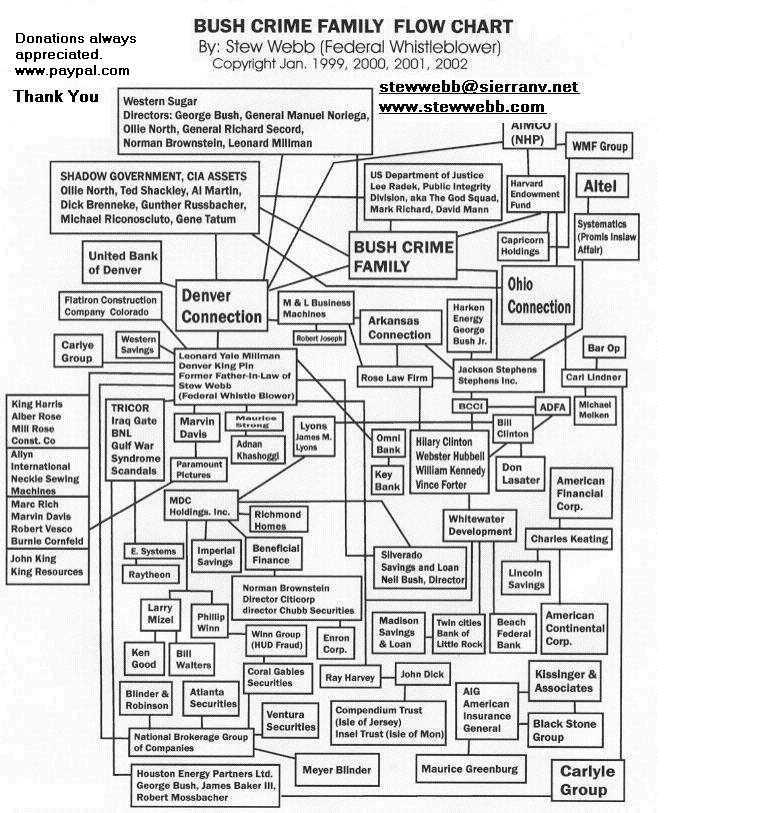

BlackRock Blackstone Silverado Saving and Loan Iran Contra Narcotics Money Laundering Neil Bush Larry Mizel Norman Brownstein Directors

Headquarters in Hudson Yards, New York City

|

|

| Type | Public |

|---|---|

| ISIN | US450614482 |

| Industry | Investment management |

| Founded | 1988 |

| Founders | |

| Headquarters | 50 Hudson Yards New York City, New York, U.S. |

|

Area served

|

Worldwide |

|

Key people

|

|

| Products | |

| Revenue | |

| AUM | |

| Total assets | |

| Total equity | |

|

Number of employees

|

19,800 (December 2022) |

| Subsidiaries | iShares |

| Website | blackrock |

| Footnotes / references [1] |

|

BlackRock, Inc. is an American multinational investment company based in New York City. Founded in 1988, initially as an enterprise risk management and fixed income institutional asset manager, BlackRock is the world’s largest asset manager, with US$8.59trillion in assets under management as of December 31, 2022.[1] BlackRock operates globally with 70 offices in 30 countries, and clients in 100 countries.[1] BlackRock is the manager of the iShares group of exchange-traded funds, and along with The Vanguard Group and State Street, it is considered to be one of the Big Three index fund managers.[2][3] Its Aladdin software keeps track of investment portfolios for many major financial institutions and its BlackRock Solutions division provides financial risk management services.[4] BlackRock is ranked 184th on the Fortune 500 list of the largest United States corporations by revenue.[5]

BlackRock has sought to position itself as an industry leader in environmental, social, and corporate governance (ESG). It has been criticized by some for investing in companies that are involved in fossil fuels, the arms industry, and human rights violations in China. Others have scrutinized BlackRock for its efforts to reduce its investments in companies that have been accused of contributing to climate change and gun violence and its promotion of gender diversity; the U.S. states of West Virginia, Florida, and Louisiana have divested money away from or refuse to do business with the firm because of its ESG policies. The company has also faced criticism for its close ties with the Federal Reserve during the COVID-19 pandemic and for anti-competitive practices due to its significant ownership stakes in many companies.

History[edit]

1988–1999[edit]

BlackRock was founded in 1988 by Larry Fink, Robert S. Kapito, Susan Wagner, Barbara Novick, Ben Golub, Hugh Frater, Ralph Schlosstein, and Keith Anderson[6] to provide institutional clients with asset management services from a risk management perspective.[7] Fink, Kapito, Golub and Novick had worked together at First Boston, where Fink and his team were pioneers in the mortgage-backed securities market in the United States.[8] During Fink’s tenure, he had lost $90 million as head of First Boston. That experience was the motivation to develop what he and the others considered to be excellent risk management and fiduciary practices. Initially, Fink sought funding (for initial operating capital) from Pete Peterson of The Blackstone Group who believed in Fink’s vision of a firm devoted to risk management. Peterson called it Blackstone Financial Management.[9] In exchange for a 50 percent stake in the bond business, initially Blackstone gave Fink and his team a $5 million credit line. Within months, the business had turned profitable, and by 1989 the group’s assets had quadrupled to $2.7 billion. The percent of the stake owned by Blackstone also fell to 40%, compared to Fink’s staff.[9]

By 1992, Blackstone had a stake equating to about 35% of the company, and Stephen A. Schwarzman and Fink were considering selling shares to the public.[10] The firm adopted the name BlackRock, and was managing $17 billion in assets by the end of the year. At the end of 1994, BlackRock was managing $53 billion.[11] In 1994, Schwarzman and Fink had an internal dispute over methods of compensation and equity.[10] Fink wanted to share equity with new hires, to lure talent from banks, unlike Schwarzman, who did not want to further lower Blackstone’s stake.[10] They agreed to part ways, and Schwarzman sold BlackRock, a decision he later called a “heroic mistake.”[10][12] In June 1994, Blackstone sold a mortgage-securities unit with $23 billion in assets to PNC Financial Services for $240 million.[13] The unit had traded mortgages and other fixed-income assets, and during the sales process the unit changed its name from Blackstone Financial Management to BlackRock Financial Management.[10] Schwarzman remained with Blackstone, while Fink became chairman and CEO of BlackRock.[10]

1999–2009[edit]

In September 1999, BlackRock became a public company, selling shares at $14 each via an initial public offering on the New York Stock Exchange.[14][11] By the end of 1999, BlackRock was managing $165 billion in assets.[11] BlackRock grew both organically and by acquisition.

In 2000, under the direction of Charles Hallac, BlackRock launched BlackRock Solutions, its analytics and risk management division. The division grew from the Aladdin System, the enterprise investment system, Green Package, the Risk Reporting Service, PAG (portfolio analytics), and AnSer, the interactive analytics.[4]

In August 2004, BlackRock made its first major acquisition, buying State Street Research & Management’s holding company SSRM Holdings, Inc. from MetLife for $325 million in cash and $50 million in stock. The acquisition increased BlackRock’s assets under management from $314 billion to $325 billion.[15] The deal included the mutual-fund business State Street Research & Management in 2005.[13]

BlackRock merged with Merrill‘s Investment Managers division (MLIM) in 2006,[11][16] halving PNC’s ownership and giving Merrill a 49.5% stake in the company.[17]

In October 2007, BlackRock acquired the fund-of-funds business of Quellos Capital Management.[18][19]

BlackRock Solutions was retained by the U. S. Treasury Department in May 2009[20] to analyze, unwind, and price the toxic assets that were owned by Bear Stearns, American International Group, Freddie Mac, Morgan Stanley, and other financial firms that were affected in the 2007–2008 financial crisis.[21][22] The Federal Reserve allowed BlackRock to superintend the $130 billion-debt settlement of Bear Stearns and American International Group.[23]

In 2009, BlackRock became the largest asset manager worldwide.[13]

In April 2009, BlackRock acquired R3 Capital Management, LLC and management of its $1.5 billion fund.[24]

2010–2019[edit]

In February 2010, to raise capital needed during the financial crisis, Barclays sold its Global Investors unit (BGI), which included its exchange traded fund business, iShares, to BlackRock for US$13.5 billion and Barclays acquired a near-20% stake in BlackRock.[25][26]

On April 1, 2011, BlackRock was added as a component of the S&P 500 stock market index.[27][28]

In 2013, Fortune listed BlackRock on its annual list of the world’s 50 Most Admired Companies.[13]

In 2014, BlackRock’s $4 trillion under management made it the “world’s biggest asset manager”.[29]

At the end of 2014, the Sovereign Wealth Fund Institute reported that 65% of Blackrock’s assets under management were made up of institutional investors.[30]

By June 30, 2015, BlackRock had US$4.721 trillion of assets under management.[31] On August 26, 2015, BlackRock entered into a definitive agreement to acquire FutureAdvisor,[32] a digital wealth management provider with reported assets under management of $600 million.[33] Under the deal, FutureAdvisor would operate as a business within BlackRock Solutions (BRS).[32] BlackRock announced in November 2015 that they would wind down the BlackRock Global Ascent hedge fund after losses. The Global Ascent fund had been its only dedicated global macro fund, as BlackRock was “better known for its mutual funds and exchange traded funds.” At the time, BlackRock managed $51 billion in hedge funds, with $20 billion of that in funds of hedge funds.[34]

In March 2017, BlackRock, after a six-month review led by Mark Wiseman, initiated a restructuring of its $8bn actively-managed fund business, resulting in the departure of seven portfolio managers and a $25m charge in Q2, replacing certain funds with quantitative investment strategies.[35]

By April 2017, iShares business accounted for $1.41tn, or 26 percent, of BlackRock’s total assets under management, and 37 percent of BlackRock’s base fee income.[36] In April 2017, BlackRock backed the inclusion of mainland Chinese shares in MSCI’s global index for the first time.[37]

