HSBC Holdings plc (ADR): Saudi Setback, Moody’s Prophecy Coming True

Published by Mohammad Shehmir on April 1, 2016 at 3:33 pm EST

Illuminati Zionist Satanic Baby Killing punk Larry Mizel

By Stew Webb

Larry Mizel is one of the most Notorious Jewish Gangsters ever to live, following in the footsteps of Meyer Lansky and Leonard Millman, Larry Mizel has escaped Justice through pay offs and Bribes of Public Officials, Justice Department Employees, Congressman and Senators, FBI, DEA, and others agents and agency Chiefs and what is even more off the charts those Bribed got to keep their Bribes.

Larry Mizel paid a hefty fine in 1997 in a special Grand Jury and walked with out Jail.

Larry Mizel has been at the top and involved in every Major Financial Crime since 1968 and he is still walking and breathing at at the Helm of HSBC Bank a subsidiary of Great West Life Insurance Company of Englewood, Colorado. Larry Mizel also runs over 5,000 other companies including M.D.C. Holding, Inc. of Denver aka Richmond American Homes NYSE: MDC.

Larry Mizel is a Director of the American Israel Political Action Committee “AIPAC” which is nothing more than Israeli Espionage against the United States of America and has bought most of the US Congress and Senate with Political Campaign Contributions.

Spot Dog

Spot Dog

Stew Webb Whistle blower Federal Grand Jury Demand against Kerre Millman, Leonard Millman, Elaine Millman, Larry Mizel, Norman Brownstein, George HW Bush, Jeb Bush, Neil Bush, Bill Clinton, Hillary Clinton and others.

http://www.stewwebb.com/2016/03/22/stew-webb-whistleblower-grand-jury-demand-against-hillary-clinton

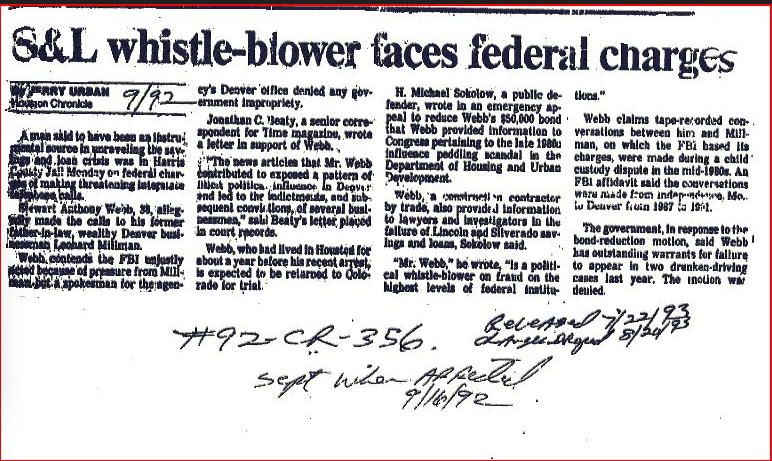

Stew Webb Savings and Loan Whistle blower Faces Illegal Charges

http://www.stewwebb.com/2013/10/08/sl-whistleblower-faces-federal-charges

Stew Webb Official SEC Whistle blower Complaint Mortgage Backed Securities Fraud

http://www.stewwebb.com/2013/10/07/stew-webb-official-sec-whistleblower-complaint-mortgage-backed-securities-fraud

