated with New Orleans mobsters.

WALT MISCHER, JR., the son, tapped to take over his father’s empire; friend of Neil Bush; Kappa Sigma president.

WALTER M. MISCHER, SR., Houston developer, banker, power broker, who headed Allied Bank; Corson’s former father-in-law; did business with the Mafia and the CIA; fourth largest landowner in Texas; owns 12 percent of Caribbean nation of Belize with partners; friend and fundraiser for LBJ, Lloyd Bentsen, Ronald Reagan and George Bush, among many others.

LARRY MIZEL, Republican fundraiser and head of M.D.C. Holdings, a Denver homebuilder, which did more than $300 million of business with Silverado Savings and owned stock in the Gouletas family’s Imperial Savings; used Burton Kanter’s law firm for family trusts.

JACK MODESETT, Houston real estate investor; headed company that did business with Howard Pulver and owned land in far west Texas by a guns-for-drugs landing strip (close to Walter Mischer’s land).

LLOYD MONROE, former Kansas City organized-crime strike force prosecutor; told to back off Farhad Azima because he had CIA-issued get-out-of-jail-free card.

MURCHISON, CLINT, SR. AND JR., Dallas oilmen and wheeler-dealers; Clint Sr. was involved in business in Haiti with a CIA operative; Clint Jr. purchased Mischer’s interest in sawmills in Honduras; Jr., was involved with a CIA operative in Libya and did business with Herman K. Beebe and Adnan Khashoggi.

MARVIN NATHAN, Houston attorney who served on Carroll Kelly’s Continental Savings’ board; related by marriage to Robert Strauss; his law firm represented Robert Corson and Mike Adkinson; bought Texas ranch from the family of late Nicaraguan dictator Anastasio Somoza, which in turn had purchased it from one of George Bush’s best friends.

WILL NORTHROP, Israeli army officer and military intelligence operative; worked in Central America with CIA; associate of Richard Brenneke; indicted with Adnan Khashoggi’s attorney in scheme to sell arms to Iran; said Robert Corson “rode the CIA mule in with the Republican party.”

LEONARD PELULLO, Philadelphia Mafia associate; borrower at Ray Corona’s Sunshine State Bank; indicted in Ohio S&L scam with a member of the Herman K. Beebe circle; tried to buy an Atlantic City casino from another S&L looter; charged with fraud at American Savings in California.

ALBERT PREVOT, Houston and Louisiana businessman; associate of Herman K. Beebe and borrower at Mainland Savings and Continental Savings.

HOWARD PULVER, Long Island apartment syndicator who got money from Mainland Savings and Sandia Federal Savings; did business with mob associate Seymour Lazar; neighbor of Martin Schwimmer.

WAYNE REEDER, California developer; associate of Herman K. Beebe; borrower at Silverado Savings; his CIA-connected associate tried to make guns for the Contras on an Indian reservation.

MARIO RENDA, Long Island money broker with Martin Schwimmer, convicted felon and Mafia associate with a number of CIA buddies.

JOHN C. RIDDLE, a University of Texas Kappa Sigma who tried to emulate his fraternity brother George Aubin; Houston lawyer, developer, banker and title-company owner; close associate of Robert Corson; borrowed several hundred million dollars from Texas S&Ls that later failed.

JOHN B. ROBERTS, San Antonio developer who owned Summit Savings in Dallas and Commerce Savings in San Antonio; associate of George Aubin, Jarrett Woods and Adnan Khashoggi; convicted felon.

VICTOR J. ROGERS II, scion of Beaumont’s Rogers family, which owned Texas State Optical; former law partner of John Riddle; former co-owner of an Austin savings and loan; former officer of Caesar’s Palace casino in Las Vegas; his uncles were the third largest stockholders of Caesar’s Palace; two uncles served as directors of a Beaumont S&L that lent money to Harvey McLean on his Palmer National Bank stock.

RICHARD ROSSMILLER, Denver developer, Herman K. Beebe associate and borrower at Hill Financial Savings; alleged to be the largest debtor to the Federal Deposit Insurance Corp. in the country; John Dick’s neighbor.

