Larry Mizel the Jewish Mobs Bank

(L) Norman Brownstein (R) Larry Mizel both Directors who run HSBC Bank a Division of Great West Life of Englewood, Colorado. Brownstein and Mizel are AIPAC Directors, Brownstein is one of George HW Bush’s six CIA Council when Bush was DCI in the mid 1970s.

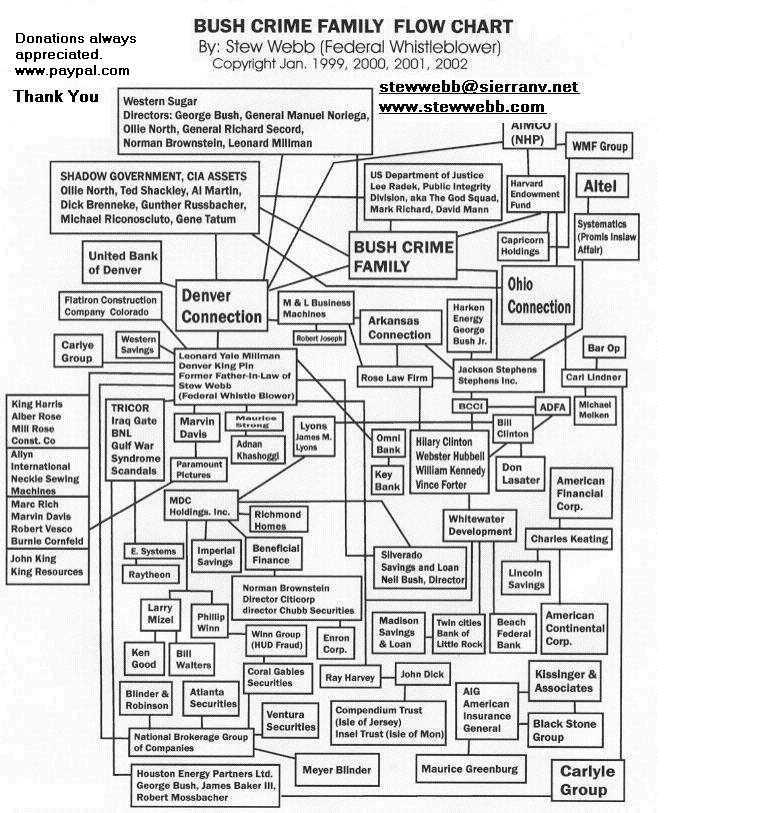

Mizel and Brownstein sold nearly $100 TrillionDolllars of Illegal Mortgage Backed Securities that lead to Bank Bail Out in 2008. Larry Mizel’s MDC Holding, Inc. (NYSE-MDC) was the parent company of Silverado Savings and Loan that collapsed with Neil Bush as the Director laundering Narcotics Money during Iran Contra from Bill and Hillary Clinton’s Iran Contra Mena, Arkansas Narcotics for weapons with Ollie North. Clinton, Mizel and Brownstein and the others have never been brought to Justice.

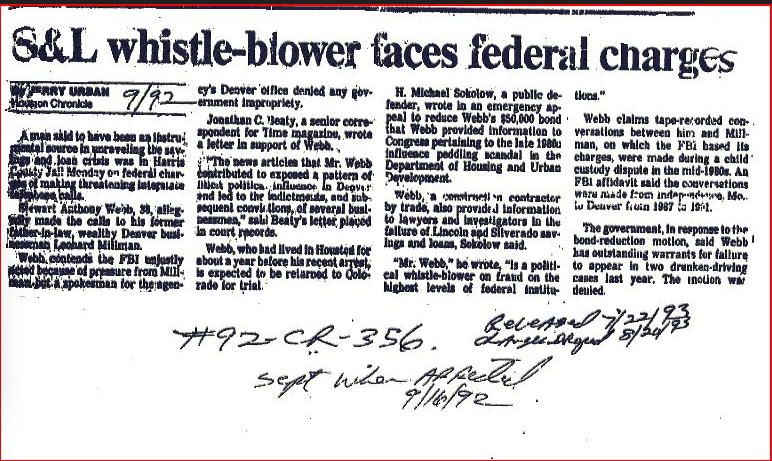

Stew Webb Savings and Loan Whistle blower Faces Illegal Charges

Stew Webb Official SEC Whistle blower Complaint Mortgage Backed Securities Fraud

Bush – Millman – Clinton Zionist Organized Crime Family Flow Chart (1)

