By Al Martin Iran Contra Whistleblower

There were about 100 such projects in all which were ultimately bailed out by some public guarantee institution.

It wasn’t necessarily the FDIC or the FSLIC, but in some cases, very esoteric public guaranteed funds were used to bail these deals out.

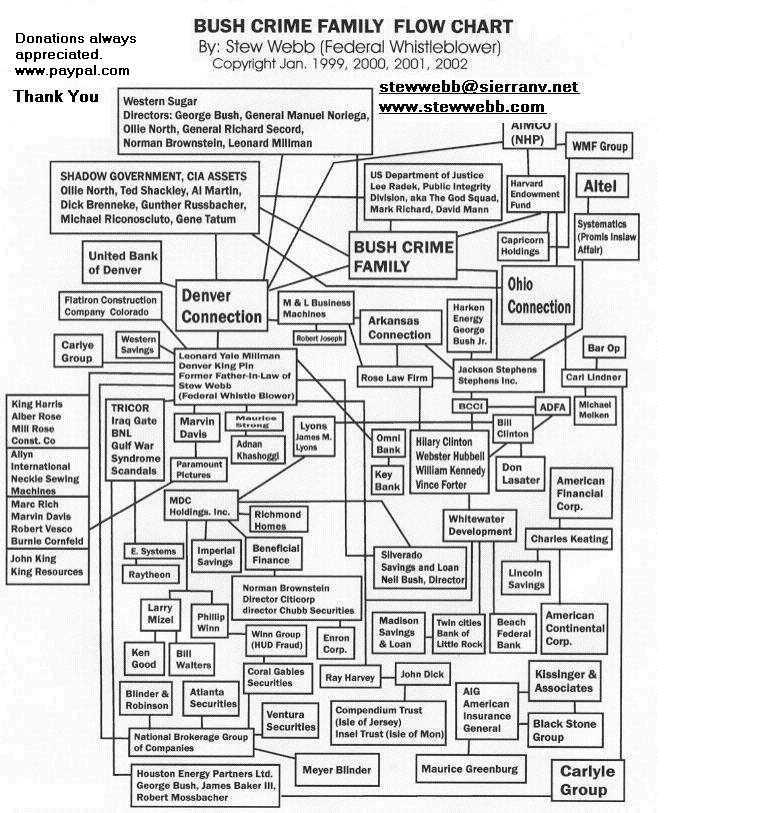

George W. Bush Jr. naturally specialized in oil since he controlled the Bush family oil portfolio including Harken Energy stock, Tidewater Development stock, and Apache and Zapata stock.

These were all deals where George H.W. Bush Sr. had formerly been on the Board of Directors. Now George Jr. was on the Board of Directors, since Sr. as Vice President couldn’t have that capacity.

Harken Energy was a classic fraud. The stock still trades on the AMEX at five or six dollars a share. It’s been pumped up recently because there’s a new fraud going on with those Bahrainian Leases that Richard Secord originally had ten years ago.

The stock will shortly collapse back to two dollars again, as soon as everybody gets out. A lot of Republicans will make money on the deal. ….

I also have a lot of documentation pursuant to George, Sr.’s involvement in fraudulent deals surrounding Zapata and Apache Energy. I have a lot of stuff with him in Harken Energy, also including a lot with George, Jr. in Harken Energy. That’s another possibility. But again, these weren’t large frauds. They were little security frauds, the fraudulent diversion of monies in those bogus Bahrainian leases when they temporarily ensconced Richard Secord to be their Middle Eastern Director for Bahrainian Operations which existed in a file drawer.

What that Bahrainian deal came down to was George Bush, Sr.’s close friend, former Saudi intelligence chief and major IranContra figure, Ghaith Pharaon. That was just a donation to IranContra by the Saudi government. And that’s what the bogus Bahrainian lease deal effectively comes down to. It wasn’t much $38 million, something like that.

Secord received about $3 million for his own pocket. Harry Aderholt was thrown a bone out of the deal. It was no big deal really. I also want to discuss an overview of Bush family fraud, ala Iran Contra profiteering.

