HSBC: Dirty Money and White Collars

Note from Stew Webb:

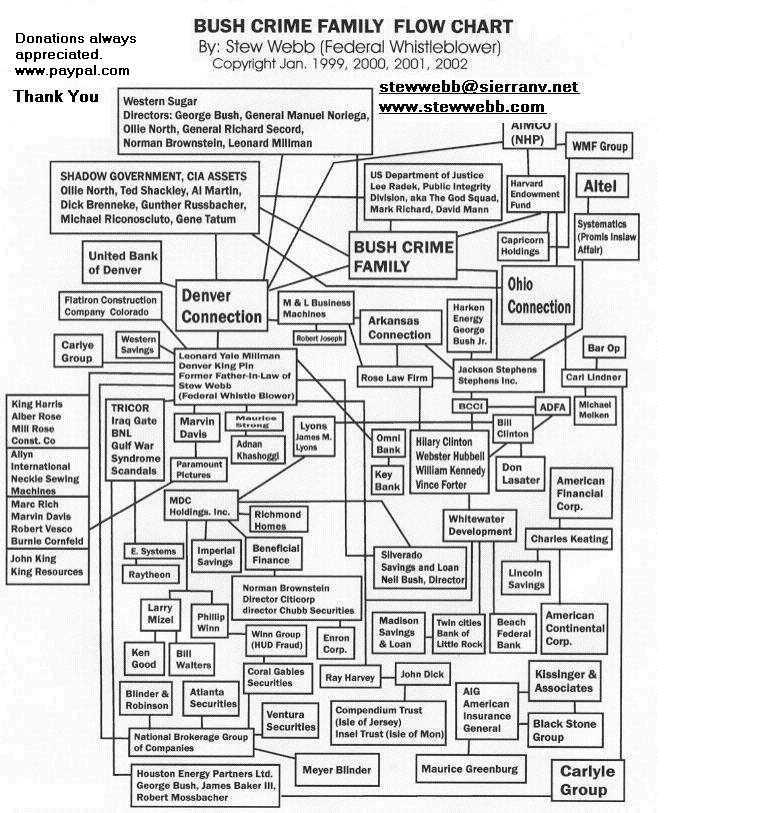

HSBC is a subsidiary of Great West Life of Englewood, Colorado

Great Webb a subsidiary of Power Financial Power Bank of Canada.

Jewish Crime Family Boss Hog Meyer Lansky owned Power Bank upon his death.

Power Bank was passed to Leonard Millman who created Great West Life susidiary’s are HSBC Bank, Western Savings that collapsed.

Upon Leonard Millman’s death in 2004 Power Bank, Great West Life, HSBC Bank, are now in the control of Larry Mizel of Denver a Fallen Angel Alien Possessed Human that does Human Sacrifices .

The Denver Illuminati

Larry Mizel was a “Buffer” for Leonard Millman since 1972

Mizel’s friend and law school buddy and now partner in crime Norman Phillip Brownstein were both Directors of MDC Holdings, Inc. subsidiary company Silverado Savings and Loan Neil Bush Director, George HW Bush’s son which Silverado Collapsed before its collapse they Laundered 9 Trillion Dollars of Clinton’s and Bush’s Iran Contra Drug and Weapons trafficking.

Guest: UMKC Law Professor William Black Who Shut Down Silverado

Savings and Loan

University of Missouri Kansas City

Subjects Financial Crises? 1 hr

Norman Brownstein was one of George HW Bush’s 6 CIA Attorneys from 1975-1977 then back to Denver to serve Leonard Millman,

Brownstein was the Boss of current Attorney General Bill Barr aka CIA Robert Johnson when Bush was CIA Director.

Both Larry Mizel and Norman Brownstein are AIPAC Directors

American Israeli PAC who own and control the US Congress and Senate.

AIPAC and Abramoff Operated Child Sex Blackmail Ring

AIPAC Directors Larry Mizel, Norman Brownstein Campaign Contributions

BlackRock BlackStone financial meltdown during coronavirus panic

Hillary Clinton and Bill Clinton Laundered to Denver over 4 Billion Dollars which was their payment of Drug proceeds from Iran Contra to Silverado and M&L Business Machines Company both collapsed.

Hillary Clinton Email: Destroy Syria for Israel

HSBC: Dirty Money and White Collars

Written by

Ignacio Rodríguez Reyna, Zorayda Gallegos and Silber Meza

Original Article please cut and paste in your browswer

insightcrime.org/news/analysis/hsbc-dirty-money-white-collars/

As drug traffickers’ bank of choice for many years, HSBC allowed its services to be used as a conduit for money laundering. The US and Mexican governments even slapped historic fines on the bank for its lax controls and permissiveness. Ramón García Gibson was the executive in charge of preventing this from happening. He now holds a high-ranking position in the Mexican government’s anti-money laundering division – a task at which he has failed before.