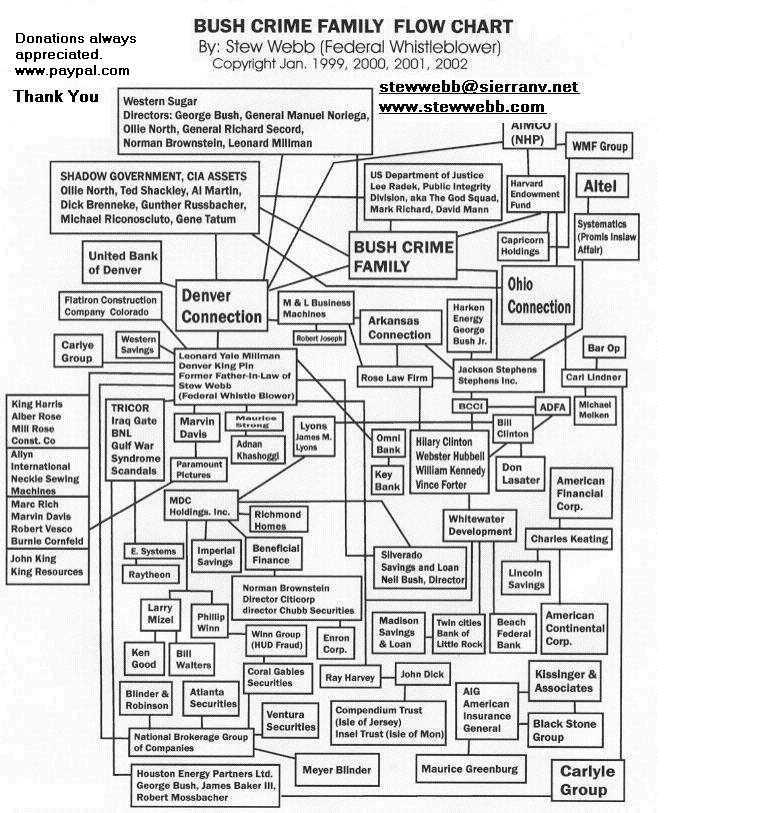

Bush – Millman – Clinton Zionist Organized Crime Family Flow Chart (1)

http://www.stewwebb.com/2013/08/11/bush-millman-clinton-zionist-organized-crime-family-flow-chart-1

FRAUDS ARE US AT MDC – NYSE The Denver Illuminati Zionist Connection

http://www.stewwebb.com/2013/08/17/frauds-are-us-at-mdc-nyse-the-denver-illuminati-zionist-connection

Illuminati Human Sacrifices June 21 and December 20-22 every year in Denver, Colorado

George HW Bush, Larry Mizel, Henry Kissinger, David Rockefeller, Rabbi Answar Bin Shari of Israel, Meyer Rothchild, and the other 12 Diciples of Satan are there Killing an Infant and drinking its blood as a Ritual to Satan.

http://www.stewwebb.com/?s=Illuminati+Human+Sacrifice&submit=Go

From Cradle to Cabal The Secret Life of Gale Norton The Denver Illuminati Zionist Connection

http://www.stewwebb.com/2013/08/12/from-cradle-to-cabal-the-secret-life-of-gale-norton-the-denver-illuminati-zionist-connection

John McCain wife hiding war profits untaxed off shore accounts

Note: Larry Mizel’s Real Corp Realty

http://www.stewwebb.com/2013/08/15/john-mccains-wife-hiding-war-profits-untaxed-off-shore-accounts

Donald Trump Vs US Senator John McCain

http://www.stewwebb.com/2016/03/06/donald-trump-vs-us-senator-john-mccain

Larry Mizel go to Jews for Republicans Who Want to Be President

http://www.stewwebb.com/2015/08/30/larry-mizel-go-to-jews-for-republicans-who-want-to-be-president

Larry Mizel another of his HSBC Bank Scandals

http://www.stewwebb.com/2016/04/03/larry-mizel-another-hsbc-bank-scandals

AIPAC Directors Larry Mizel, Norman Brownstein Campaign Contributions

http://www.stewwebb.com/2016/04/03/aipac-directors-larry-mizel-norman-brownstein-campaign-contributions

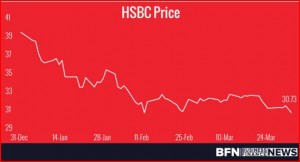

HSBC’s Saudi wing recently revealed a large provision for lawsuits, just as Moody’s predicted in mid-March

HSBC Holdings plc’s (ADR) (NYSE:HSBC) new fund inflows were blocked by the Saudi regulator in 2014-15, and we now know the reason. Yesterday, the bank’s Saudi unit revealed lawsuit provisions worth $42 million for the past two years. We seek to highlight how the bank is moving in the direction Moody’s recently predicted.

The figure could be one of the reasons HSBC stock fell 3% yesterday, and opened down 1.29% today. The provisions were accumulated over the past two years, and will be utilized to pay fines on violated regulations, from 2002 to 2014, and cater to future fines. The bank said it would not reveal details of settlements reached in the past.