The TriLateral Investment Group, Ltd. is also one of the deals (one of the very few deals, perhaps only a few dozen deals in that era by this group of guys) that you could connect Jeb, Neil, George, Jr., Prescott, and Wally Bush.

All five you can put in the TriLateral Investment Group, Ltd. You can put Neil Bush in it visa vis TriLateral’s dealings with Neil’s Gulf Stream Realty.

Neil Bush was a Director of Silverado Savings and Loan which collapsed in 1990 and was the main Iran Contra Money Laundering.

Silverado was a subsidary of M.D.C. Holding, Inc of Denver run by Leonard Millman, Larry Mizel and Norman Brownstein both AIPAC Directors, Brownstein was on of the six CIA Council for George H.W. Bush when he was CIA Director.

Then you back up a step and put Neil Bush into TriLateral Investment Group’s dealings with the Winn Financial Group of Denver run by the infamous former Ambassador to Switzerland, Phillip Winn a M.D.C. Director. You can put George, Jr. in the deal visa vis the TriLateral Group Ltd.’s fraudulent relationship with American Insurance General (AIG) , of which George, Jr. was a part through the same series of fraudulent fidelity guarantee instruments issued on behalf of Harken Energy from American Insurance General.

TriLateral Investment Group then sold bogus oil and gas leases to AIG. This is a direct fraud that George, Jr. profited to the extent of (not a lot) $1.6 or $1.7 million. But it was a clear out and out fraud.

Rolling Stone magazine did a good piece on George Bush, Jr. and three of his oil and gas companies which failed. But the article really didn’t go far enough.

It did not go really into Harken and Tidewater and other public corporations which George, Jr. was involved in and in which securities fraud was committed. He was able to neatly skirt the laws or should we say deflect the shit away from himself through a whole series of contrivances. The way he was able to do this, by the way, was to post these essentially bogus fidelity and guaranty instruments, so the deals wouldn’t be scrutinized until long after they had collapsed.

This was one of George Jr’s specialities and I did this myself, by the way. It was a common tactic in IranContra Securities Fraud. As the expression goes, it was to “back in” fraudulent assets, normally of a real estate nature, to back in fraudulent assets into a public shell. More commonly, they were known by their regulatory names in those days as a Reg D offering, or a Reg 501 or 505, or an S1, S3 or S18 offering. These were the common euphemisms used in the day. This is, of course, Security and Exchange Commission language, or “SEC speak” as we used to call it, for various types of offerings, which govern how large these offerings could be, how many states they could be ‘blueskied’ in (meaning how many states they could be sold in), the total amount of money that could be raised, the market making regulation that was necessary to maintain a market in the shares therein after.

Anyway, a very common securities fraud was the use of 144 stock. 144 stock refers to Rule 144, or Restricted Shares (shares that are not free to trade under the twoyear restriction rule). Often a company that would nominally have ten million shares outstanding could issue a hundred million shares of 144 stock that would then be sold at a steep discount to the market price. If you had a stock trading at a dollar, you would issue scads and scads of 144 stock, and you sell it for twenty cents a share. This stock would get bounced out into offshore bank loans, principally through the Union Bank of Switzerland, but also through a whole host of offshore banks through the Caribbean.

The large French bank, Banque Paribas, for instance, was notorious for this because of George, Sr.’s relationship with the bank. What would happen is you would raise an enormous amount of money, but you would also have an enormous amount of restricted stock, out of which at some point, the letter (what is known as the restriction or the letter) would come off that stock, and that stock is going to come bouncing back at some point to the market makers.

Because the scheme was at the banks, this was only meant to be interim financing. We are now talking about cooperative banks who were not meant to be burnt. They were just meant to provide bridge financing. This was very, very true with Union Bank of Switzerland, Royal Trust of Canada, and Imperial of Canada, Banque Z of Curaao, Banco de Populare. These were banks that you did not burn. These banks just acted as facilitator banks. But you have to make them “whole” in the end. Now, if you bury them under a pile of 144 stock, how did you make them “whole” in the end? How you made them “whole” is by pumping up the deal as the letter began to expire on the 144 stock that was out.