The El Dorado Task Force, made up of agents from the US Departments of Justice, Treasury and Homeland Security, traced the channels used by Mexican and Colombian drug traffickers to launder their money within the country’s financial system.

Years of police and financial intelligence work led to results at the end of 2012: HSBC Mexico was one of the banks recommended by drug traffickers and money launderers between 2006 and 2010, due to its lax controls and its ability to turn a blind eye in exchange for constant business.

*This investigation was carried out by Quinto Elemento Lab and CONNECTAS, with the support of the ICFJ, within the framework of the Investigative Reporting Initiative in the Americas (IRIA). It has been edited for clarity and reprinted with permission. It does not necessarily reflect the views of InSight Crime. Read the original in Spanish here.

The discovery of HSBC’s multiple failures to prevent the laundering of illicit funds resulted in the heaviest fines ever imposed on a financial institution in either the United States or Mexico: $1.9 billion and 379 million pesos (about $27.5 million), respectively.

Through Mexico’s Access to Public Information Law, Quinto Elemento Lab obtained the comprehensive files prepared between 2007 and 2012 by the National Banking and Securities Commission (Comisión Nacional Bancaria y de Valores – CNBV) which, across more than 20 volumes and some 10,000 pages, established how HSBC Mexico’s top management committed serious mistakes, such as:

- Deliberately failing to report suspicious transactions.

- Permitting the exponential growth of bulk dollar shipments on armored trucks bound for the US.

- Deliberately delaying the issuance of client reports with unusual and suspicious transactions.

- Maintaining business relationships, until the last possible moment, with people, businesses and currency exchange houses used by drug traffickers to acquire aircraft.

***

The discovery made by Mexican authorities aligned with the findings revealed in December 2012, by a squad of prosecutors and US special agents. The US Justice Department reported that HSBC had accepted full responsibility for committing crimes that seriously affected the workings of the US financial system and that the bank would face the largest fine ever for a financial institution within the country.

HSBC and its subsidiaries, most notably HSBC Mexico, were accused of five serious violations, among others:

- Deliberately failing to maintain and implement strict controls that would have avoided the laundering of proceeds from illicit activities and the financing of terrorism.

- Maintaining supervision with “staggering and obvious blunders,” that permitted Mexican and Colombian drug traffickers to launder at least $881 million in the US financial system between 2006 and 2010.

- “Turning a blind eye to money laundering” that occurred “right in front of their eyes.”

- Intentionally making mistakes when it came time to put in action an effective program for monitoring suspicious transactions conducted by HSBC Mexico.

- Relying on a system with such weak anti-money laundering controls that drug traffickers could deposit hundreds of thousands of dollars in cash into its HSBC Mexico accounts on a daily basis.

The agreement between US authorities and HSBC only validated what the US Congress documented during an exhaustive investigation conducted during the first half of that year.

The report elaborated by the end US Senate Committee’s Permanent Subcommittee on Investigations, entitled “U.S. Vulnerabilities to Money Laundering, Drugs, and Terrorist Financing: HSBC Case History,” laid the groundwork for conclusions that would be reached six months later by the US Justice Department.

A fourth of the US Senate investigation’s 334 pages were dedicated to examining the numerous flaws and shortcomings in HSBC Mexico’s anti-money laundering performance. And in 77 pages dedicated to revising the bank’s practices in Mexico, it mentions the name of a specific Mexican executive, whose performance was severely questioned, 59 times.

This same individual is now a high-ranking official within the government of President Andrés Manuel López Obrador. His main duty is to prevent money laundering within the Tax Administration Service (Servicio de Administración Tributaria – SAT).

This is almost as difficult to believe as the fact that HSBC Mexico is a repeat offender: even after receiving the historic fine, the bank has received 19 more sanctions for the same issue: its failure to stop money laundering.

***

Day after day, over the course of almost six months between 2007 and 2008, a robust team of auditors, led by Lorena Campia Acevedo, worked in the HSBC Tower located on Avenida Reforma in Mexico City.

These auditors sought to document what Mexican financial intelligence authorities already knew with a great degree of certainty: HSBC was the bank of choice for various drug trafficking groups due to weak anti-money laundering measures and its willingness to maintain business relationships with individuals and businesses despite continued warnings that they were laundering proceeds from illicit operations.

The team spent hundreds of hours reviewing account statements, customer records, reports of unusual transfers and systems for monitoring high-risk activities, among dozens of other documents.

The work carried out over that six-month period produced some 10,000 pages in total that reflected the authors’ complete access to information, thanks to requests and resources provided by the National Institute for Access to Public Information.