HEINRICH RUPP, Denver gold dealer and CIA operative; convicted of bank fraud with mobsters; associate of Richard Brenneke.

JOE RUSSO, noted Houston developer; good friend of George Bush and Lloyd Bentsen; owned Ameriway Savings; big borrower at five failed S&Ls; minority owner of United Press International; Kappa Sigma.

STEVE SAMOS, convicted drug trafficker; helped Ray Corona set up Sunshine State Bank for drug smugglers; helped set up companies that funneled money and weapons to the Contras.

KENNETH SCHNITZER, noted Houston developer; business associate of Walter Mischer; owned BancPlus Savings; allegedly associated with mobsters.

MARTIN SCHWIMMER, convicted Long Island money broker with Mario Renda; Ph.D. and author; Mafia money launderer; neighbor of Howard Pulver.

BARRY SEAL, murdered drug smuggler, gun runner, DEA informant and CIA asset; used by CIA on drug sting of Sandinistas; had owned C-123K used to resupply the Contras; caught in 1972 guns-for-drugs operation with Cuban exiles in Mexico that included a Texas rancher, a Gambino family associate and Herman K. Beebe.

MORRIS SHENKER, deceased mob lawyer and casino owner; several of his properties ended up in the hands of Southmark, a Dallas real estate firm that was a mob dumping ground and owner of San Jacinto Savings.

REBECCA SIMS, former accountant for Robert Corson turned free-lance investigator and journalist.

ELLISON TRINE STARNES, JR., Houston con man and son of famous evangelist; borrower at Mischer’s Allied Bank; second largest borrower at Silverado Savings ($77 million); associate of John Riddle; borrowed more than $27 million from Carroll Kelly’s Continental Savings; one of the biggest private donors to the Contras.

ROBERT STRAUSS, Dallas attorney; U.S. Ambassador to Moscow and former chairman of the Democratic National Committee; friend of George Bush and former business partner with James A. Baker III; he and his son, Richard, were involved in a number of failed Texas S&Ls, including Lamar and Gibraltar.

SANTO TRAFFICANTE, the late Tampa Mafia boss; worked with CIA to try to assassinate Fidel Castro; involved in narcotics trafficking in Southeast Asia with CIA operatives; close to Carlos Marcello; one of his money launderers was Lawrence Freeman.

JACK TROTTER, Houston investor and close associate of Walter Mischer; headed Lloyd Bentsen’s trust; business partner of Jim Bath.

BILL WALTERS, Denver developer; borrower at Silverado Savings; helped set up Neil Bush in business; associate of Richard Rossmiller and John Dick.

MARVIN WARNER, native Alabaman who was involved in a number of failed S&Ls in Ohio and Florida; former U.S. ambassador to Switzerland; former chairman of Great American Bank and American Savings of Florida; convicted of S&L fraud in Ohio; had business ties to Robert Corson.

STEPHEN CASS WEILAND, Robert Corson’s attorney; former chief counsel to Senate Permanent Subcommittee on Investigations; expert on narcotics trafficking, money laundering and offshore banks; makes cameo appearance in Oliver North’s notebooks regarding a White House project in Belize.

JARRETT WOODS, former head of Western Savings; childhood buddy and close associate of George Aubin; sentenced to 25 years in jail for S&L fraud.

By Pete Brewton

CIA SCAMS

http://www.minormusings.com/Page/Norton.html

Marc Rich Leonard Millman and Marvin Davis

What sets this tale apart, what makes it truly extraordinary, is the extent and degree of the apparent exploitation and deceit. Even in this town, where huge sums are routinely paid as the price of political access, the figures are astonishing.”