The company has been inspected by various capital market authorities during the 2002-2014 period. On its website, it said the provisions were for the settlement of past issues, and a part of the provisions was put aside owing to high risk attached to the terms on which the remaining issues will be solved. The bank is uncertain about how much time the remaining issues would take to be resolved.

The ban on HSBC Saudi Asset Management Company was imposed in 2014, and lifted last year. According to Bloomberg, regulators found the company had breached local laws, but details over which ones, are unknown.

The revelations are a cause of concern for investors, since the bank has been involved in a lot of litigation around the globe. The company paid $618 million fines in 2014, over rigging foreign exchange benchmarks. It settled a US money laundering case in 2012, with $1.9 billion.

Business Finance News believes the company needs to tackle its risk management and compliance issues urgently, to be able to dispose off recurrent litigation. The company has improved compliance measure at a commendable pace, but needs to fortify the measures to improve profitability.

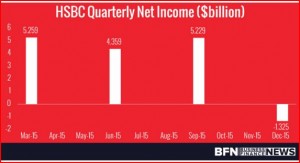

In Saudi Arabia, the bank’s profits last year were recorded at 279 million riyals, while the figure had come in at 229 million riyals in 2014. But profitability elsewhere is not pleasing. It recorded a net loss of $1.325 billion in fourth-quarter fiscal 2015 (4QFY15), while in 3QFY15, it had recorded net income at $5.23 billion. As a high priority growth market, Saudi Arabia gets special attention in matters related to expansion, but the aforementioned ban made it harder to pursue plans.

At the start of February, the Saudi unit was found to have hired two senior compliance employees, who held unaccredited business degrees. As such, they were ineligible even for an entry level position. This lifted the lid on the bank’s loopholes in checks and balances, which are bound to cause further issues in future.

Last Monday, a US federal judge rejected an appeal on the part of 14 large banks, to dismiss a private lawsuit, which accused them of rigging the interest rate benchmark, used in the derivative market, which happens to be worth $553 trillion. HSBC is one of those banks, which suggests we can reasonably expect it to incur further litigation expenses this quarter.

Moody’s Warning

On March 22, 2016, Moody’s warned that legal fees and remediation costs will continue to add downside risks for large British banks. It has also warned that charges are on the rise, and profitability is likely to be affected.

The combined litigation charges for Lloyds, HSBC, Barclays, RBS, and Santander UK, rose 40%, to 15 billion pounds in 2015. Laurie Mayers, an associate managing director at Moody’s said: “This significant increase in 2015, despite some decline in 2013 and 2014, demonstrates that these charges continue to present considerable tail risk.”

The aforementioned banks paid 7.6 billion pounds for payment protection insurance (PPI), which is a 51% year-over-year (YoY) increase. At the time, Moody’s had said that these banks will continue to increase provisions for litigation, and that prediction came true in the case of HSBC’s Saudi wing. The Financial Conduct Authority (FCA)’s deadline for the filing of relevant PPI claims is 2018.

Compliance lags

The bank has been reducing the size of its businesses around the world, to reduce financial-crime risk, having recently cut operations in 17 countries. It has also shut its branches in regions it is currently doing business in. The monitor looking after the settlement on HSBC’s money laundering case, has uncovered several potential lapses, from which we conclude that despite efforts to bring its compliance system up to US standards, it still struggles.

A five-year deferred prosecution agreement was part of the deal HSBC struck with the government in 2012. The government demanded that it improve compliance, and hire a monitor to keep an eye on progress. HSBC’s banking license in the US would be at risk if it fails to impress the US Department of Justice (DoJ). US authorities also found that HSBC was involved in the trafficking of $881 million worth of drugs, from Mexico to the US.

HSBC’s Measures

HSBC chief legal officer Stuart Levey said: “It’s as high a priority as anything in the bank, and we’re making the progress that we need to make.” He said he believed the bank would not be prosecuted after 2017.

Mr. Levey said the bank’s ability to detect fraud had increased manifold in the last few years. In 2015, the bank’s anti-financial crime program cost it $2.9 billion. He also said that the number of compliance officers at HSBC had been increased to three times as many as before, taking the current number to 9,000.

Stew Webb Radio Network

Listen Live

US Intel Breaking News

http://www.stewwebb.com

Listen live by phone

712-775-8269

federalwhistleblower@gmail.com

.jpg)