The CNBV auditors worked over two inspection periods, from July to August 2007 and from July to October 2008. With great patience and thoroughness, they produced the reports that led to the historic fine of 379 million pesos (some $27.5 million).

The abundance of deficiencies and irregularities discovered led Mexican financial authorities to conclude that HSBC constituted a “vehicle for crime, placing, concealing, legitimizing and distributing resources of illicit origin.”

Francisco Romo Navarrete, head of the CNBV’s General Management for the Prevention of Operations with Resources of Illicit Origin, synthesized the findings i an written statement dated August 29, 2011. The inefficiencies detected by auditors at HSBC Mexico “put at risk the national financial system’s regime for preventing money laundering and terrorist financing, with the resulting financial, economic and political repercussions.”

***

Among the thousands of pages within the file, the investigation team found the meeting minutes for HSBC Mexico’s Communication and Control Commission (CCC), the bank’s highest internal body responsible for addressing all aspects associated with money laundering, high-risk clients, politically-exposed persons, unusual operations and suspicious transactions.

Chaired by the head of the Executive Directorate for Compliance, representatives from the bank’s various business sections participated in the committee, including its legal area and its bodies responsible for preventing money laundering and terrorist financing.

Diverse functions have been assigned to the CCC, but the main one is: avoiding that the bank becomes an instrument for laundering profits derived from activities like drug trafficking.

A revision and analysis of the 20 minutes of the CCC’s monthly meetings show, in detail, how its members deliberately engaged in omissions and irregularities between June 2006 and March 2008, a period in which currency exchange houses and electronic fund transfer businesses used HSBC to launder drug trafficking proceeds.

The laundering of drug trafficking capital extended well beyond the period reviewed in the minutes. According to revelations by the US Department of Justice, the total figure came to more than $881 million between 2006 and 2010.

The copies of the minutes, which are no longer accessible due to the protection granted to HSBC Mexico after the CNBV handed over the complete file to this team of journalists, allow observers to appreciate, with unusual detail, the resistance CCC members expressed toward fulfilling their obligations.

For example, the committee’s refusal to report suspicious operations and cancel the accounts of Unimed, a business property belonging to Zhenli Ye Gon, a Chinese citizen accused of money laundering; or to end its relationship with the Casa de Cambio Puebla or with Sigue Corporation, businesses that had already had assets worth tens of millions of dollars frozen by US authorities, as they were suspected to be laundering money on behalf of Mexico’s Sinaloa Cartel and Colombia’s Norte del Valle Cartel.

***

Hours before a small group of senior HSBC Mexico executives were set to meet at 9 a.m. on June 28, 2007, newspaper headlines reported about climate change warnings from the United Nations, about Mexico beating Brazil in the Copa America and a discreet announcement made by Andrés Manuel López Obrador. The Honestidad Valiente (Brave Honesty) Association would open an account in Banorte to receive donations from the people after another bank closed their existing ones.

This other bank was HSBC, whose Communication and Control Committee would consider at that day’s meeting the details of the cancellation of Honestidad Valiente’s accounts. The association was created by López Obrador following the 2006 presidential election won by Felipe Calderón, in a process fraught by irregularities that led many to decry state fraud.

At the indication of Ramón García Gibson, the president of the CCC, the meeting agenda was read aloud. The third point on this agenda was a discussion of cases involving “special category customers,” as they called clients that should be given special attention due to various reasons. The cancellation of Honestidad Valiente’s accounts was included under this third point. This decision had been taken, on the recommendation of the CCC itself, due to the alleged risk of association with a Politically Exposed Person, the bank’s term for individuals potentially participating in acts of corruption by virtue of their political position and influence.

“The account was canceled on June 25, 2007, following the recommendation made by the Communication and Control Committee on May 31, 2007,” the meeting minutes read.

Moments before this issue was resolved, the CCC reviewed another the case of a special client: Sigue Corp., a firm that was described as a “leader in money transfers from the US to Mexico,” with thousands of agencies distributed across 48 US state.

Leopoldo Rodríguez Barroso, HSBC Mexico’s anti-money laundering (AML) Director, proposed that Sigue Corp’s accounts be canceled, as the company was being investigated and US authorities would impose a multi-million dollar fine on the bank for being linked in any way to illicit activities.

His proposal did not receive a lot of support. The committee led by García Gibson tossed out the proposal after the representatives of HSBC’s commercial area provided a “letter in response to the (money laundering) area,” with a statement that would be repeated in future CCC meetings: “(The head of the division) is aware of and in accordance with the business relationship [with Sigue Corp].”

The case resolution was emphatic, as te meeting minutes showed: the members of the CCC unanimously agreed to continue the business relationship and customer monitoring.