You would pump up the shares artificially in the marketplace and begin to bleed the stock back through your market makers at forty or fifty cents on the dollar. You would make money again. You had originally borrowed twenty cents on the dollar. You perhaps would bleed the stock back into the marketplace at forty cents on the dollar by the tactic of what is known as “backdooring” the stock to your market makers and dealers, and issuing certain guarantees to them that they in turn would be made whole. The ultimate bag-holder in these deals, of course, are the people that bought the hype, the people that bought the endless press releases, most of which were all bogus.

In some cases, we would have to make the representation that Company A has a tremendous new product or that it just has a contract with the International Monetary Finance Corporation. And boy, this is just going to be the greatest since sliced bread. Of course, what the prospective hypee didn’t know is that the International Monetary Corporation was in fact a shell that had been formed by the very same people who had perpetrated the original fraud. It is the only way you could keep control of the hype. So you would have one bogus company signing a contract to purchase ten zillion widgets from another bogus company. Not only did the widgets not exist, but both the companies themselves were essentially worthless. In this way, you could pump up the price of the shares and be able to create enough liquidity, enough excitement in the shares to distribute all of the stock, all of this 144 stock that you had bouncing back. Since the problem was obvious, you would vastly expand the flow to the shares in some cases, by a factor of ten.

There were previously, let’s say, 10 million shares authorized, but usually there was 300,000 or 400,000 shares that were actually out. The rest of it was buried in the hands of dealers or constituted restricted stock. So what would happen is towards the end, when the deal would falter, you could always give the deal a second shot by instituting a reverse stock split, which would bring the stock back up to a level where penny stock investors and speculators felt more comfortable, and also back to a level where the shares would then again meet certain regulatory hurdles, thus making it easier to distribute the stock. You took the stock that was originally done and pumped it up to a dollar. In order to maintain it at a dollar and absorb all the stock, you needed a constant flow of hype.

When the shares eventually sank (because the distribution began to back up on the dealers a little bit), you would give the stock a secondary chance by instituting a reverse stock split. That would boost the price of the shares back up to where they were, usually even higher. Of course the spreads would widen out, and as anyone knows in reverse stock split penny deal, the spreads always get very, very wide. But you simply disguise those spreads.

The dealers can very easily disguise those spreads by either not posting Bids and Asks on the pink sheets, or just posting socalled nominal Bids and Asks which would give the appearance to the wouldbe investor that the stock was substantially more liquid than it was. But the reverse stock split was always the last link in the chain of the fraud of the underlying deal. Because the last time you would pump it up would be through this artifice, this device using a reverse stock split. It wouldn’t be long thereafter that simply the deal would fall apart, and you could distribute the stock all the way back down to a penny bid, three cents offered, which we did on a lot of deals.

Once the broker/dealers were out or were “whole” financially as well as your other market makers and specialists, once you had made them whole financially, because you had so severely discounted the stock to them to begin with, then there would always be 30 million or 40 million shares left over. And the Bids and Asks would quickly go to like a penny bid, three cents offered, but with that, you would get a whole new crop of potential investors. You would keep a little bit of hype there. You’d keep a little bit of activity and spread on the sheets. And there’s a whole lot of people that will buy 10,000, 20,000 shares of a two or three cent stock in hopes that it might be a twenty or thirty cent stock. You do open yourself up at a penny making a market of one and three cents you open yourself up to a whole new crop of speculators that will be sellers of a deal at twenty cents, not buyers of a deal at twenty cents.

We use to call these type of penny speculators “green feet.” We used to delineate them by where the stocks traded, on what sheets, in other words. For instance, a pink sheet speculator is someone who bought higher priced penny stocks and shares that traded in the low dollars. Of course, when the stock fell down below the pink sheet regulatory level, it would be kicked down to the green sheets. That’s where you find the one cent, three cent, five cent stocks. When they could no longer be maintained at that level, they would be kicked down to the yellow sheets. That’s where you would sometimes see stocks trading in mils so many mils bid, so many mils offered. As long as there was still somebody willing to buy it, a market could be maintained, particularly since the stock, by this point, did not cost anything to the broker/dealers or those who initiated the fraud. Everybody was out and clean and made their money, and public shareholders were the ultimate bag holders. But you could actually keep these deals floating and alive for a long time before they absolutely fell apart.

.jpg)