2020–present[edit]

In January 2020, PNC Financial Services sold its stake in BlackRock for $14.4 billion.[38]

In March 2020, the Federal Reserve chose BlackRock to manage two corporate bond-buying programs in response to the COVID-19 pandemic, the $500 billion Primary Market Corporate Credit Facility (PMCCF) and the Secondary Market Corporate Credit Facility (SMCCF), as well as purchase by the Federal Reserve of commercial mortgage-backed securities (CMBS) guaranteed by Government National Mortgage Association, Fannie Mae, or Freddie Mac.[23][39][40]

In August 2020, BlackRock received approval from the China Securities Regulatory Commission to set up a mutual fund business in the country. This made BlackRock the first global asset manager to get consent from the Chinese government to start operations in the country.[41][42]

In November 2021, Blackrock lowered its investment in India while increasing investment in China. The firm maintains a dedicated India Fund, through which it invests in Indian start-ups Byju’s, Paytm, and Pine Labs.[43][44]

In April 2023, the company was hired to sell $114 billion in assets of Signature Bank and Silicon Valley Bank after the 2023 global banking crisis.[45][46]

In July 2023, the company appointed Amin H. Nasser to its Board.[47]

Finances[edit]

In 2020, the non-profit American Economic Liberties Project issued a report highlighting the fact that “the ‘Big Three’ asset management firms –BlackRock, Vanguard and State Street – manage over $15 trillion in combined global assets under management, an amount equivalent to more than three-quarters of U.S. gross domestic product.”[48] The report called for structural reforms and better regulation of the financial markets. In 2021, BlackRock managed over $10 trillion in assets under management, about 40% of the GDP of the United States (nominal $25.347 trillion in 2022).[49]

| Year[50] | Revenue (million USD) |

Net income (million USD) |

Total assets (million USD) |

AUM[51] (million USD) |

Price per share (USD) |

Employees |

|---|---|---|---|---|---|---|

| 2005 | 1,191 | 234 | 1,848 | 62.85 | 2,151 | |

| 2006 | 2,098 | 323 | 20,469 | 103.75 | 5,113 | |

| 2007 | 4,845 | 993 | 22,561 | 128.69 | 5,952 | |

| 2008 | 5,064 | 784 | 19,924 | 144.07 | 5,341 | |

| 2009 | 4,700 | 875 | 178,124 | 136.79 | 8,629 | |

| 2010 | 8,612 | 2,063 | 178,459 | 3,561,000 | 145.85 | 9,127 |

| 2011 | 9,081 | 2,337 | 179,896 | 3,513,000 | 148.27 | 10,100 |

| 2012 | 9,337 | 2,458 | 200,451 | 3,792,000 | 158.53 | 10,500 |

| 2013 | 10,180 | 2,932 | 219,873 | 4,325,000 | 238.52 | 11,400 |

| 2014 | 11,081 | 3,294 | 239,792 | 4,651,895 | 289.80 | 12,200 |

| 2015 | 11,401 | 3,345 | 225,261 | 4,645,412 | 322.68 | 13,000 |

| 2016 | 12,261 | 3,168 | 220,177 | 5,147,852 | 334.16 | 13,000 |

| 2017 | 13,600 | 4,952 | 220,217 | 6,288,195 | 414.60 | 13,900 |

| 2018 | 14,198 | 4,305 | 159,573 | 5,975,818 | 492.98 | 14,900 |

| 2019 | 14,539 | 4,476 | 168,622 | 7,430,000 | 448.22 | 16,200 |

| 2020 | 16,205 | 4,932 | 176,982 | 8,677,000 | 558.56 | 16,500 |

| 2021 | 19,169 | 5,901 | 152,648 | 10,010,143 | 913.76 | 18,400 |

| 2022 | 17,873 | 5,178 | 117,628 | 8,594,485 | 708.63 | 19,800 |

Mergers and acquisitions[edit]

| Number | Acquisition date | Company | Country | Price (USD) | Used as or integrated with | Refs. |

|---|---|---|---|---|---|---|

| 1 | February 10, 2006 | Merrill‘s Investment Managers division (MLIM) | $9.3B | Retail and international presence | [52] | |

| 2 | January 12, 2009 | Barclays Global Investor | $13.5B | ETF | [53] | |

| 3 | January 15, 2010 | Helix Financial Group | – | CRE | [54][55] | |

| 4 | August 25, 2015 | FutureAdvisor | $150M | Robo-advisory | [56][57] | |

| 5 | April 18, 2016 | Money market fund business of Bank of America | – | $80 billion in assets in money market funds | [58] | |

| 6 | February 1, 2017 | Energy infrastructure investment platform of First Reserve Corporation | – | Funds investing in energy | [59] | |

| 7 | June 9, 2017 | Cachematrix | – | Liquidity management | [60] | |

| 8 | January 8, 2018 | Tennenbaum Capital Partners | – | Private credit | [61][62] | |

| 9 | September 24, 2018 | Asset Management Business of Citibanamex | $350 million | Fixed income, equity, and multi-asset funds holding | [63][64] | |

| 10 | October 5, 2019 | eFront | $1.3 billion in cash | Alternative investment management software | [65][66] | |

| 11 | February 1, 2021 | Aperio | $1.05 billion in cash | A provider of tax-optimized index equity separately managed accounts | [67][68] | |

| 12 | June 8, 2023 | Kreos | – | Private credit | [69] |

Criticism[edit]

Influence and power[edit]

In 2010, Ralph Schlosstein, the CEO of Evercore Partners and a BlackRock founder, called BlackRock “the most influential financial institution in the world.”[20]

Due to its power and the sheer size and scope of its financial assets and activities, BlackRock has been called the world’s largest shadow bank.[70][29] In 2020, U.S. Representatives Katie Porter and Jesús “Chuy” García proposed a U.S. House bill aiming to restrain BlackRock and other so-called shadow banks.[71] On March 4, 2021, U.S. Senator Elizabeth Warren suggested that BlackRock should be designated “too big to fail“, and should be regulated accordingly.[72]

BlackRock invests the funds of its clients (for example, the owners of iShares exchange-traded fund units) in numerous publicly traded companies, some of which compete with each other.[73][74][75] Because of the size of BlackRock’s funds, the company is among the top shareholders of many companies, including the largest companies in the world. BlackRock states these shares are ultimately owned by the company’s clients, not by BlackRock itself – a view shared by multiple independent academics – but acknowledges it can exercise shareholder votes on behalf of these clients, in many cases without client input.[76]

This concentration of ownership has raised concerns of possible anti-competitive practices.[77][78] A 2014 study analyzed the effects of this type of common ownership on airline ticket prices.[79] The study found that “Prices go up and quantity goes down when the airlines competing on a given route are more commonly owned by the same set of investors.” The authors noted that this price increase does not necessarily imply conscious collusion among the common owners, but could perhaps be that these firms are now “too lazy to compete” with themselves.[80]

BlackRock has been the subject of conspiracy theories, including the conspiracy theory that BlackRock owns both Fox News and Dominion Voting Systems, which Snopes described as “false” and PolitiFact described as “mostly false”.[81][82] Some BlackRock conspiracy theories have also incorporated antisemitism, such as the conspiracy theory that Jewish people including BlackRock founder Robert Kapito are part of a cabal responsible for COVID and a “COVID agenda”.[83]

[edit]

In 2017, BlackRock expanded its environmental, social and corporate governance (ESG) projects with new staff and products.[84][85][86][87][88]

BlackRock started drawing attention to environmental and diversity issues by means of official letters to CEOs and shareholder votes together with activist investors or investor networks such as the Carbon Disclosure Project, which in 2017 backed a shareholder resolution for ExxonMobil to act on climate change.[89][90][91]

In 2018, it asked Russell 1000 companies to improve gender diversity on their board of directors if they had fewer than two women on them.[92]

In August 2021, a former BlackRock executive who had served as the company’s first global chief investment officer for sustainable investing, said he thought the firm’s ESG investing was a “dangerous placebo that harms the public interest.” The former executive said that financial institutions are motivated to engage in ESG investing because ESG products have higher fees, which in turn increase company profits.[93]

In October 2021, The Wall Street Journal editorial board wrote that BlackRock was pushing the U.S. Securities and Exchange Commission to adopt rules requiring private companies to publicly disclose their climate impact, the diversity of their boards of directors, and other metrics. The editorial board opined that “ESG mandates, which also carry substantial litigation and reputation risks, will cause many companies to shun public markets. This would hurt stock exchanges and asset managers, but most of all retail investors.”[94]

In January 2022, BlackRock founder and CEO Larry Fink defended the company’s focus on ESG investing, pushing back “against accusations the asset manager was using its heft and influence to support a politically correct or progressive agenda.”[95] Fink said the practice of ESG “is not woke.”[96]

BlackRock’s emphasis on ESG has drawn criticism as “either bowing to anti-business interests” or being “merely marketing”.[97]

In a talk at the Aspen Ideas Festival in June 2023, BlackRock CEO Larry Fink said he has stopped using the term “ESG” because the term has been “weaponized”. According to an Axios reporter, Fink also said “I’m ashamed of being part of this conversation.” Later, according to Axios, Fink said, “I never said I was ashamed. I’m not ashamed. I do believe in conscientious capitalism.”[98]

In July 2023, BlackRock announced that it would allow retail investors a proxy vote in its biggest ETF from 2024. The move was initiated in the context of claims from US Republicans that Blackrock is systematically trying to push a ‘woke agenda’ through its pro-ESG activities. Under the plan, investors in BlackRock’s iShares Core S&P 500 ETF will be asked to make choices from seven different general policies ranging from voting generally with BlackRock’s management, to environmental, social and governance factors or prioritizing Catholic values. Investors will not be able to vote on specific companies.[99] The Editorial Board at The Wall Street Journal argued that it amounted to a “false voting choice” since almost all of the pre-selected voting policies are devised by the ESG-aligned proxy advisories Glass Lewis and Institutional Shareholder Services.[100]