It would not be the only setback that Rodríguez Barroso would face that day. The sixth point on the day’s meeting agenda addressed one more topic: unusual and concerning transactions conducted by some of the bank’s clients.

Rodríguez Barroso suggested the bank cut its losses and cancel accounts with the Casa de Cambio Puebla. There were reasons to do so. In May 2007, the US government had frozen more than $11 million held by this currency exchange center at Wachovia Bank branches in Miami and London. Financial authorities alleged that these accounts contained proceeds from drug trafficking proceeds.

Additionally, this came shortly after a scandal in March 2007, when Mexico’s Attorney General’s Office raised the residence of Zhenli Ye Gon, owner of a company importing chemical precursors used to make synthetic drugs, seized $205 million in cash, weapons and records of bank transfers made from HSBC accounts.

The CCC meeting minutes showed that Rodríguez Barroso had sent, as of June 12, 2007, a written proposal for HSBC terminate the business relationship with the Casa de Cambio Puebla, due to its Wachovia Bank accounts being frozen.

The CCC did not give in. The representative of HSBC’s Commercial Banking Division alleged that he had already requested that they “not cancel the client’s accounts” and reported that the director of the division “has knowledge of the business and agrees to maintain it.”

These words were enough for the CCC, chaired by García Gibson, to “unanimously” reach the decision to maintain a business relationship with the currency exchange house, with the caveat that they would ask the bank’s director of commercial banking to inform “the CEO about its decision to continue the relationship.”

The minutes do not provide the details of the conversations held within the CCC, but the refusal to close the Casa de Cambio Puebla and Sigue Corp accounts was based on what would be exposed by investigations years later: HSBC did not want to lose high-volume business.

It would later be discovered, for example, that the Casa de Cambio Puebla was selling high quantities of US dollars to HSBC within the United States and that its activity multiplied rapidly. It rose from selling $18 million dollars in February 2005 to $113 million in March 2007, according to findings by the US Department of Justice and other agencies.

In October 2017 alone, the Casa de Cambio Puebla used its accounts with HSBC Mexico to generate 650 electronic transactions to its accounts in the United States. These were not paltry amounts, with $7.3 million being transferred in just 170 of these transactions.

The ‘business is business’ logic prevailed.

***

For Ramón García Gibson, 2005 did not get off to a particularly promising start. A tip reported via HSBC Mexico’s internal complaints line interrupted his December holidays.

An anonymous whistleblower alerted senior executives in HSBC Mexico that minutes and attendance records from the CCC’s obligatory monthly meetings had been falsified.

In fact, an email sent by Marion Roach, an HSBC compliance officer, to Stephen Green, the Global Corporate CEO at the time, revealed that the meetings had not actually taken place between July and December 2004.

An internal audit conducted after the fact by HSBC Mexico concluded that “the minutes were fabricated by a junior employee within the Anti-Money Laundering (AML) Directorate of the Mexican subsidiary.”

García Gibson was the Executive Director of Compliance and President of the CCC at the time, responsible for leading the monthly meetings which never happened. He was therefore clearly responsible for this irregularity and could not claim to have been unaware of it.

Nevertheless, someone lower down the chain took the blame: Carlos Rochín, the HSBC Mexico’s anti-money laundering director at the time, who resigned from his position and left the bank.

Still, García Gibson did not get off scot-free. He received a written warning and he was denied “what would have been a substantial [annual performance] bonus in 2004.”

But no further escalation, which would have meant his dismissal, took place because the HSBC Global Compliance Chief felt that his “mistake was limited to not adequately supervising a high-ranking subordinate that took advantage of his experience and his trust.”

The following months were not easy for García Gibson, who had held a similar position within Banamex. In December 2005, an internal audit team from HSBC Mexico compiled a 55-page report that did not portray him in a flattering light.

Despite the progress made to address HSBC’s multiple and deeply-seated shortcomings to prevent money laundering, the evaluation detailed with precision the irregularities found, many of them falling under the responsibility led by García Gibson.

There were more than just a few shortcomings: account monitoring system deficiencies, failures to guarantee oversight complying with official regulation, high-risk client records without documentation, unusual transactions going unreported, negligent monitoring and poor detecting of analyzing suspicious activity alerts, among other shortcomings.

This would not be the only time García Gibson caused alarm among superiors at HSBC in London. In October 2006, for example, they were informed that the anti-money laundering committee which he chaired had adopted a policy to close client accounts after four suspicious activity reports; HSBC Global’s internal policy set the cap at two such reports.

The chiefs in London expressed disbelief in the face of the revelation: “Four reports of suspicious activity seems to be a horribly indulgent policy, even for local standards (in Mexico). From any point of view, it goes against the group’s policies,” one of HSBC’s highest global corporate compliance directors responded.