–Senator John McCain, chairman,

Senate Committee on Indian Affairs

While media cameras were focused on Scooter Libby, who obtained access to executive decision-making through the front door of the White House, attention to the back door process had been lagging. An examination of Abramoff’s political background and connections to the current administration reveals a closely kept secret about how political campaign funds are siphoned from the very clientele the U.S. Department was designed to protect. Deeper investigation will also reveal historical ties that extend back to Theodore Roosevelt’s so-called “progressive” reforms at the turn of the 20th century that put the damper on populism. [1]

The Revolving Door Between Government and Industry

CSPAN viewers had a fascinating peek at Interior’s intrigue on November 2 when two former officials of George W. Bush’s Interior Department, sitting side by side, facing the Senate Committee on Indian Affairs, related completely contradictory interpretations of Jack Abramoff’s touted access to Secretary Gale Norton and her former Deputy Secretary, J. Stephen Griles. Michael Rossetti, the Department’s former counsel, had accused Griles of aggressive meddling in land-into-trust applications requested by Abramoff’s Indian gaming clients, while Abramoff’s emails indicated a belief he had Griles in his pocket. In contrast, Griles, his face growing increasingly red, spluttered that he had done nothing to give Abramoff such an idea.

Exemplifying what a recent New York Times editorial called an “ever-whirring carousel for business lobbyists and government appointees,” Rosetti left the department to work for Akin, Gump, the Dallas-based lobbying and law firm, [2] and Griles set up a lobbying firm of his own. [3] Griles worked six years under James Watt in the Reagan and Bush administrations, dealing primarily with surface mining issues. As Judy Bonds, director of the Whitesville, West Virginia-based environmental group phrased his performance, “Griles allowed the coal industry to rape the people and the environment of Appalachia.” [4] He then re-entered the private sector in 1989 to work in the mining industry and as a lobbyist for a firm which represented the National Mining Association and Dominion Resources, among others. [5]

The Reservation’s Resources—Fair Game?

Though Chairman McCain indicated there was “no evidence to suggest that Secretary Norton knew of, much less sanctioned, Mr. Abramoff or anyone else using her name in seeking fees and donations from Native Americans,” yet, because of Norton’s close ties to Italia Federici, a former aide, to whose political action committee Abramoff is alleged to have directed $250,000 from his Indian clients, can it be only a matter of time before another Cabinet official is dragged into the spotlight?

There is a familiar pattern to Norton’s background which should cause concern. Like Condoleezza Rice, Norton acquired her undergraduate degree from the University of Denver, graduating in 1975. She followed up with a law degree therein 1978 and then spent four more years in Denver, working for Mountain States Legal Foundation, an organization set up by James Watt with funds from the Coors family and Colorado’s mining interests.[6] Again following Condi’s path, Norton completed a one-year fellowship at the Hoover Institution in Stanford, California before beginning work for the federal government in the Reagan Administration, first at Agriculture and then Interior until 1987.

When she ran for the Senate in 1996, after two terms as Colorado’s state attorney general, Federici came onboard as Norton’s chief fundraiser, joining forces with the same types of aggressive fundraisers previously described in this writer’s articles on Karl Rove and Tom DeLay.

After the Senate defeat, Norton worked as a lobbyist for NL Industries (formerly known as National Lead), which faced numerous lawsuits over toxic-waste sites and lead paint products that it had sold. Today’s largest shareholders of NL Industries are Harold C. Simmons of Dallas and his brother through various corporate holdings like Valhi, Tremont, Titanium Metals, Keystone Consolidated Industries, and Kronos Worldwide. [7]

However, according to research of professor of chemistry Alanah Fitch:

NL dates back historically to William Collins Whitney, Bernard Baruch (son of Daniel Guggenheim’s physician), and attempts by Theodore Roosevelt’s cronies to take control of the industry. [8] Baruch, liked Whitney, worked in the administrations of Democrats (Wilson, FDR and Truman). What Fitch fails to mention in her environmental case study is the Yale and Skull and Bones connections of many of those involved, as well as the overriding presence of the families behind the Chicago Tribune–the Medill-McCormick-Patterson-Blair axis, previously mentioned at this website. [9]

In 1987 Norton became a trustee of the Coors-funded Independence Institute, and in 1998 (four years after Adolph Coors Foundation spun off Castle Rock Foundation) Norton founded the Council of Republicans for Environmental Advocacy (CREA). With help from chief aide Griles’ nemesis, Italia Federici, CREA was designed and set up by Republican fundraiser Grover Norquist. Coors money is makes up one of the largest components of the Heritage Foundation. [10]

During 1999 and 2000 Norton worked in private practice at Brownstein, Hyatt, Farber & Strickland, “known in Denver as a predominantly Democratic law firm,” according to an ABC news profile. Actually, the Brownstein firm, founded by Norman Brownstein, Vice President of the American Israel Public Affairs Committee (AIPAC), has used the Democratic Party to gain access to the White House for pro-Zionist issues. Brownstein has been attorney and friend of the late Denver oil magnate Marvin Davis, who was a one-time partner with Marc Rich in 20th Century Fox holdings.