Investments in contributors to climate change[edit]

As of December 2018, BlackRock was the world’s largest investor in coal-fired power stations, holding shares worth $11 billion in 56 companies in the industry.[101] BlackRock owned more oil, gas, and thermal coal reserves than any other investment management company with total reserves amounting to 9.5 gigatonnes of CO2 emissions or 30 percent of total energy-related emissions from 2017.[102] Environmental groups including the Sierra Club[103] and Amazon Watch[104] launched a campaign in September 2018 called “BlackRock’s Big Problem”,[105] claiming that BlackRock is the “biggest driver of climate destruction on the planet”, due in part to its opposition to fossil fuel divestment.[105] On January 10, 2020, a group of climate activists rushed inside the Paris offices of BlackRock France, painting walls and floors with warnings and accusations on the responsibility of the company in the effects of global warming.[106]

In May 2019, BlackRock was criticized for the environmental impact of its holdings as it was a major shareholder in every oil supermajor except Total S.A. and in 7 of the 10 biggest coal producers.[107]

On January 14, 2020, the company shifted its investment policy; BlackRock CEO Larry Fink said that environmental sustainability would be a key goal for investment decisions.[108] BlackRock announced that it would sell $500 million worth of coal-related assets, and created funds that would not invest in companies profiting from fossil fuels.[109][108] Nonetheless, BlackRock’s support for shareholder resolutions requesting climate risk disclosure fell from 25% in 2019 to 14% in 2020.[110]

BlackRock has also been criticized regarding climate change inaction and deforestation in the Amazon rainforest.[111][112] According to The New Republic, BlackRock “has positioned itself as the good guy on Wall Street, and its executives as a crew of mild-mannered money managers who understand the risks of the climate crisis and the importance of diversity. But those commitments, critics say, only extend so far into the firm’s day-to-day operations.”[71]

Investments in gun manufacturers[edit]

In May 2018, anti-gun protesters held a demonstration outside the company’s annual general meeting in Manhattan.[113]

After discussions with firearms manufacturers and distributors, on April 5, 2018, BlackRock introduced two new exchange-traded funds (ETFs) that exclude stocks of gun makers and large gun retailers such as Walmart, Dick’s Sporting Goods, Kroger, Sturm Ruger, American Outdoor Brands, and Vista Outdoor, and removed the stocks from seven existing ESG funds.[114][115][116]

BlackRock study on integrating ESG into banking rules[edit]

The European Ombudsman opened an inquiry in May 2020 to inspect the commission’s file on the European Commission‘s decision to award a contract to BlackRock to carry out a study on integrating environmental, social and governance risks and objectives into EU banking rules (‘the prudential framework’). European Parliament members questioned the impartiality of BlackRock given its investments in the sector.[117][118]

U.S states refusing to do business with BlackRock due to ESG policies[edit]

Riley Moore, the State treasurer of West Virginia, said in June 2022 that BlackRock and five other financial institutions would no longer be allowed to do business with the state of West Virginia, because of the company’s advocacy against the fossil fuel industry.[119]

In December 2022, Jimmy Patronis, the Chief Financial Officer of Florida, announced that the government of Florida would be divesting $2 billion worth of investments under management by BlackRock, due to the firm’s move to strengthen ESG standards and ESG policies.[120][121] BlackRock later responded to the announcement with a statement stating that the divestment would place politics over investor interest.[122]

In October 2022, Louisiana removed $794 million from BlackRock due to the company’s support of ESG and green energy.[123]

Criticism of investments in China[edit]

In August 2021, BlackRock set up its first mutual fund in China after raising over one billion dollars from 111,000 Chinese investors. BlackRock became the first foreign-owned company allowed by the Chinese government to operate a wholly-owned business in China’s mutual fund industry.[124][125][126] Writing in The Wall Street Journal, George Soros described BlackRock’s initiative in China as a “tragic mistake” that would “damage the national security interests of the U.S. and other democracies.”[127][128][129]

In October 2021, non-profit group Consumers’ Research launched an ad campaign criticizing BlackRock’s relationship with the Chinese government.[130]

In December 2021, it was reported that BlackRock was an investor in two companies that had been blacklisted by the US government accusing China of human rights abuses against the Uyghurs in Xinjiang. In one case (Hikvision) BlackRock increased its level of investment after the company’s blacklisting.[131]

In August 2023, the US House of Representatives’ Select Committee on the Chinese Communist Party initiated an investigation into the firm’s investments in Chinese companies accused of violating human rights and aiding the People’s Liberation Army.[132][133]

Ties with Federal Reserve[edit]

BlackRock was scrutinized for allegedly taking advantage of its close ties with the Federal Reserve during the COVID-19 pandemic response efforts.[134][135][136] In June 2020, The New Republic wrote that BlackRock “was having a very good pandemic” and was casting “itself as socially responsible while contributing to the climate catastrophe, evading regulatory scrutiny, and angling to influence [a potential] Biden administration.”[71] The Financial Times described BlackRock as having secured a prominent advisory role in the Fed’s post-COVID asset purchase program, prompting concerns over whether BlackRock would use its influence to encourage the Fed to purchase BlackRock products; during the Fed’s 2020 quantitative easing program, BlackRock’s corporate bond ETF received $4.3 billion in new investment, compared to the respective $33 million and $15 million received by BlackRock’s competitors Vanguard Group and State Street.[137]

Involvement in reconstruction of Ukraine[edit]

On December 28, 2022, it was announced that BlackRock and Volodymyr Zelensky had coordinated a role for the company in the reconstruction of Ukraine.[138][139] The arrangement was criticized, with BlackRock being accused of “cashing in” on Ukrainian destruction.[140][141]

Key people[edit]

As of 2023, Blackrock has a 16-person board of directors:[142]

- Larry Fink – founder, chairman and CEO[22]

- Bader M. Alsaad

- Pamela Daley

- William E. Ford

- Fabrizio Freda

- Murry S. Gerber

- Margaret “Peggy” L. Johnson

- Robert S. Kapito – founder and co-president[143]

- Cheryl D. Mills

- Gordon M. Nixon

- Kristin Peck

- Charles H. Robbins

- Marco Antonio Slim Domit

- Hans V. Vestberg

- Susan Wagner – founder, member of the board[144]

- Mark Wilson

- Amin H. Nasser

People who have previously served on the Blackrock board of directors include:

- Brian Deese – former Global Head of Sustainable Investing[145]

- Blake Grossman, former vice chairman[146]

See also[edit]

- Companies listed on the New York Stock Exchange (B)

- List of asset management firms

- List of CDO managers

- List of companies based in New York City

- List of hedge funds

- List of mutual-fund families in the United States

- List of S&P 500 companies

References[edit]

- ^ Jump up to:abc “BlackRock, Inc. 2022 Form 10-K Annual Report”. U.S. Securities and Exchange Commission. February 24, 2023.

- ^ Bebchuk, Lucian; Hirst, Scott (2019). “Index Funds and the Future of Corporate Governance: Theory, Evidence, and Policy”. Columbia Law Review. 119 (8): 2029–2146. SSRN3282794.

- ^ McLaughlin, David; Massa, Annie (January 9, 2020). “The Hidden Dangers of the Great Index Fund Takeover”. Bloomberg Businessweek. Retrieved June 7, 2021.

- ^ Jump up to:ab Briefing: BlackRock – The Monolith And The Markets, The Economist, December 7, 2013, pp. 24-26.

- ^ “BlackRock”. Fortune.

- ^ Appell, Douglas (July 9, 2012). “BlackRock departures spur talk about Fink’s future”. Pensions & Investments. Retrieved April 15, 2019.

- ^ “The rise of BlackRock”. The Economist. December 5, 2013. ISSN0013-0613. Retrieved April 15, 2019.

- ^ “Larry Fink Q&A: “I Don’t Identify as Powerful””. Bloomberg.com. Bloomberg. Retrieved April 15, 2019.

- ^ Jump up to:ab Carey, David; Morris, John E. (2012). King of Capital: The Remarkable Rise, Fall, and Rise Again of Steve Schwarzman and Blackstone. Crown Publishing Group. p. 59. ISBN978-0307886026.

- ^ Jump up to:abcdef Banerjee, Devin (September 30, 2013). “Schwarzman Says Selling BlackRock Was ‘Heroic’ Mistake”. Bloomberg News.

- ^ Jump up to:abcd “History”. BlackRock.

- ^ Foley, John; Cox, Rob (December 23, 2019). “BlackRock is Wall Street’s object of fantasy M&A”. Reuters.

- ^ Jump up to:abcd Loomis, Carol J. (July 7, 2014). “BlackRock: The $4.3 trillion force”. Fortune.

- ^ “Here come the IPOs”. CNN. September 26, 1999.

- ^ “BlackRock Acquiring State Street Research from MetLife” (Press release). Business Wire. August 24, 2004.

- ^ “BlackRock and a hard place”. The Economist. February 16, 2006.

- ^ Spence, John (October 2, 2006). “BlackRock, Merrill fund unit complete merger”. MarketWatch.

- ^ “BlackRock to Buy Quellos Fund of Funds Business”. CNBC. Reuters. June 26, 2007.

- ^ DeSilver, Drew (June 27, 2007). “Quellos is selling unit to BlackRock in $1.72 billion deal”. The Seattle Times.

- ^ Jump up to:ab Kolhatkar, Sheelah (December 9, 2010). “Fink Builds BlackRock Powerhouse Without Goldman Sachs Backlash”. Bloomberg News.