García Gibson retreated and soon announced that the branch in Mexico would adopt the global standard. He never complied with that commitment. Months later, García Gibson revealed during a group conference that HSBC Mexico “had numerous cases of accounts with multiple reports of suspicious activities [up to 16 in one case] that remain open.”

The environment within HSBC Mexico’s money-laundering prevention area became increasingly complicated. After several warning signs, a scandal erupted involving Zhenli Ye Gon, the Mexican citizen of Chinese origin that owned several chemical precursor importers used in the manufacture of methamphetamine, and at whose Mexico City residence police seized $205 million in cash.

It soon became known that Zhenli Ye Gon, whom Mexican authorities arrested on charges related to money laundering, drugs and arms trafficking, had been a longstanding client of HSBC Mexico. His accounts were never classified as high-risk, despite the fact that his unusual transactions had caught the attention of the bank back in 2003 and that HSBC headquarters had ordered the branch to terminate its business relationship with him, instructions that were never followed by the CCC headed by García Gibson.

By then, superiors’ confidence in García Gibson had taken a hit. A new internal audit showed daunting results. Little progress had been made in the proper implementation of anti-money laundering measures at the bank.

Tensions grew but did not boil over until early July 2007 when García Gibson sent a report to his superiors in London.

John Root, HSBC’s senior manager of global compliance, responded on July 27, 2007, with a strongly worded email. “There are a number of items that jump out from the most recent weekly report…they all pale in comparison to the issue of money laundering.” He reproached the AML Committee for accepting unacceptable risks. “I am quite concerned that the committee is not functioning properly. I am close to picking up the phone to your CEO.”

The situation further broke down when London learned of the decision by the Mexico anti-money laundering committee to maintain the business relationship with Sigue Corp.

García Gibson explained that the company, which was widely suspected of laundering money, had signed an assumption responsibility letter. In any case, he stated, authorities would impose a fine on the bank but this did not carry a risk of anyone going to jail. This infuriated John Root. “What on earth is an ‘assumption responsibility letter’ and how would it protect the bank if the client is a money launderer? Please note that you can dress up the $10 million to be paid… to the US authorities as an ‘economic penalty’ if you wish but a fine is a fine, and a hefty one at that. What is this, the School of Low Expectations Banking?”

Root, one of HSBC’s highest-ranked global corporate executives issued a warning to García Gibson. HSBC Mexico’s “AML Committee just can’t keep rubber-stamping unacceptable risks merely because someone on the business side writes a nice letter. It needs to take a firmer stand. It needs some balls. We have seen this movie before, and it ends badly,” he wrote.

The avalanche questions surrounding AML compliance and prevention did not stop there. One after another, audits starkly exhibited systemic failures and deficiencies. HSBC was such a good conduit for laundering illicit proceeds that authorities from Mexico’s National Banking and Securities Commission (Comisión Nacional Bancaria y de Valores – CNBV) had no qualms in telling Michael Geoghegan, the bank’s global president, what they thought. “Wherever we find a serious money laundering scheme, HSBC seems to be involved,” they wrote to him.

In February 2008, Paul Thurston, the CEO of HSBC Mexico, became aware of something he had not previously realized. Mexican authorities did not entirely trust the head of the AML division. “It is clear that the CNBV does not hold our chief compliance officer (García Gibson) in high regard as we had thought. And, in fact, it seems that he lied to us in regards to the extent to which the CNBV had been informed and what it thought of our actions” to prevent laundering via HSBC Mexico, he said in an email to the bank’s global general manager.

When the constant shortcomings and failures almost became too much for the Mexican HSBC subsidiary, the corporate office executives decided to lay off the individual running the AML Division, Leopoldo Rodríguez Barroso.

Before leaving, at the end of February 2008, Rodríguez Barroso was given the opportunity to express himself freely. He did not hold back. He said that the bank had an unacceptable level of controls, that senior executives within the Mexican subsidiary showed no commitment to strengthening anti-money laundering measures and that, therefore, he would not be surprised if, sooner or later, the bank faced criminal sanctions.

When asked to describe Ramón García Gibson, he stated that “he is indecisive, weak, desperate to not lose his job and lacks a basic understanding of how to prevent money laundering.”

These were damning terms for García Gibson who is now a senior government official, tasked with implementing policies to prevent money laundering, an area in which he has already failed.

***

The setbacks that Leopoldo Rodríguez Barroso suffered during the June 28, 2007 meeting did not stop him. He attended the next CCC meeting and again tabled proposals to terminate business relationships that represented a high risk for HSBC Mexico.

In his role as a “guest” during a session on July 26, 2007, with a voice but no vote despite his position, Rodríguez Barroso waited for the third point on the day’s agenda when he would once again touch upon “special category clients.