Brownstein’s connection to the Bush family through the President’s brother, Neil Mallon Bush, was well documented by author Pete Brewton, who called Brownstein “one of the key figures in the middle of the big Silverado borrowers from Denver.” It was the billion-dollar failure of Silverado Savings that tainted the so-called career of Neil, who served on the board from 1985 to 1988. While Brownstein was acting as Marvin Davis’ attorney, Davis’ daughter—Nancy Davis Zarif—was involved in a “small cookie business called Cookie Express” with Neil’s wife (now ex-wife) Sharon Bush as her partner. The two women made the rounds of Denver’s charitable social scene together.

In Pete Brewton’s groundbreaking expose The Mafia, CIA and George Bush, Brownstein is named as “one of the most influential political fund-raisers in Colorado.” What is most revealing about Brownstein and his Denver law firm (which included attorney Gale Norton) is the knowledge acquired as a result of Brownstein’s relationships with other attorneys like Calvin Eisenberg and Burton Wallace Kanter, two Chicago tax attorneys with secretive connections to CIA attorney and paymaster Paul Helliwell, who incorporated drug airline Air America and helped to launder its cash profits into Florida real estate. Kanter used his contacts with Helliwell to launder the proceeds into Chicago real estate. [11]

Whether the Senate committee will follow this money trail or not once the Senators come face to face with Italia Federici still remains to be seen.

Don’t hold your breath.

[1] For further insight into this history, see Murray Rothbard’s article “Why Conservatives Love War and the State.”

[2] Akin, Gump represented the Seneca Nation of New York, a gaming tribe, and includes Democratic moneymen Robert S. Strauss and Vernon E. Jordan, Jr. among its partners.

[3] Griles’ firm handled environmental issues for the Quapaw Tribe of Oklahoma.

[4] Jason Stevenson, Outside Magazine, May 2005.

[5] According to the Union of Concerned Scientists website, documents obtained through FOIA indicated that Griles had written a memo instructing drafters of Economic Impact Statements to “focus on centralizing and streamlining coal-mining permitting.”

[6] A website called All Ears dot org, sponsored by the Heritage Forest Campaign and the Earth Justice website in 2005 stated: “CREA is funded almost entirely by the Coors’ Heritage Foundation, the Chemical Manufacturers Association, and National Mining Association.”

[7] One of the board members of Kronos, of which Harold C. Simmons is chairman, is Robert D. Graham, who has served as vice president, general counsel and secretary of Kronos Worldwide and NL since 2003 and vice president of Valhi and Contran since 2002. From 1997 to 2002, Graham served as an executive officer, and most recently as executive vice president and general counsel, of SSI. From 1985 to 1997, Mr. Graham was a partner in the law firm of Locke Purnell Rain Harrell (A Professional Corporation), a predecessor to Locke Liddell & Sapp LLP (now Locke Lord Bissell & Liddell LLP)—the same law firm for which Harriet Miers spent most of her career. KRONOS WORLDWIDE, INC. Attorneys from Locke, Liddell serve on the boards of virtually every Simmons corporation.

[8] Alanah Fitch, Sublime Lead: The Biography of a 5000 Year Toxic Love Affair (2004).

[9] Bernard Baruch,Baruch: My Own Story (New York: Henry Holt & Co.). It should be noted that the lead mining and smelting industry overlap with the mining of other metals such as titanium and uranium, strategic in manufacture of defense related weapons and aircraft. Titanium—a lightweight metal used in aerospace, power generation, pollution control, and auto industries—is produced from rutile and ilmenite, a mineral from which pig iron for castings is also made. Steel castings is the same industry in which the President’s great-grandfather, Samuel Bush of Ohio, became wealthy.