- ^ Rappaport, Liz; Craig, Susanne (May 19, 2009). “BlackRock Wears Multiple Hats”. The Wall Street Journal. ISSN0099-9660.

- ^ Jump up to:ab Andrews, Suzanna. Larry Fink’s $12 Trillion Shadow, Vanity Fair, April 2010: “There is little doubt among the financial establishment in Washington and on Wall Street that BlackRock was the best choice to handle the government’s problems.”

- ^ Jump up to:ab Annie Massa. Why BlackRock Has a Role in the Fed Bond-Buying Spree, The Washington Post, May 22, 2020

- ^ “BlackRock to Acquire R3 Capital”. The New York Times. April 17, 2009.

- ^ “BlackRock wraps up merger with Barclays Global Investors”. Associated Press. February 16, 2010.

- ^ “US giant BlackRock buys arm of Barclays bank”. The Guardian. June 12, 2009.

- ^ “BlackRock to join S&P 500 index”. Reuters. March 29, 2011.

- ^ “BlackRock to join S&P 500 index, replacing Genzyme”. The Boston Globe. March 29, 2011.

- ^ Jump up to:ab “Shadow and substance”. The Economist. May 10, 2014.

- ^ “Is BlackRock Too Big”. Sovereign Wealth Fund Institute. n.d. Retrieved February 9, 2015.

- ^ “BlackRock profit falls as shift from stocks hits fee revenue”. Reuters. July 14, 2016. Retrieved January 15, 2019.

- ^ Jump up to:ab “BlackRock to Acquire FutureAdvisor”. Business Wire. BlackRock. Retrieved August 26, 2015.

- ^ Tepper, Fitz (June 24, 2015). “YC Alum FutureAdvisor Is Now Managing $600 Million In Assets”. TechCrunch. Retrieved September 12, 2015.

- ^ Stevenson, Alexandra (November 18, 2015). “BlackRock to Wind Down Macro Hedge Fund”. The New York Times. ISSN0362-4331. Retrieved November 19, 2015.

- ^ “BlackRock cuts ranks of stockpicking fund managers”. Financial Times. March 27, 2017. Archived from the original on December 11, 2022. Retrieved March 30, 2017.

- ^ Foley, Stephen (April 19, 2017). “BlackRock assets under management hit $5.4tn on record ETF inflows”. Financial Times. Archived from the original on December 11, 2022. Retrieved May 10, 2017.

- ^ Hughes, Jennifer (April 20, 2017). “BlackRock backs mainland China shares for MSCI benchmarks”. Financial Times. Archived from the original on December 11, 2022.

- ^ Sabatini, Patricia (May 15, 2020). “PNC sold its shares to Blackrock stake for $14.4 billion”. Pittsburgh Post-Gazette.

- ^ Sophie Baker. Fed chooses BlackRock for pandemic support programs, Pensions & Investments, March 25, 2020

- ^ Jonnelle Marte. Fed opens primary market corporate bond facility, Reuters, June 29, 2020

- ^ Zacks Equity Research (September 2, 2020). “BlackRock Gets Nod to Set Up Mutual Fund Business in China (Revised)”. Nasdaq.

- ^ “BlackRock Gets Nod to Set Up Mutual Fund Business in China (Revised)”. news.yahoo.com. Retrieved September 16, 2020.

- ^ “World’s biggest asset manager BlackRock trimming investments in India, more optimistic on China”. ThePrint. November 23, 2021. Retrieved March 24, 2022.

- ^ “BlackRock says it’s time to buy China stocks and trim India exposure: Report”. Business Today. November 23, 2021. Retrieved March 24, 2022.

- ^ Reichl, Dan; Brush, Silla (April 5, 2023). “BlackRock to Sell $114 Billion of Failed Banks’ Securities”. Bloomberg News.

- ^ Hughes, Jennifer; Masters, Brooke (April 5, 2023). “BlackRock to manage $114bn of asset disposals after US bank failures”. Financial Times.

- ^ “BlackRock Names Aramco CEO Amin Nasser to Its Board of Directors”. Bloomberg.com. July 17, 2023. Retrieved July 19, 2023.

- ^ The New Money Trust: How Large Money Managers Control Our Economy and What We Can Do About It, November 23, 2020

- ^ “World Economic Outlook Database, April 2022”. IMF.org. International Monetary Fund. April 2022. Retrieved April 19, 2022.

- ^ BlackRock Financials(PDF), 2018, archived from the original(PDF) on April 1, 2019, retrieved April 1, 2019

- ^ “BlackRock – Verwaltetes Vermögen bis 2017 | Statistik”. Statista (in German). Retrieved October 30, 2018.

- ^ “Investors weigh up Merrill’s deal with BlackRock”. Financial Times. February 20, 2006. Archived from the original on December 11, 2022. Retrieved July 29, 2020.

- ^ “US giant BlackRock buys arm of Barclays bank”. the Guardian. June 12, 2009. Retrieved July 29, 2020.

- ^ “BlackRock Acquires the Helix Financial Group LLC Business”. www.businesswire.com. January 19, 2010. Retrieved July 30, 2020.

- ^ “BlackRock buys Helix Financial Group”. The Economic Times. Retrieved July 30, 2020.

- ^ “Blackrock Acquires FutureAdvisor For $150M To Pivot B2B”. August 27, 2015. Retrieved July 29, 2020.

- ^ “BlackRock to acquire robo-adviser”. Reuters. August 26, 2015. Retrieved July 29, 2020.

- ^ “BlackRock Closes Transaction to Transfer $80 Billion of Client Assets from BofA® Global Capital Management” (Press release). Business Wire. April 18, 2016.

- ^ “BlackRock Acquires Energy Infrastructure Franchise from First Reserve” (Press release). First Reserve Corporation. February 1, 2017.

- ^ “BlackRock Completes Acquisition of Cachematrix”. BlackRock. Retrieved July 29, 2020.

- ^ Corp, BlackRock TCP Capital. “BlackRock Completes Acquisition of Tennenbaum Capital Partners, LLC”. www.prnewswire.com (Press release). Retrieved July 29, 2020.

- ^ “BlackRock says to buy private credit investor Tennenbaum Capital”. Reuters. April 17, 2018. Retrieved July 29, 2020.

- ^ “BlackRock to pay $350m for Citibanamex’s AM arm”. Citywire. Retrieved July 29, 2020.

- ^ “BlackRock Completes Acquisition of Asset Management Business of Citibanamex”. BlackRock. Retrieved July 29, 2020.

- ^ “BlackRock Completes Acquisition of eFront” (Press release). eFront. May 10, 2019.

- ^ “BlackRock to Acquire eFront” (Press release). eFront. March 22, 2019.

- ^ “BlackRock Completes Acquisition of Aperio” (Press release). Business Wire. February 1, 2021 – via Nasdaq.

- ^ Kumar, Arunima (November 23, 2020). “BlackRock to buy Aperio for $1.05 billion from Golden Gate Capital, employees”. Reuters.

- ^ “BlackRock grows private credit business with Kreos acquisition”. Financial Times. June 8, 2023.

- ^ “Die grösste Schattenbank der Welt”. Basler Zeitung. November 20, 2012.

- ^ Jump up to:abc Aronoff, Kate (June 26, 2020). “Is BlackRock the New Vampire Squid?”. The New Republic.

- ^ Cox, Jeff (March 24, 2021). “Yellen supports banks’ share buybacks. Sen. Warren wants BlackRock designated too big to fail”. CNBC.

- ^ Fichtner, Jan; Heemskerk, Eelke M.; Garcia-Bernardo, Javier (2017). “Hidden power of the Big Three? Passive index funds, re-concentration of corporate ownership, and new financial risk”. Business and Politics. 19 (2): 298–326. doi:10.1017/bap.2017.6.

- ^ “Who owns big business: the rise of passive investors (@uvaCORPNET)”. YouTube. November 3, 2016. Archived from the original on December 21, 2021.

- ^ “BlackRock – The company that owns the world? (Investigate Europe)”. YouTube. May 10, 2018. Archived from the original on December 21, 2021.

- ^ “Fact Check-Video claiming BlackRock and Vanguard ‘own all the biggest corporations in the world’ is missing context”. Reuters. April 20, 2022. Archived from the original on June 6, 2023.

- ^ Solomon, Steven (April 12, 2016). “Rise of Institutional Investors Raises Questions of Collusion”. New York Times.

- ^ Guest, Greta (February 1, 2016). “Common ownership of big banks kills competition”. University of Michigan News.

- ^ “Anticompetitive Effects of Common Ownership”. Journal of Finance. 73: 1513–1565. 2014. doi:10.2139/ssrn.2427345. S2CID18018480.

- ^ Kosdrosky, Terry (September 17, 2015). “Competitors With Common Owners”. University of Michigan.

- ^ “Does BlackRock Own Both Fox News and Dominion Voting Systems?”. Snopes. April 27, 2023. Retrieved April 27, 2023.

- ^ “Facebook posts”. Retrieved April 27, 2023.

- ^ “‘COVID agenda is Jewish’: Antisemitic flyer found at Melbourne synagogue”. The Jerusalem Post. Retrieved April 27, 2023.

- ^ “BlackRock stakes claim on ‘sustainable investing’ revolution”. Financial Times. October 22, 2018. Archived from the original on December 11, 2022.

BlackRock intends to become a global leader in “sustainable investing”, says Larry Fink, as the world’s largest asset manager launched

- ^ Chasan, Emily (October 10, 2017). “BlackRock Names Former Obama Aide to Run Sustainable Investing”. Bloomberg.

- ^ Jarsh, Melissa; Chasan, Emily (June 13, 2018). “BlackRock, Wells Fargo Are Betting on Ethical Investing Funds for 401(k)s”. Bloomberg.