When the moment arrived, he asked for the floor and insisted on his proposal to close Sigue Corp’s accounts. But again, his message caused annoyance, evidenced in the cold tone of the minutes.

“Notwithstanding the agreement made during the June 28, 2007 session, the subject was once again brought before the Committee by Leopoldo Rodríguez as he received information from the Commercial Banking division (CMB), related to possible sanctions from the US government of $10 million for being involved in operations related to resources of illicit origins.”

The CCC resolution chaired by García Gibson was predictable. “It decided to maintain the relationship with Sigue Corp., based on evidence that the client has a clear compliance risk management structure in place.”

For the members of the CCC and for García Gibson, who was assigned the task of visiting the client once US authorities publicly announced their reasons for sanctioning the business dedicated to money transfers to Mexico, the events had “originated in the past or [only] during a maximum period of two months.”

The reality was quite different. Sigue Corp. was negotiating an agreement with the US Justice Department as between November 2003 and March 2005, a group of undercover DEA agents used the business to send around half a million dollars to Mexico, which they made clear was dirty money made from marijuana sales. Months later, Sigue Corp. accepted the charges and paid a $15 million fine.

Despite having no success in getting his colleagues to heed his warnings, HSBC’s AML director did not give up. Several minutes later, he once again laid out the reasons why accounts belonging to Casa de Cambio Puebla should be closed

He had an argument. In June 2007, the US Justice Department ordered the freezing of existing funds in the 23 accounts that the currency exchange house held at the Wachovia Bank branch in Miami.

Once again, the CCC minutes recorded the result of Rodríguez Barroso’s attempt. “The issue was once again brought to the Committee by Leopoldo Rodríguez, in relation to the US government freezing $10.5 million in funds belonging to the company, possibly linked to drug trafficking, in accounts at Wachovia Bank.”

They also recorded that the CCC did not want to take any decision: “The subject was escalated to General Management. Resolution pending.”

The Casa de Cambio Puebla’s accounts remained open for many months. Those belonging to Sigue Corporation were never closed.

When Karla opened her account at the branch in Caborca, Sonora, she filled out the form and declared that not only had she been employed by HSBC, but that she had another hobby: cultivating vines, melons and asparagus.

At least, that is what she told the executives at the branch in Caborca, a dream spot for drug trafficking. It is located along the border with the United States, it has a long stretch of coastline along the Gulf of California and a very small population density.

Caborca is a key point for drugs trafficking, arms trafficking and money laundering for the Sinaloa Cartel, currently led by Ismael Zambada García, alias “El Mayo,” according to reports by US and Mexican authorities.

Even when the region of Caborca began reporting unusual financial movements as far back as 2006, coinciding with the start of Mexico’s bloody war on drugs, alerts did not go off at HSBC.

Karla, a fake name we use as the woman’s real name was omitted in the official report, was connected to other high-ranking launderers that the Sinaloa Cartel had infiltrated in Puebla and Mexico City, but the CNBV auditors did not know this at the time they reviewed the high-risk client reports and unusual transactions at HSBC.

Perhaps the auditors’ suspicion was aroused when they saw the account of a former bank employee suddenly showing transactions that did not align with her usual behavior, but that not been reported by HSBC employees.

So they included her name, along with a dozen others, in a report entitled “Operations that reflect notable changes in the transactional behavior of clients,” a copy of which Quinto Elemento Lab was able to obtain.

According to a report by CNBV, during the months of February, March and June 2008, Karla participated in a very popular scheme among money launderers: she received multiple cash deposits of under $10,000, adding up to $162,000.

The money remained in her account for a very short time before almost immediately transferred to five different recipients. The crucial element was not the amount, which was not as massive as in other money laundering cases, but one of those recipients: a business called Insured Aircraft Title, dedicated to buying and selling planes.

This is where Karla was connected to people that she very likely never met, such as Jorge Barraza and Jorge Medina, who had previously sent transfers to the same company and others involved in the aviation sector. Barraza and Medina were members of a financial structure used to launder resources for the Sinaloa Cartel. Both men had acquired a fleet of 13 airplanes that had been used to transfer drugs from South America to Mexico. The HSBC accounts of Casa de Cambio Puebla were used to make the transfers to pay for them.

A DEA investigation would later reveal that, as of 2003, a dozen people used Casa de Cambio Puebla accounts at HSBC to deposit several million dollars in cash to pay for aircraft, including DC-9, Falcon 20 and Super King 200 planes.

Despite multiple forms of evidence, the CCC at HSBC resisted closing the accounts for months.

***

The call for an additional CCC meeting was unusual for HSBC Mexico. No issues of major relevance had required a special meeting.