[10] See history of Coors conservative activism, and Joel Pelletier’s American Fundamentalists.

[11] Penny Lernoux, In Banks We Trust: Bankers and Their Close Associates: The CIA, the Mafia, Drug Traders, Dictators, Politicians and the Vatican.

http://www.salon.com/2005/11/18/federici_2/

Friday, Nov 18, 2005 7:00 AM Central Standard Time

By Michael Scherer

Topics:John McCain, R-Ariz.

Italia Federici is a minor Republican player in Washington, the sort of dime-a-dozen functionary who can build a career trading favors in backrooms and producing political campaigns for moneyed interests. Her specialty is the environment. She leads a conservative front group called the Council of Republicans for Environmental Advocacy, or CREA, a tiny outfit, originally founded by Interior Secretary Gale Norton, that argues it is healthy for forests to clear-cut trees, good for the air to weaken air-quality controls, and “environmentally responsible” to drill for oil in the Alaskan wilderness.

For the past five years, Federici has limited her public activities to supporting President Bush’s environmental plans. She claims that traditional environmentalists, groups like the Sierra Club and Democrats like Sen. John Kerry, D-Mass., are dishonest and deceptive. But that is just the public face of Federici. In private, she has played a very different role in Washington, one that has now put her in the middle of one of the largest political ethics scandals in a decade.

On Thursday, she appeared before the Senate Indian Affairs Committee to explain under oath her relationship with Jack Abramoff, the disgraced Republican lobbyist whose exploits have already led to a handful of criminal indictments. For critics of Republican politics, the Abramoff investigations are a gift that keeps on giving. They reveal a world of ethical violations, illegal money transfers, perjury and graft that flowed between some of the biggest names in Republican politics. Already, Abramoff has been charged with fraud; a top White House official, David Safavian, has been charged with perjury; and another former White House official, Timothy Flanigan, has withdrawn from a Senate confirmation process.

Abramoff’s dealings have thrown ethical clouds over a number of Republican heavyweights, including Rep. Tom DeLay, R-Texas., evangelical activist Ralph Reed, and anti-tax crusader Grover Norquist. And the investigation is far from over.

Under the direction of Sen. John McCain, R-Ariz., the committee has uncovered evidence that suggests Federici entered into an unspoken deal with Abramoff, who is accused of stealing millions of dollars from his Native American clients. He funneled nearly $500,000 in donations from these clients to her environmental organization. In exchange, Federici became his advocate in the inner sanctum of the Bush administration, offering him access to at least two of her close friends, Norton and Deputy Secretary J. Steven Griles. “Ms. Federici would help get inside information about and possibly influence tribal issues within the Interior,” explained Sen. McCain, at the start of the hearing.

For her part, Federici flatly denied all allegations that she had done anything untoward. “We provided excellent environmental advocacy consistent with our mission,” she said of her work with CREA, which is registered as a nonprofit. “I get a lot of unsolicited e-mail, and I am helpful to all of my friends.”

Sitting before the Senate panel, Federici had the bearing of a quiet, sympathetic elementary school teacher. She wore her blond hair loose over her shoulders, and spoke in soft tones. At one point she portrayed herself as an honest subordinate who had found herself working with unethical friends. “Jack was close to 50, a man and a high-dollar donor,” she said of his blunt e-mails to her. “I did not feel comfortable correcting his vernacular.” But she gave no ground to her inquisitors. She said, instead, that she believed the committee’s staff had engaged in a smear campaign against her. She called McCain’s investigation a “witch hunt,” adding that she believed the senator might hold a grudge because she had opposed a bipartisan bill on air quality that McCain had sponsored.

McCain seemed to take pleasure in the suggestion that he was the one bending ethical rules. He focused instead on the evidence he had compiled. He described multiple e-mails in which Federici responded to Abramoff’s requests for help lobbying Interior officials. In April of 2003, for example, Abramoff asked her to find out about a procedural change proposed by the department that had upset his clients. “Hi Jack: I will definitely see what I can find out,” she wrote back, before immediately changing the topic. “I hate to bug you, but is there any news about a possible contribution…?”