- ^ Camilla Giannoni (October 19, 2018). “BlackRock hires new Switzerland CEO”.

deepen our commitment to clients in Switzerland and broaden our sustainable investing footprint in Europe

- ^ Gruber, Angelika (October 19, 2018). “Independent Capital’s Staub-Bisang to run BlackRock Switzerland”. Reuters.

- ^ Tarek Soliman (June 1, 2017). “The new normal: Exxon shareholders vote in favour of climate action”.

- ^ Gary McWilliams (May 31, 2017). “Exxon shareholders approve climate impact report in win for activists”. Reuters.

- ^ Winston, Andrew (January 19, 2018). “Does Wall Street Finally Care About Sustainability?”. Harvard Business Review.

- ^ Chasan, Emily (November 3, 2018). “BlackRock Is Sick of Excuses for Corporate Boards Lacking Women”. Bloomberg.

- ^ Amaro, Silvia (August 24, 2021). “Blackrock’s former sustainable investing chief now thinks ESG is a ‘dangerous placebo'”. CNBC. Retrieved October 26, 2021.

- ^ The Editorial Board (October 24, 2021). “Opinion: BlackRock’s Wish Is Your Command”. The Wall Street Journal.

- ^ Meredith, Sam (January 18, 2022). “BlackRock CEO Larry Fink says stakeholder capitalism is not ‘woke'”. CNBC.

- ^ Brush, Silla; Ward, Russell (January 17, 2022). “BlackRock CEO Says Stakeholder Capitalism Isn’t ‘Woke'”. Bloomberg News.

- ^ Sorkin, Andrew Ross; Karaian, Jason; Kessler, Sarah; Gandel, Stephen; Merced, Michael J. de la; Hirsch, Lauren; Livni, Ephrat (January 18, 2022). “Larry Fink Defends Stakeholder Capitalism”. The New York Times.

- ^ Frank, John (June 26, 2023). “Larry Fink “ashamed” to be part of ESG political debate”. Axios.

- ^ Masters, Brooke (July 17, 2023). “BlackRock offers a vote to retail investors in its biggest ETF”. Financial Times. Retrieved July 17, 2023.

- ^ “BlackRock’s False Voting ‘Choice'”. The Wall Street Journal. July 24, 2023.

- ^ “New Research Reveals the Banks and Investors Financing the Expansion of the Global Coal Plant Fleet”. Urgewald. December 5, 2018.

- ^ “New report confirms BlackRock’s big fossil fuel problem”. Friends of the Earth. December 10, 2018.

- ^ “New Campaign Is Calling Out BlackRock’s Big Climate Problem”. Sierra Club. October 5, 2018.

- ^ “BlackRock Targeted as Largest Driver of Climate Destruction in New Campaign”. Amazon Watch. September 27, 2018.

- ^ Jump up to:ab “BlackRock’s Big Problem- Making the climate crisis worse”. BlackRock’s Big Problem.

- ^ Sebag, Gaspard (February 10, 2020). “BlackRock’s Paris Office Barricaded by Climate Activists”. Bloomberg News.

- ^ “World’s biggest investor accused of dragging feet on climate crisis”. May 21, 2019.

- ^ Jump up to:ab Sorkin, Andrew Ross (January 14, 2020). “BlackRock C.E.O. Larry Fink: Climate Crisis Will Reshape Finance”. The New York Times. ISSN0362-4331.

- ^ GANDEL, STEPHEN (January 14, 2020). “BlackRock to sell $500 million in coal investments in climate change push”. CBS News.

- ^ Cook, Jackie (September 28, 2020). “How Big Fund Families Voted on Climate Change: 2020 Edition”. Morningstar, Inc.

- ^ Gandel, Stephen (March 2, 2020). “Investment giant BlackRock faces critics on climate change, Amazon deforestation”. CBS News.

- ^ Greenfield, Patrick (October 12, 2019). “World’s Top Three Asset Managers Oversee $300bn Fossil Fuel Investments”. The Guardian.

- ^ Marcius, Chelsia Rose; Schapiro, Rich (May 23, 2018). “Anti-gun protesters rally outside BlackRock shareholder meeting to condemn its Sturm Ruger investments”. New York Daily News.

- ^ Moyer, Liz (April 5, 2018). “BlackRock to offer new funds that exclude stocks of gun makers and retailers including Walmart”. CNBC.

- ^ Gibson, Kate (April 5, 2018). “BlackRock unveils line of gun-free investment products”. CBS News.

- ^ Siegel, Rachel (April 6, 2018). “BlackRock unveils gun-free investment options”. The Washington Post.

- ^ “European Ombudsman”. Europa. November 23, 2020.

- ^ “The Commission’s decision to award a contract to BlackRock to oversee the development of ESG factors in the EU banking sector and corporate investment policies”. Europa. April 20, 2020.

- ^ Schroeder, Pete (June 14, 2022). “West Virginia threatens to bar big banks, BlackRock over perceived fossil fuel boycotts”. Reuters.

- ^ Folmar, Chloe (December 2, 2022). “Florida pulls $2B worth of investments from BlackRock over ESG investment after DeSantis resolution”. The Hill.

- ^ “Florida to pull $2bn from BlackRock in spreading ESG backlash”. Financial Times. December 1, 2022. Archived from the original on December 11, 2022.

- ^ Kerber, Ross (December 1, 2022). “Florida pulls $2 bln from BlackRock in largest anti-ESG divestment”. Reuters.

- ^ Nishant, Niket; Bedi, Mehr (October 5, 2022). “Louisiana to remove $794 mln from BlackRock funds over ESG drive”. Reuters.

- ^ Chandler, Clay; Gordon, Nicholas (September 9, 2021). “BlackRock is ‘blundering’ in China—all the way to the bank”. Fortune. Retrieved October 25, 2021.

- ^ Madhok, Diksha (September 8, 2021). “Chinese investors pour $1 billion into BlackRock’s new fund”. CNN. Retrieved October 25, 2021.

- ^ “BlackRock’s China unit raises $1 bln in maiden mutual fund”. Reuters. September 8, 2021.

- ^ Meredith, Sam (September 8, 2021). “BlackRock responds to George Soros’ criticism over China investments”. CNBC. Retrieved October 25, 2021.

- ^ Soros, George (September 6, 2021). “Opinion: BlackRock’s China Blunder”. The Wall Street Journal. ISSN0099-9660.

- ^ Meredith, Sam (September 8, 2021). “BlackRock responds to George Soros’ criticism over China investments”. CNBC.

- ^ Rapoza, Kenneth (October 27, 2021). “BlackRock’s China Relationship Target In Nationwide Ad Campaign”. Forbes. Retrieved October 27, 2021.

- ^ “Nonprofit Warns Governors About BlackRock Retirement Funds’ Chinese Investments”. fa-mag.com. December 3, 2021. Retrieved December 12, 2021.

- ^ Suter, Tara (August 1, 2023). “House China committee launches probe into investment firm BlackRock”. The Hill.

- ^ O’Keeffe, Kate; Driebusch, Corrie (August 1, 2023). “BlackRock, MSCI Face Congressional Probes for Facilitating China Investments”. The Wall Street Journal. ISSN0099-9660. Retrieved August 2, 2023.

- ^ Leslie P. Norton. BlackRock Is Biggest Beneficiary of Fed Purchases of Corporate Bond ETFs, Barron’s, June 1, 2020

- ^ Richard Henderson and Robin Wigglesworth. Fed’s big boost for BlackRock raises eyebrows on Wall Street, Financial Times, March 27, 2020

- ^ Richard Henderson and Robin Wigglesworth. BlackRock’s growing clout carries risks for asset manager: Group faces increased scrutiny as central banks ask it to help run stimulus packages, Financial Times, April 30, 2020

- ^ “BlackRock trounces ETF rivals after Fed appointment”. Financial Times. May 20, 2020. Retrieved February 18, 2023.

- ^ Smith, Elliot (December 28, 2022). “Zelenskyy, BlackRock CEO Fink agree to coordinate Ukraine investment”. CNBC. Archived from the original on December 30, 2022.

- ^ Schonfeld, Zach (December 28, 2022). “Zelensky agrees to Ukraine rebuild investment with BlackRock CEO”. The Hill. Archived from the original on December 29, 2022.

- ^ Devlin, Bradley (December 30, 2022). “BlackRock Plots to Buy Ukraine”. The American Conservative.

- ^ Wilkins, Brett (December 29, 2022). “BlackRock Accused of ‘Trying to Cash In On the Disaster’ With Ukraine Reconstruction Deal”. Common Dreams.

- ^ “Board of Directors”. ir.blackrock.com. Archived from the original on June 17, 2023. Retrieved July 6, 2023.

- ^ De La Merced, Michael J. (April 6, 2014). “BlackRock Elevates Executives in Succession Planning Move”. The New York Times.

- ^ Lin, Ed. “BlackRock Co-Founder Susan Wagner Sells Stock”. www.barrons.com. Retrieved October 26, 2021.

- ^ Schwartz, Brian (March 20, 2021). “Biden’s closest advisors have ties to big business and Wall Street with some making millions”. CNBC. Retrieved March 27, 2021.

- ^ Blackrocks Blake Grossman will leave Firm one year after BGI Acquisition January 2011, bloomberg.com. Retrieved February 2011

Further reading[edit]

- Brooker, Katrina (October 29, 2008). “Can this man save Wall Street?”. Fortune.

- Foley, Stephen (April 2, 2017). “BlackRock’s active funds navigate rough seas”. Financial Times. Archived from the original on December 11, 2022.

- Ungarino, Rebecca (December 30, 2020). “Here are 9 fascinating facts to know about BlackRock, the world’s largest asset manager popping up in the Biden administration”. Business Insider.

