Silverado collapse cost taxpayers $1 billion

Colorado had front-row seats to the last U.S. financial crisis that led to a multibillion-dollar bailout.

During the savings-and-loan debacle that began in the mid-1980s, federal authorities took over 18 Colorado thrifts, more than in any state except Texas and California.

The real-estate crash that accompanied the S&L crisis and oil-industry meltdown hit Colorado hard. Foreclosures reached record levels, and home values plummeted across the state.

“Back then, you got the sense the real-estate market was really in the tank,” said John Ikard, president and chief executive of FirstBank Holding Co. in Lakewood. “Locally, it was a much more difficult time than it is today. . . . What’s happening now is much more national and international.”

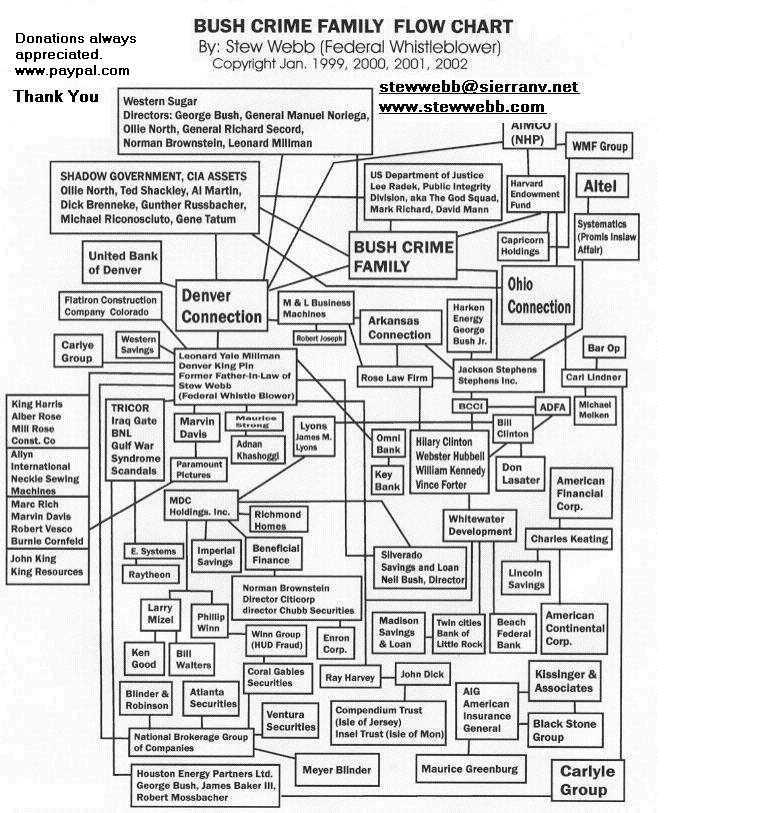

The failure of one of Colorado’s thrifts, Silverado Banking Savings and Loan, was legendary. Its collapse in 1988 cost taxpayers $1 billion and entangled prominent Denver businessmen, including Neil Bush.

The son of then-President George H.W. Bush and a brother of the current president, Neil Bush was on Silverado’s board of directors. Silverado made loans to developers who owned shares in the thrift and who had bankrolled Neil Bush’s oil company.

In what was considered a largely symbolic ruling, Neil Bush was barred by an administrative judge from having conflicts of interest at a savings and loan again.

Silverado’s chairman, Michael Wise, had grown the thrift from humble roots to a national powerhouse. He had become a well-known figure in the industry and in Denver. With the thrift’s fall, Wise became a symbol of the savings-and-loan debacle.

Prosecutors accused him of pocketing $500,000 from a $1.45 million loan. A jury found him not guilty, but regulators barred him from the S&L industry.

Later, Wise pleaded guilty to wire fraud related to the theft of nearly $9 million from investors while he was chief executive of Cornerstone Private Capital in Aspen. He went to prison for 3½ years and after his release sold mortgages in Florida.

The Resolution Trust Corp., the agency set up to recover S&L losses, found evidence of fraud and improper dealings at 17 of Colorado’s 18 failed thrifts. It estimated losses directly accountable to criminal activity at more than $117 million.

Greg Griffin: 303-954-1241 or ggriffin@denverpost.com

I Stew Webb, have contributed to the following books:

* “Defrauding America”, by Rodney Stitch

* “Drugging America”, by Rodney Stitch

* “The Mafia, CIA and George Bush” by Pete Brewton

* “The Oklahoma City Bombing Power of Politics”, by David Hoffman

* “Bushwacked” by Uri Dowbenko

* “Silverado Savings and Loan” by Steve Wilmsen

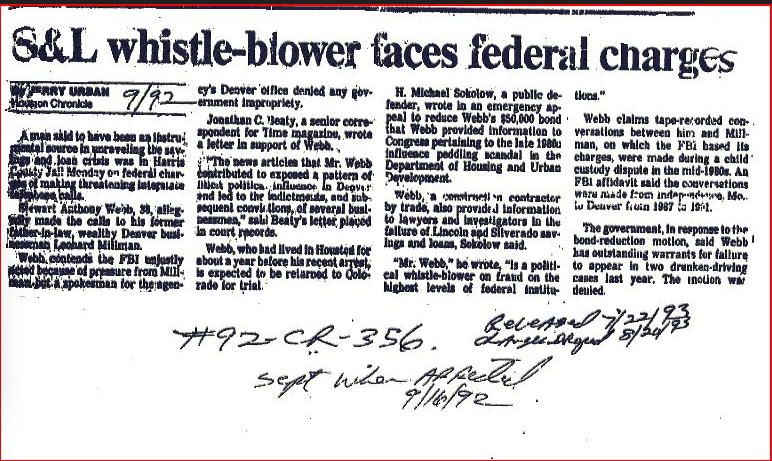

* I was instrumental in brokering a deal that has lead to Al Martin’s new book “The Conspirators”, www.almartinraw.com I have known Al since 1991, when I had to hide from the FBI who tried to jail me for exposing,“The Bush Crime Family-Denver Connection-King Pin Leonard Millman”, my former-father-in-law.

.jpg)