But these were strange and unprecedented times. In September 2007, the federal government was raging its war against drug cartels such as Los Zetas and La Familia Michoacana.

The call came for an extraordinary meeting to take place at 9 a.m. on September 6, 2007. It took several of the committee members by surprise, they could not attend and sent stand-ins in their place. With a minimum quorum present, Rodríguez Barroso presented the details of a special investigation that had been conducted in Mexico’s Northern Pacific region.

He told the CCC that a criminal organization had penetrated the HSBC structure in this region. In reality, it was a huge asset laundering operation run by the Sinaloa Cartel that would not be made public for five more years.

The report, that would internally be referred to as “The Sinaloa Case,” included the details of an unusual pattern detected in the transactions of 81 clients, a scheme involving bank employees in Culiacán, San Luis Río Colorado and Nogales, Sinaloa as well as Tijuana and Mexicali in Baja California. The first city is the Sinaloa Cartel’s center of operations and the other four are located along the border with the United States.

This same day, CCC members agreed to process all reports of unusual operations of the 81 clients involved in the operation as well as the concerning transactions of the four employees implicated.

It was also requested that the accounts of those involved be closed, that the members of the CCC be informed of the steps taken and that a list of executives possibly involved be drawn up “in order to launch an investigation to identify all employees involved.”

According to the minutes, the meeting concluded with a commitment to conduct a more thorough evaluation in order to strengthen oversight and accountability in that region of the country.

But despite these pledges, this matter was shelved just three months later, on December 17. During the monthly CCC meeting, it was simply announced that the report had been prepared by the division responsible and that all employees in the personal banking division in northern Mexico had been informed and trained so as to avoid a similar situation occurring in the future.

The Sinaloa Case file was forgotten for several years and was not opened again until December 11, 2012, when the US Department of Justice laid out the facts before a federal court in Brooklyn, New York.

As part of a deferred prosecution agreement with HSBC’s global corporate office, US prosecutors reported that HSBC Mexico learned from emails from employees that “a massive money laundering scheme,” executed by employees and managers of many branches in Sinaloa, was taking place.

Although the accounts involved were closed and the employees involved were let go, the HSBC branches in Sinaloa continued to accept large cash deposits in dollars.

The State Department expressed stark concern around the high volume of physical dollar bills that were being sent, including in armored transports, from the HSBC Mexico branches to the United States.

Prosecutors from the Justice Department pointed out that “the significant amount of physical dollar bills that HSBC Mexico exports to the United States come from Culiacan, the home of the Sinaloa Cartel.” Between 2006 and 2008, HSBC shipped more than $1.1 billion in dollar bills from Sinaloa.

It was never known with complete certainty if the participation of the HSBC executives and managers in the massive money-laundering scheme was the result of corruption or threats.

What is certain is that the final time HSBC mentioned the Sinaloa Case internally came in March 2008 when the bank’s human resources division agreed to establish “an employee care program for employees who, upon reporting suspicious activity, believe their physical integrity to be in danger.”

***

Elise J. Bean held a key and influential role at the Capitol Building in Washington for many years: she was the director and chief advisor to the US Senate Permanent Subcommittee on Investigations.

It was in this capacity that she led an investigation, for over a year, into the US’ vulnerability to money laundering and terrorist financing, in which it was discovered that HSBC bank branches in the United States and Mexico would be perfect conduits for these activities.

Now the director of the Washington Office of the Levin Center of Wayne State University, Elise J. Bean remembers the report in detail that she and her team compiled about their findings on HSBC Mexico.

She did not want to go into details, but she agreed to respond to a few questions sent by reporters via email.

She avoided judgment of the performance of Ramón García Gibson, president of the CCC at the time, saying that he is not a US citizen nor a resident, “and the Congress’ work is to examine public policies, not to prosecute individuals.” Nevertheless, she did point out that the investigation “detailed a lot of problematic behaviors” among CCC members.

García Gibson’s professional performance during this highly questioned and tense period inevitably caught the attention of his international colleagues working to curb money laundering, who did not accept the idea that all that happened was due to negligence.

In fact, they were surprised by the fact that criminal charges have not been pressed against García Gibson and that he has remained an influential figure in the sector.

Shortly after the US Senate made its report public, which highlighted the multiple failures in his performance, García Gibson was invited to be a speaker at an international anti-money laundering conference in Mexico City. Some of the attendees were surprised that the organizers chose not to remove him from the list of invitees.

They believed García Gibson to have been conveniently careless. “He did nothing (to prevent the bank from being used by drug traffickers); he looked the other way,” said a money-laundering specialist from Argentina, who has met García Gibson several times over the years at seminars and international conferences. “You can miss one, two, three, four transactions, but not that amount [that he did not report].”