External links[edit]

- Official website

-

- Bloomberg

- Reuters

- SEC filings

- Yahoo!Business data for BlackRock Inc

Blackstone Inc.

|

|

Headquarters at 345 Park Avenue

|

|

| Type | Public |

|---|---|

|

|

| Industry | Financial services |

| Founded | 1985 |

| Founder | |

| Headquarters | 345 Park Avenue New York City, U.S. |

|

Key people

|

|

| Products | |

| Revenue | |

| AUM | |

| Total assets | |

| Total equity | |

|

Number of employees

|

|

| Subsidiaries | Blackstone Credit |

| Website | blackstone |

| Footnotes / references [1] |

|

Blackstone Inc. is an American alternative investment management company based in New York City. Blackstone’s private equity business has been one of the largest investors in leveraged buyouts in the last three decades, while its real estate business has actively acquired commercial real estate. Blackstone is also active in credit, infrastructure, hedge funds, insurance, secondaries, and growth equity. As of June 2023, the company’s total assets under management were approximately US$1 trillion, making it the largest alternative investment firm globally.[2]

Blackstone was founded in 1985 as a mergers and acquisitions firm by Peter G. Peterson and Stephen A. Schwarzman, who had previously worked together at Lehman Brothers.

History[edit]

| History of private equity and venture capital |

|---|

|

| Early history |

| (origins of modern private equity) |

| The 1980s |

| (leveraged buyout boom) |

| The 1990s |

| (leveraged buyout and the venture capital bubble) |

| The 2000s |

| (dot-com bubble to the credit crunch) |

| The 2010s |

| (expansion) |

| The 2020s |

| (COVID-19 recession) |

Founding and early history[edit]

Blackstone was founded in 1985 by Peter G. Peterson and Stephen A. Schwarzman with $400,000 in seed capital.[3]: 45–56 [4] The founders named their firm “Blackstone,” using a cryptogram derived from the names of the two founders (Schwarzman and Peterson). “Schwarz” is German for “black”; “Peter”, “Petros” or “Petra” (Πέτρος and πετρα, the masculine and feminine rendering of the word, respectively), in Greek means “stone” or “rock”.[5][6][7] The two founders had previously worked together at Lehman Brothers. There, Schwarzman served as head of Lehman Brothers’ global mergers and acquisitions business.[8] Prominent investment banker Roger C. Altman, another Lehman veteran, left his position as a managing director of Lehman Brothers to join Peterson and Schwarzman at Blackstone in 1987, but left in 1992 to join the Clinton Administration as Deputy Treasury Secretary and later founded top advisory investment bank Evercore Partners in 1995.[9]

Blackstone was originally formed as a mergers and acquisitions advisory boutique. Blackstone advised on the 1987 merger of investment banks E. F. Hutton & Co. and Shearson Lehman Brothers, collecting a $3.5 million fee.[10][11]

From the outset in 1985, Schwarzman and Peterson planned to enter the private equity business but had difficulty in raising their first fund because neither had ever led a leveraged buyout.[3]: 45–56 Blackstone finalized fundraising for its first private equity fund in the aftermath of Black Monday, a global stock market crash in October 1987. After two years of providing strictly advisory services, Blackstone decided to pursue a merchant banking model after its founders determined that many situations required an investment partner rather than just an advisor. The largest investors in the first fund included Prudential Insurance Company, Nikko Securities and the General Motors pension fund.[12]

Blackstone also ventured into other businesses, most notably investment management. In 1987 Blackstone entered into a 50–50 partnership with the founders of BlackRock, Larry Fink (current CEO of BlackRock), and Ralph Schlosstein (CEO of Evercore). The two founders, who had previously run the mortgage-backed securities divisions at First Boston and Lehman Brothers, respectively, initially joined Blackstone to manage an investment fund and provide advice to financial institutions. They also planned to use a Blackstone fund to invest in financial institutions and help build an asset management business specializing in fixed income investments.[13][14]

As the business grew, Japanese bank Nikko Securities acquired a 20% interest in Blackstone for a $100 million investment in 1988 (valuing the firm at $500 million). Nikko’s investment allowed for a major expansion of the firm and its investment activities.[15] The growth firm also recruited politician and investment banker David Stockman from Salomon Brothers in 1988. Stockman led many key deals in his time at the firm, but had a mixed record with his investments.[3]: 144–147 He left Blackstone in 1999 to start his own private equity firm, Heartland Industrial Partners, based in Greenwich, Connecticut.[16][17]

The firm advised CBS Corporation on its 1988 sale of CBS Records to Sony to form what would become Sony Music Entertainment.[18] In June 1989, Blackstone acquired freight railroad operator, CNW Corporation.[19] That same year, Blackstone partnered with Salomon Brothers to raise $600 million to acquire distressed thrifts in the midst of the savings and loan crisis.[20]

1990s[edit]

In 1990, Blackstone launched its hedge funds business, initially intended to manage investments for Blackstone senior management.[21] That same year, Blackstone formed a partnership with J. O. Hambro Magan in the UK and Indosuez in France.[22][23] Additionally, Blackstone and Silverman acquired a 65% interest in Prime Motor Inn’s Ramada and Howard Johnson franchises for $140 million, creating Hospitality Franchise Systems as a holding company.[24]

In 1991, Blackstone created its Europe unit[25][26] and launched its real estate investment business with the acquisition of a series of hotel businesses under the leadership of Henry Silverman. In October 1991, Blackstone and Silverman added Days Inns of America for $250 million.[27] In 1993, Hospitality Franchise Systems acquired Super 8 Motels for $125 million.[28] Silverman would ultimately leave Blackstone to serve as CEO of HFS, which would later become Cendant Corporation.[29]

Blackstone made a number of notable investments in the early and mid-1990s, including Great Lakes Dredge and Dock Company (1991), Six Flags (1991), US Radio (1994), Centerplate (1995), MEGA Brands (1996). Also, in 1996, Blackstone partnered with the Loewen Group, the second largest funeral home and cemetery operator in North America, to acquire funeral home and cemetery businesses. The partnership’s first acquisition was a $295 million buyout of Prime Succession from GTCR.[30][31][32]

In 1995, Blackstone sold its stake in BlackRock to PNC Financial Services for $250 million. Between 1995 and 2014, PNC reported $12 billion in pretax revenues and capital gains from BlackRock, Schwarzman later described the selling of BlackRock as his worst business decision ever.[33]

In 1997, Blackstone completed fundraising for its third private equity fund, with approximately $4 billion of investor commitments[34] and a $1.1 billion real estate investment fund.[35] Also in 1997, Blackstone made its first investment in Allied Waste.[36] In 1998, Blackstone sold a 7% interest in its management company to AIG, valuing Blackstone at $2.1 billion.[37] In 1999, Blackstone partnered, together with Apollo Management to provide capital for Allied Waste’s acquisition of Browning-Ferris Industries. Blackstone’s investment in Allied was one of its largest at that point in the firm’s history.[38]

In 1999, Blackstone launched its mezzanine capital business. Blackstone brought in five professionals, led by Howard Gellis from Nomura Holding America’s Leveraged Capital Group to manage the business.[39]

Blackstone’s investments in the late 1990s included AMF Group (1996), Haynes International (1997), American Axle (1997), Premcor (1997), CommNet Cellular (1998), Graham Packaging (1998), Centennial Communications (1999), Bresnan Communications (1999), PAETEC Holding Corp. (1999). Haynes and Republic Technologies International, both had problems and ultimately filed bankruptcy.[3]: 145–146

Blackstone’s investments in telecommunications businesses—four cable TV systems in rural areas (TW Fanch 1 and 2, Bresnan Communications and Intermedia Partners IV) and a cell phone operator in the Rocky Mountain states (CommNet Cellular) were among the most successful of the era, generating $1.5 billion of profits for Blackstone’s funds.[3]: 148–155

Blackstone Real Estate Advisers, its real estate affiliate, bought the Watergate complex in Washington D.C. in July 1998 for $39 million[40] and sold it to Monument Realty in August 2004.[41]

Early 2000s[edit]

In October 2000, Blackstone acquired the mortgage for 7 World Trade Center from the Teachers Insurance and Annuity Association.[42][43]

In July 2002, Blackstone completed fundraising for a $6.45 billion private equity fund, Blackstone Capital Partners IV, the largest private equity fund at that time.[45]

With a significant amount of capital in its new fund, Blackstone was one of a handful of private equity investors capable of completing large transactions in the adverse conditions of the early 2000s recession. At the end of 2002, Blackstone, together with Thomas H. Lee Partners and Bain Capital, acquired Houghton Mifflin Company for $1.28 billion. The transaction represented one of the first large club deals completed since the collapse of the Dot-com bubble.[46]

In 2002, Hamilton E. James joined global alternative asset manager Blackstone, where he currently serves as president and chief operating officer. He also serves on the firm’s executive and management committees, and its board of directors.[47] In late 2002, Blackstone remained active acquiring TRW Automotive in a $4.7 billion buyout, the largest private equity deal announced that year (the deal was completed in early 2003). TRW‘s parent was acquired by Northrop Grumman, while Blackstone purchased its automotive parts business, a major supplier of automotive systems.[3]: 176, 197, 206–207 [48] Blackstone also purchased a majority interest in Columbia House, a music-buying club, in mid-2002.[49]

Blackstone made a significant investment in Financial Guaranty Insurance Company (FGIC), a monoline bond insurer alongside PMI Group, The Cypress Group and CIVC Partners. FGIC incurred heavy losses, along with other bond insurers in the 2008 credit crisis.[50]