“Any objective observer would see that there is a connection between contributions to your organization and the work that you would be doing on behalf of Mr. Abramoff,” McCain said.

“I attached a second unrelated thought about an environmental project,” Federici protested.

“Since your answers are so bizarre, I won’t continue,” said McCain a few minutes later. “I will let others make the judgment.”

The e-mails released by the committee on Thursday certainly presented a damning case. At minimum, it appears Abramoff believed he was buying access to the Interior Department through Federici. He claimed to colleagues that Federici had “juice” at the agency. He claimed that CREA functioned as “Norton’s main group outside the department.” He offered Federici skybox seats at Redskins games and paid the bill for her meals and cocktail parties at his downtown restaurant, Signatures.

At the same time, Federici appeared to be catering to Abramoff’s every wish. She arranged meetings, requested photo opportunities, delivered memos and newspaper articles to Interior officials. She even organized Georgetown dinner parties, under the cover of CREA, so Abramoff’s clients could meet with Norton and Griles. “Thanks for all you do for my clients, the cause and me personally,” Abramoff wrote her in a 2002 e-mail.

“When my friends reach out to me and ask me to help them with things, I never turn around and say why don’t you just do it yourself,” Federici said, adding that she paid for her own cellphone to facilitate this process. “I believed at the time that the reason Jack was giving us money is because he was a very generous Republican contributor,” she said at another point in the hearing.

“That is unbelievable,” said Sen. Byron Dorgan, D-N.D., who is co-chairman of the committee.

There was far less disagreement about what Federici had done with the tribal money she collected from Abramoff’s clients. CREA spent it on initiatives that had nothing to do with the Native American tribes, but much to do with furthering President Bush’s agenda. In April 2002, for example, CREA ran a $40,000 full-page ad in the Washington Post praising the environmental merits of the president’s plan to drill in the Arctic National Wildlife Refuge.

“We are also going to do something mean to Senator John Kerry,” Federici wrote Abramoff, a few days before the ad ran. She then described a video CREA had packaged that showed Sen. Kerry leaving an Earth Day celebration and stepping into a gas-guzzling sports utility vehicle. She sent the video to at least two television programs on the Fox News Network, “The O’Reilly Factor” and “Hannity and Colmes.” “I am letting EVERYONE know that you are the only reason we have the funding to do this,” she gushed to Abramoff in the same e-mail.

At the same time, e-mails show that Abramoff and Federici plotted to use environmental causes to help Abramoff’s gambling clients. In December 2002, Abramoff proposed to Federici that she encourage the Interior Department to “say that they are not satisfied with the Environmental Impact Report” of a proposed casino in Michigan that would compete with one of Abramoff’s clients. “This is a direct assault on our guys,” Abramoff wrote to Federici. Eight minutes later, she wrote back to say she would contact Griles. “I will call him asap,” she said. The casino was eventually approved, after a protracted delay.

Sen. Dorgan compared Federici’s story to a fairy tale. “You know what bothers me?” Dorgan asked at the end of the hearing. “It’s pretty clear that this is one of the most disgusting tales of greed and avarice, and perhaps fraud and stealing. It’s unbelievable what we have uncovered here. It’s almost sickening to see what we have uncovered. And you come to our table and say, ‘Oh, gosh, this is just about friendships.’

“Somehow none of this adds up,” he continued. “This committee, in my judgment, has had people testify, and, in my judgment, some of the testimony was fraudulent. We need to find out who, because there are consequences to that.”

Dorgan may well have his way. The Senate Finance Committee is beginning its own investigation into the use of nonprofits like CREA by lobbyists like Abramoff. The Justice Department is in the midst of a wide-ranging investigation of Abramoff’s lobbying operation. Sen. McCain has suggested the Internal Revenue Service should mount its own investigation. And Dorgan said he will ask for another hearing of the Indian Affairs Committee.

No date has yet been set. But it is clear that Federici, a backroom player in big-money politics, will not have the last word.