FRAUDS ARE US AT MDC-NYSE The Denver Illuminati Zionist Connection

Illuminati Human Sacrifices June 21 and December 20-22 every year in Denver, Colorado

George HW Bush, Larry Mizel, Henry Kissinger, David Rockefeller, Rabbi Answar Bin Shari of Israel, Meyer Rothchild, and the other 12 Disciples of Satan are there Killing an Infant and drinking its blood as a Ritual to Satan.

From Cradle to Cabal The Secret Life of Gale Norton The Denver Illuminati Zionist Connection

Great-West shares dive among long-term jitters

MIKE DEAL / WINNIPEG FREE PRESS files

Great West-Lifeco CEO Paul Mahon says the firm is diversified and prepared for surprises such as the Brexit vote.

Despite only experiencing a modest impact from the disruption in the U.K. market relative to the Brexit vote, Great-West Lifeco shares plummeted almost six per cent Thursday amid investor uncertainty about long-term earnings growth.

The Winnipeg-based global insurance and investment company missed analysts’ forecast earnings growth in the second quarter prompting the share-price decline, down $1.99 to $31.77 on very heavy trading.

Even still, the company posted earnings of $671 million, up 1.8 per cent from the same period last year and an eight per cent increase from the previous quarter.

Assets under administration at the end of the quarter, June 30, 2016, were $1.2 trillion, a decline of $28.7 billion from the same period last year.

Premiums and deposits in the quarter were up 28 per cent compared to the second quarter of 2015 to $28.2 billion.

In a conference call with analysts Thursday, Great-West Lifeco CEO Paul Mahon voiced strong confidence in the company’s diversified asset mix in the U.K. and Europe despite the market volatility and uncertainty.

“The Brexit results were a surprise for many, but we were well-prepared for any eventuality,” Mahon said.

“There was a range of scenarios we had considered, and even under extreme impacts we believed our capital position was very strong and our business model resilient. It’s early days yet, but what has unfolded to date is a modest impact relative to the range of scenarios we tested.”

In addition to its large individual life and group life and disability insurance and retirement savings businesses in Canada and the U.S., the company has significant operations in the U.K., Ireland and Germany.

Gabriel Dechaine, an analyst with Cannacord Genuity, said, “There is lots of discussion around (GWL’s business in) Europe. People are wondering if this is still a growth part of the business, and it’s 40 per cent of their business, so it is very important.”

Dechaine said it is widely acknowledged Great-West Lifeco is a very well-run business, and he said he there is no big balance-sheet risk, including from its European assets.

“They are fine from that perspective,” he said.

“The issue is how earnings will grow from that business.”

Mahon said the mix of assets in the U.K., including real estate holdings, are performing well, with high-quality leases and low exposure to the office market in London.

“Property-related exposure has been of particular focus, and we are well-positioned with long leases and low LTVs (loan-to-value),” he said.

“Our business continues to operate smoothly. Obviously, we need to remain diligent… at this stage we are driving the business forward, and we’re seeing very sound results.”

There was a sharp decline in GWL’s share price after the June 23 vote, but Thursday’s drop was a bit of a delayed reaction.

“Brexit is just not a positive sentiment-builder,” Dechaine said.

He believes the investor response has something to do with the fact that it is an expensive stock to begin with.

“Any time there is any major macro-issue or overhang on a stock that up until then had a very rich multiple relative to its peer group, then it’s prime for a big correction like we are seeing today (Thursday),” said Dechaine.

Stew Webb Radio Network

Listen Live

US Intel Breaking News

http://www.stewwebb.com

Listen live by phone

712-775-8269

federalwhistleblower@gmail.com

.jpg)