Furthermore, the expert believed that “if he did not end up in prison, it is because individuals higher up knew about it.” From his point of view, the case was symbolic, because normally drug traffickers use different banks. “In this case, they spread the money out within the same bank,” he commented.

At the time of publication, Ramón García Gibson had not responded to requests for an interview nor to a 23-part questionnaire sent to the email address that he provided us.

García Gibson survived this entire episode.

After this “incident,” he became, at least for the next 15 years, one of the most recognized voices in Mexico on how to prevent money laundering and terrorist financing.

His name is well-known in the banking sector in Mexico and aboard, as well as in academia, the business sector and among public servants.

Trained in law at the Ibero-American University, the National Autonomous University of Mexico and the University of Houston in Texas, García Gibson rarely appears in the media. When he does, he looks sharp: simple haircut, white shirt, well-spoken and appearing concentrated.

In June 2009, following his departure from HSBC, he founded an anti-money laundering consulting firm that bears his name. Over time, he was invited to give lectures, workshops and seminars.

He then became an investigator for the National Institute of Criminal Sciences (Instituto Nacional de Ciencias Penales-Inacipe), where he developed a proposal for a national strategy to combat money laundering and even designed and launched an academic proposal for a one-year specialization training program.

His students are generally agents of public institutions, compliance officers at banking institutions and even officials from Mexico’s Financial Intelligence Unit (Unidad de Inteligencia Financiera – UIF).

Then, according to a partial resume obtained thanks to an information request made to the Tax Administration Service (SAT), García Gibson was appointed as Director-General of Inspections and Evaluations at Mexico’s National Security Commission (Comision Nacional de Seguridad – CNS) in October 2015.

He lasted one year in the role. From November 2016 to October 2018, he served as the federal police’s coordinator for investigations of operations with resources from illicit origins.

The change in administration also benefited him. Within the first few months of López Obrador’s presidency, he was named head of the SAT’s Central Administration of Legal Affairs for Vulnerable Activities, a strategic position among the agency’s highest ranks. It is a crucial position to combat money laundering in Mexico.

***

“What do you think of the committee responsible for preventing money laundering at HSBC Mexico?” we asked Bean.

“The decisions made by the CCC at HSBC Mexico during the period we examined were deeply concerning, as we detailed in the report. The committee did nothing to detect, exhibit, report and detain the suspicious activities and close the accounts,” she responded.

The president of this committee was García Gibson.

***

Once the actress Dolores Heredia had introduced the program on the morning of June 20, 2007, producer Jesús Ramírez Cuevas told the cameras to cut to the feed of López Obrador.

As the main guest of the program ‘La Verdad Sea Dicha,’ (The Truth Is Told) a half-hour program broadcast at 1 a.m. on TV Azteca, López Obrador emphasized how the corrupt political system of Mexico’s old regime was attacking him.

He informed the program’s viewers that HSBC had just sent him a letter, stating it would close the two accounts belonging to Honestidad Valiente (account numbers “4038497855 and 40387848, as well as any other escrow accounts”) that were being used to raise funds from supporters of “Mexico’s legitimate government.”

At the time, Felipe Calderón had been the president for six months, amidst a tense political climate and questions around the government’s legitimacy.

López Obrador stated that there had been many accusations against him. “We are the main political force in this country because we number millions, because we are defending our ideals,” he said.

“We just received a letter from HSBC canceling our account,” he announced. Some 11,238 people had voluntarily deposited $15.8 million pesos (around $745,000) on these accounts between November 3, 2006 to June 8, 2007.

López Obrador clarified that the contributions were made by thousands of individuals, in small quantities, and that he was using them to pay for his expenses during tours around the country.

“Now the bank (comes out) with this letter…because it is convenient for its interests to cancel the account,” he said.

He blamed the director of Mexico’s central bank at the time, Guillermo Ortiz, and Treasury Secretary Agustín Carstens for pressuring HSBC to cancel Honestidad Valiente’s accounts.

***

Twelve years later, months of work by the National Banking and Securities Commission (CNBV) to obtain the records of the fines and irregularities committed by HSBC showed that President López Obrador was mistaken.

Neither Guillermo Ortiz nor Agustín Carstens pushed for Honestidad Valiente’s accounts to be canceled. It was Ramón García Gibson, then president of the CCC of HSBC. And today, he is a high-ranking official within López Obrador’s own government.

*This investigation was carried out by Ignacio Rodríguez Reyna, Zorayda Gallegos and Silber Meza for Quinto Elemento Lab and CONNECTAS, with the support of the ICFJ, within the framework of the Investigative Reporting Initiative in the Americas (IRIA). It has been edited for clarity and reprinted with permission. It does not necessarily reflect the views of InSight Crime. Read the original in Spanish here.

More on HSBC Bank

.jpg)