Close

Michael Scherer is Salon’s Washington correspondent. Read his other articles here. More Michael Scherer

http://www.bhfs.com/People/nbrownstein

Norman Brownstein Shareholder nbrownstein@bhfs.com v-card Denver T 303.223.1101 F 303.223.0336

|

|

A founding member and Chairman of the Board of Brownstein Hyatt Farber Schreck, Norman is nationally recognized for his extensive experience in real estate law, commercial transactions and public policy advocacy. Resident in the firm’s Denver office, his policy practice spans the economic spectrum, extending to telecommunications, financial services, agriculture, tax and health care interests.

Norman has helped dozens of major organizations and corporations successfully develop and execute myriad legislative and regulatory strategies, including AT&T, Apollo Private Equity, Toshiba Corporation, Western Union, New School, National Association of Real Estate Investment Trusts Real Estate Roundtable, Comcast, Intelsat, Global Crossing, the National Cable & Telecommunications Association and the Private Equity Growth Capital Council. He has overseen the development and implementation of strategy for such complex matters as: |

|

In light of these and many successes in other legal areas, the National Law Journal named Norman one of the “100 Most Influential Lawyers in America” in 1997. Active in community affairs, Norman is involved in many activities on behalf of the University of Colorado and the American Israel Public Affairs Committee (AIPAC), where he is currently vice president. He is presently a director of National Jewish Health and a trustee of the Simon Wiesenthal Center. Norman is a past presidential appointee of the U.S. Holocaust Memorial Council (1996-2006).

Norman has received many awards and recognitions during his career. He is a past recipient of the Distinguished Humanitarian Award and the President’s Award from National Jewish Health, the Talmud Leadership Award from AIPAC, the Distinguished Service Award from ArtReach, and the Distinguished Alumni Award from the University of Colorado School of Law. In 2008, he was awarded the Mizel Museum’s Community Cultural Enrichment Award and the University Medal from the University of Colorado. Norman was both named as one of Lawdragon’s 500 Top Leading Lawyers in America, and awarded the National Jewish Health® Arthur B. Lorber Award for Distinguished Service, in 2009.

Since founding the firm in 1968, Norman’s strategic vision has helped build a three-man partnership into the powerhouse law firm it is today, with nearly 250 attorneys and legislative consultants in offices across the country.

http://www.bhfs.com/News/InTheNews?find=41123

In its fourth year, Lawdragon’s 500 Leading Lawyers in America guide identifies the most talented, respected and influential professionals handling the biggest legal matters of the year. This guide to the best lawyers in the United States is created through a unique combination of online balloting and independent research. Reporters and editors interview thousands of lawyers to get their input on the top “Dragons.” Votes are also collected via an online ballot.

A founding member and chairman of the board of Brownstein Hyatt Farber Schreck, Norman Brownstein is nationally recognized for his extensive experience in real estate law, commercial transactions and public policy advocacy. Brownstein’s policy practice spans the economic spectrum, extending to telecommunications, financial services, agriculture, tax and health care interests. Throughout his successful career, Brownstein has helped dozens of major organizations and corporations successfully develop and execute a myriad of legislative and regulatory strategies, including AT&T, Apollo Private Equity, Toshiba Corporation, Western Union, Comcast, Intelsat, Global Crossing and the National Cable & Telecommunications Association.

Frank A. Schreck is chair of the firm’s gaming law group and a member of the corporate and securities group. Schreck’s work revolves around licensing matters and all other aspects of regulatory compliance, representing Wynn Resorts, MGM Mirage, Harrah’s Entertainment, Pinnacle Entertainment, Station Casinos, WMS Industries, Riviera Hotel and Casino, Kerzner International and Barden Gaming. Schreck created the licensing structure used in achieving regulatory approval for private equity acquisitions in the gaming sector. Additionally, Schreck coordinated the gaming licensing efforts in the U.S. and internationally for Apollo Management and Texas Pacific Group in their purchase of Harrah’s Entertainment, Inc., and Fortress Investment Group in the purchase of Penn International, Inc.

http://www.bhfs.com/Practices/GovernmentRelations/CongressionalOversightInvestigations