Two years later, in 2005, Blackstone was one of seven private equity firms involved in the buyout of SunGard in a transaction valued at $11.3 billion. Blackstone’s partners in the acquisition were Silver Lake Partners, Bain Capital, Goldman Sachs Capital Partners, Kohlberg Kravis Roberts, Providence Equity Partners, and TPG Capital. This represented the largest leveraged buyout completed since the takeover of RJR Nabisco at the end of the 1980s leveraged buyout boom. Also, at the time of its announcement, SunGard would be the largest buyout of a technology company in history, a distinction it would cede to the buyout of Freescale Semiconductor. The SunGard transaction is also notable in the number of firms involved in the transaction, the largest club deal completed to that point.[3]: 225 The involvement of seven firms in the consortium was criticized by investors in private equity who considered cross-holdings among firms to be generally unattractive.[51][52]

In 2006, Blackstone launched its long/short equity hedge fund business, Kailix Advisors. According to Blackstone, as of September 30, 2008, Kailix Advisors had $1.9 billion of assets under management. In December 2008, Blackstone announced that Kailix would be spun off to its management team to form a new fund as an independent entity backed by Blackstone.[53]

While Blackstone was active on the corporate investment side, it was also busy pursuing real estate investments. Blackstone acquired Prime Hospitality[54] and Extended Stay America in 2004. Blackstone followed these investments with the acquisition of La Quinta Inns & Suites in 2005. Blackstone’s largest transaction, the $26 billion buyout of Hilton Hotels Corporation occurred in 2007 under the tenure of Hilton CFO Stephen Bollenbach.[55] Extended Stay Hotels was sold to The Lightstone Group in July 2007 and Prime Hospitality’s Wellesley Inns were folded into La Quinta.[56] La Quinta Inns & Suites was spun out for IPO in 2014 and was later acquired by Wyndham Hotels & Resorts[57]

Buyouts (2005–2007)[edit]

During the buyout boom of 2006 and 2007, Blackstone completed some of the largest leveraged buyouts. Blackstone’s most notable transactions during this period included the following:

| Investment | Year | Company Description | Ref. |

|---|---|---|---|

| TDC | 2005 | In December 2005, Blackstone together with a group of firms, including Kohlberg Kravis Roberts, Permira, Apax Partners and Providence Equity Partners, acquired Tele-Denmark Communications. The firms acquired the former telecom monopoly in Denmark, under the banner Nordic Telephone Company (NTC) for approximately $11 billion. | [58] |

| EQ Office | 2006 | Blackstone completed the $37.7 billion acquisition of one of the largest owners of commercial office properties in the US. At the time of its announcement, the EQ Office buyout became the largest in history, surpassing the buyout of Hospital Corporation of America. It would later be surpassed by Kohlberg Kravis Roberts‘s buyout of TXU. Vornado Realty Trust bid against Blackstone, pushing up the final price. | [3]: 239–254 [59] |

| Freescale Semiconductor | A consortium led by Blackstone and including the Carlyle Group, Permira and the TPG Capital completed the $17.6 billion takeover of the semiconductor company. At the time of its announcement, Freescale would be the largest leveraged buyout of a technology company ever, surpassing the 2005 buyout of SunGard. The buyers were forced to pay an extra $800 million because KKR made a last minute bid as the original deal was about to be signed. Shortly after the deal closed in late 2006, cell phone sales at Motorola Corp., Freescale’s former corporate parent and a major customer, began dropping sharply. In addition, in the recession of 2008–2009, Freescale’s chip sales to automakers fell off, and the company came under great financial strain. | [3]: 231–235 [60] | |

| Michaels | Blackstone, together with Bain Capital, acquired Michaels, the largest arts and crafts retailer in North America in a $6.0 billion leveraged buyout in October 2006. Bain and Blackstone narrowly beat out Kohlberg Kravis Roberts and TPG Capital in an auction for the company. | [61] | |

| Nielsen Holdings | Blackstone together with AlpInvest Partners, Carlyle Group, Hellman & Friedman, Kohlberg Kravis Roberts and Thomas H. Lee Partners acquired the global information and media company formerly known as VNU. | [62][63][64] | |

| Orangina | Blackstone, together with Lion Capital acquired Orangina, the bottler, distributor and franchisor of a number of carbonated and other soft drinks in Europe from Cadbury Schweppes for €1.85 billion | [65] | |

| Travelport | Travelport, the parent of the travel website Orbitz.com, was acquired from Cendant by Blackstone and Technology Crossover Ventures in a deal valued at $4.3 billion. The sale of Travelport followed the spin-offs of Cendant’s real estate and hospitality businesses, Realogy Corporation and Wyndham Worldwide Corporation, respectively, in July 2006. (Later in the year, TPG and Silver Lake would acquire Travelport’s chief competitor Sabre Holdings.) Soon after the Travelport buyout, Travelport spun off part of its subsidiary Orbitz Worldwide in an IPO and bought a Travelport competitor, Worldspan. | [66] | |

| United Biscuits | In October 2006 Blackstone, together with PAI Partners announced the acquisition of the British biscuit producer. The deal was completed in December 2006. | [67][68] | |

| RGIS Inventory Specialists | 2007 | In March 2007, RGIS announced that Blackstone Group purchased a controlling interest in the company, the terms of the transaction were not disclosed. | [69] |

| Biomet | Blackstone, Kohlberg Kravis Roberts, TPG Capital and Goldman Sachs Capital Partners acquired Biomet, a medical device manufacturer for $10.9 billion. | [70] | |

| Hilton Worldwide | Blackstone acquired the premium hotel operator for approximately $26 billion, representing a 25% premium to Hilton’s all-time high stock price. The Hilton deal, announced on July 3, 2007, is often referred to as the deal that marked the “high water mark” and the beginning of the end of the multi-year boom in leveraged buyouts. The company restructured its debt in 2010. | [71][72][3]: 299–300 |

Initial public offering in 2007[edit]

In 2004, Blackstone had explored the possibility of creating a business development company (BDC), Blackridge Investments, similar to vehicles pursued by Apollo Management.[73] However, Blackstone failed to raise capital through an initial public offering that summer and the project were shelved.[74] It also planned to raise a fund on the Amsterdam stock exchange in 2006, but its rival, Kohlberg Kravis Roberts & Co., launched a $5 billion fund there that soaked up all demand for such funds, and Blackstone abandoned its project.[3]: 221–223

In 2007, Blackstone acquired Alliant Insurance Services, an insurance brokerage firm. The company was sold to Kohlberg Kravis Roberts in 2012.[75]

On June 21, 2007, Blackstone became a public company via an initial public offering, selling a 12.3% stake in the company for $4.13 billion, in the largest U.S. IPO since 2002.[76][77]

2008 to 2010[edit]

During the financial crisis of 2007–2008, Blackstone managed to close only a few transactions. In January 2008, Blackstone made a small co-investment alongside TPG Capital and Apollo Management in their buyout of Harrah’s Entertainment, although that transaction had been announced during the buyout boom period. Other notable investments that Blackstone completed in 2008 and 2009 included AlliedBarton, Performance Food Group,[78][79] Apria Healthcare and CMS Computers.

In July 2008, Blackstone, together with NBC Universal and Bain Capital acquired The Weather Channel from Landmark Communications for $3.5 billion. In 2015, the digital assets were sold to IBM for $2 billion. In 2018, the remainder of the company was sold to Byron Allen for $300 million.[80]

In December 2009, Blackstone acquired Busch Entertainment Corporation from Anheuser-Busch InBev for $2.9 billion.[81]

In November 2013, Merlin Entertainments, owned in part by Blackstone Group, became a public company via an initial public offering on the London Stock Exchange.[82][83]

In August 2010, Blackstone announced it would buy Dynegy, an energy firm, for nearly $5 billion; however, the acquisition was terminated in November 2010.[84]

Investments 2011 to 2015[edit]

- In February 2011, the company acquired Centro Properties Group US from Centro Retail Trust (now Vicinity Centres) for $9.4 billion.[85] The company became Brixmor Property Group and Blackstone sold its remaining interest in the company in August 2016.[86]

- In November 2011, a fund managed by the company acquired medical biller Emdeon for $3 billion.[87]

- In late 2011, Blackstone Group LP acquired Jack Wolfskin, a German camping equipment company. In 2017, the company was handed over to its lenders.[88]

- In August 2012, Blackstone was part of a consortium that financed Knight Capital after a software glitch threatened Knight’s ability to continue operations.[89]

- In October 2012, the company acquired G6 Hospitality, operator of Motel 6 & Studio 6 motels from AccorHotels, for $1.9 billion.[90]

- In November 2012, the company acquired a controlling interest in Vivint, Vivint Solar, and 2GIG Technologies.[91] In February 2013, 2GIG was flipped to Nortek Security & Control, LLC for $135M.[92]

- In April 2013, the company discussed buying Dell, but it did not pursue the acquisition.[93]

- In June 2013, Blackstone Real Estate Partners VII acquired an industrial portfolio from First Potomac Realty Trust for $241.5 million.[94] Part of this portfolio was developed by StonebridgeCarras as Oakville Triangle (Now “National Landing“)[95]

- In September 2013, Blackstone announced a strategic investment in ThoughtFocus Technologies LLC, an information technology service provider.[96]

- In August 2013, Blackstone acquired Strategic Partners, manager of secondaryfunds, from Credit Suisse.[97]

- In February 2014, Blackstone purchased a 20% stake in the Italian luxury brand Versace for €150 million.[98][99]

- In April 2014, Blackstone’s charitable arm, the Blackstone Charitable Foundation, donated $4 million to create the Blackstone Entrepreneurs Network in Colorado. The program encourages increased collaboration among local business leaders with the goal of retaining high-growth companies in the state.[100]

- In May 2014, Blackstone Group acquired the Cosmopolitan of Las Vegas resort from Deutsche Bank for $1.73 billion.[101]

- In August 2014, Blackstone Energy Partners acquired Shell Oil‘s 50% stake in a shale-gas field in the Haynesville Shale for $1.2 billion.[102]

- In January 2015, Blackstone Real Estate Partners VI announced it would sell a Gold Fields House in Sydney to Dalian Wanda Group for A$415 million.[103]

- In June 2015, Blackstone acquired the Willis Tower in Chicago for $1.3 billion.[104]

- In July 2015, Blackstone acquired Excel Trust, a real estate investment trust, for around $2 billion.[105]

- In November 2015, the company agreed to sell facility management firm GCA Services Group to Goldman Sachs and Thomas H. Lee Partners.[106]

Investments since 2016[edit]

- In January 2016, Blackstone Real Estate Partners VIII L.P. acquired BioMed Realty Trust for $8 billion.[107]

- In February 2016, Blackstone sold four office buildings to Douglas Emmett for $1.34 billion.[108]

- In April 2016, Blackstone acquired 84 percent of Hewlett Packard Enterprise‘s stake in the Indian IT services firm Mphasis.[109]

- On January 4, 2017, Blackstone acquired SESAC, a music-rights organization.[110]

- On February 10, 2017, Aon PLC agreed to sell its human resources outsourcing platform for $4.3 billion to Blackstone Group L.P.,[111] creating a new company called Alight Solutions.[112]

- On June 19, 2017, Blackstone acquired a majority interest in The Office Group, valuing the company at $640 million.[113]

- In July 2017, the company announced an investment in Leonard Green & Partners.

- In January 2018, the company acquired Pure Industrial, a Canadian real estate investment trust for C$2.5 billion.[114]

- In January 2018, the company announced acquisition agreement for 55% of Thomson Reuters Financial & Risk unit for $20 billion.[115]

- In March 2018, Blackstone Real Estate Income Trust, Inc. acquired a 22 million square foot portfolio of industrial properties from Cabot Properties for $1.8 billion.[116][117]

- In March 2018, Blackstone’s Strategic Capital Holdings Fund invested in Rockpoint Group.[118]

- In March 2018, the company’s Strategic Capital Holdings Fund announced an investment in Kohlberg & Company, a private equity firm.[119]

- In August 2018, PSAV was able to merge with Encore Global due to the help from an investment firm Blackstone.[120]

- In September 2018, the company acquires control of Luminor Bank in the Baltic countries.[121]

- In October 2018, Blackstone launched Refinitiv, the company resulting from its January deal for a 55 per-cent stake in Thomson Reuters Financial and Risk business.[122]

- In October 2018, Blackstone announced to buy Clarus. The deal includes assets worth $2.6 billion.[123]

- In March 2019, Blackstone purchased, with Yankee Global Enterprises, a minority stake in YES Network.[124][125]

- In April 2019, Blackstone acquired a majority stake in the tube packaging company, Essel Propack for $310 million.[126][127]

- In June 2019, Blackstone announced it had teamed with the Canada Pension Plan Investment Board and KIRKBI to buy Merlin Entertainment, the owners of Legoland in a deal worth £5.9 billion (about $7.5 billion). This would be the 2nd time Blackstone would own the company as they previously purchased it in 2005.[128]

- On July 15, 2019, Blackstone announced its plans to acquire Vungle Inc., a leading mobile performance marketing platform.[129]

- In September 2019, Blackstone announced it agreed to purchase 65% controlling interest in Great Wolf Resorts from Centerbridge Partners. They plan to form a joint venture worth $2.9 billion or more to own the company.[130]

- On November 8, 2019, Blackstone Group acquired a majority stake in MagicLab, the owner of dating app Bumble.[131]

- Blackstone Group on November 15, 2019, invested $167 million in the holding company of Future Lifestyle Fashions Ltd., Ryka Commercial Ventures Pvt. Ltd.[132]

- On November 18, 2019, Blackstone Real Estate Income Trust, Inc. acquired the Bellagio resort in Las Vegas, Nevada from MGM Resorts in a sale-leaseback transaction.[133]

- On November 25, 2019, Reuters reported that Blackstone planned to invest $400 million in a joint venture with Swiss drug company Ferring. The joint venture will work on gene therapy for bladder cancer. The investment represents Blackstone Group’s largest investment in drug development to date.[134]

- In March 2020, Blackstone announced that it is buying a majority stake in HealthEdge, a health-care software company.[135] The deal worth $700 million was completed on April 13, 2020.[136]

- In July 2020, Blackstone invested US$200m in the Swedish oat milk brand, Oatly, for a 7% stake in the company, triggering outrage among some segments of its customer base.[137][138]

- In August 2020, Blackstone announced that it will buy a majority stake in Ancestry.com for $4.7 billion (including debt).[139]

- In August 2020, Blackstone acquired Takeda Consumer Healthcare for $2.3 billion.[140]

- In December 2020, Blackstone invested nearly $400 million in Liftoff, a mobile advertising company.[141]

- In January 2021, Blackstone acquired a majority shareholding in Bourne Leisure, a UK holiday and leisure company which owns Butlin’s, Haven Holidays, and Warner Leisure, for £3 billion.[142]

- In March 2021, Blackstone made a $6.2 billion takeover bid for Australian casino operator Crown Resorts, offering a 20% premium to its closing share price at the time of the offer. Blackstone held at the time a near 10% stake in the company.[143][144]

- In April 2021, Blackstone acquired eOne music from Hasbro for $385 million.[145]

- In July 2021, MGM Resorts International announced it sold Aria Resort and Casino and Vdara to Blackstone for $3.89 billion in a sale-leaseback transaction.[146]

- In July 2021, Blackstone Group and AIG announced that the company would acquire 9.9% of AIG’s life and retirement insurance investment portfolio, for $2.2 billion cash, during AIG’s spin-off of the unit by IPO in 2022. The two firms also entered a long-term asset management agreement for about 25% of AIG’s life and retirement portfolio, scheduled to increase in subsequent years.[147]

- In August 2021, the merger of two Blackstone portfolio companies, Vungle and Liftoff, was announced. Both companies are in the mobile advertising space.[148]

- In October 2021, the Blackstone Group acquired a majority stake of Spanx, Inc. The company was valued at US$1.2 billion.[149] The deal was prepared by an all-female investment team from Blackstone, and it was announced that the Board of Directors would be all-female.

- In October 2021, Blackstone acquired the Nucleus Network, Australia’s premier clinical researcher, who are providing staple ‘healthy’ volunteers large financial rewards for drug trials.[150]

- On February 14, 2022 Crown Resorts accepted Blackstone’s takeover offer. Blackstone will pay US$6.6 billion for 90% of shares outstanding.[151][152]

- In April 2022, Blackstone agreed to acquire the Austin-based American Campus Communities, Inc. for nearly $13 billion.[153]

- In April 2022, Blackstone announced that it would acquire PS Business Parks for $7.6 billion.[154]

- In October 2022, Emerson Electric agreed to sell a 55 percent majority stake in its climate technologies business to Blackstone in a $14 billion deal including debt.[155][156]

- In June 2023, Blackstone acquired cloud-based event-software provider Cvent for $4.6 billion.[157][158]

Operations[edit]

Blackstone operates through four primary departments: private equity; real estate; hedge funds; and credit.[13]

Corporate private equity[edit]

As of 2019, Blackstone was the world’s largest private equity firm by capital commitments as ranked by Private Equity International‘s PEI 300 ranking.[159] After dropping to second behind KKR in the 2022 ranking,[160] it regained top spot in 2023.[161] The firm invests through minority investments, corporate partnerships, and industry consolidations, and occasionally, start-up investments. The firm focuses on friendly investments in large capitalization companies.[13]

Blackstone has primarily relied on private equity funds, pools of committed capital from pension funds, insurance companies, endowments, fund of funds, high-net-worth individuals, sovereign wealth funds, and other institutional investors.[162] From 1987 to its IPO in 2007, Blackstone invested approximately $20 billion in 109 private equity transactions.[13]

Blackstone’s most notable investments include Allied Waste,[38] AlliedBarton Security Services, Graham Packaging, Celanese, Nalco, HealthMarkets, Houghton Mifflin, American Axle, TRW Automotive, Catalent Pharma Solutions, Prime Hospitality, Legoland, Madame Tussauds,[163] Luxury Resorts (LXR), Pinnacle Foods, Hilton Hotels Corporation, Motel 6, Apria Healthcare, Travelport, The Weather Channel (United States) and The PortAventura Resort. In 2009, Blackstone purchased Busch Entertainment (comprising the Sea World Parks, Busch Garden Parks and the two water parks).[citation needed] In 2020 they acquired Ancestry.com.

In 2012, Blackstone acquired a controlling interest in Utah-based Vivint, Inc., a home automation, security, and energy company.[164]

Real estate[edit]

Blackstone’s most notable real estate investments have included EQ Office, Hilton Worldwide, Trizec Properties, Center Parcs UK, La Quinta Inns & Suites, Motel 6, Wyndham Worldwide, Southern Cross Healthcare and Vicinity Centres.[165]

The purchase and subsequent IPO of Southern Cross led to controversy in the UK. Part of the purchase involved splitting the business into a property company, NHP, and a nursing home business, which Blackstone claimed would become “the leading company in the elderly care market”. In May 2011, Southern Cross, now independent, was almost bankrupt, jeopardizing 31,000 elderly residents in 750 care homes. It denied blame, although Blackstone was widely accused in the media for selling on the company with an unsustainable business model and crippled with an impossible sale and leaseback strategy.[166][167]

After the 2007–2010 subprime mortgage crisis in the United States, Blackstone Group LP bought more than $5.5 billion worth of single-family homes to rent, and then be sold when the prices rise.[168]

In 2014, Blackstone sold Northern California office buildings for $3.5 billion.[169] The buildings sold in San Francisco and Silicon Valley included 26 office buildings and two development parcels.[170]