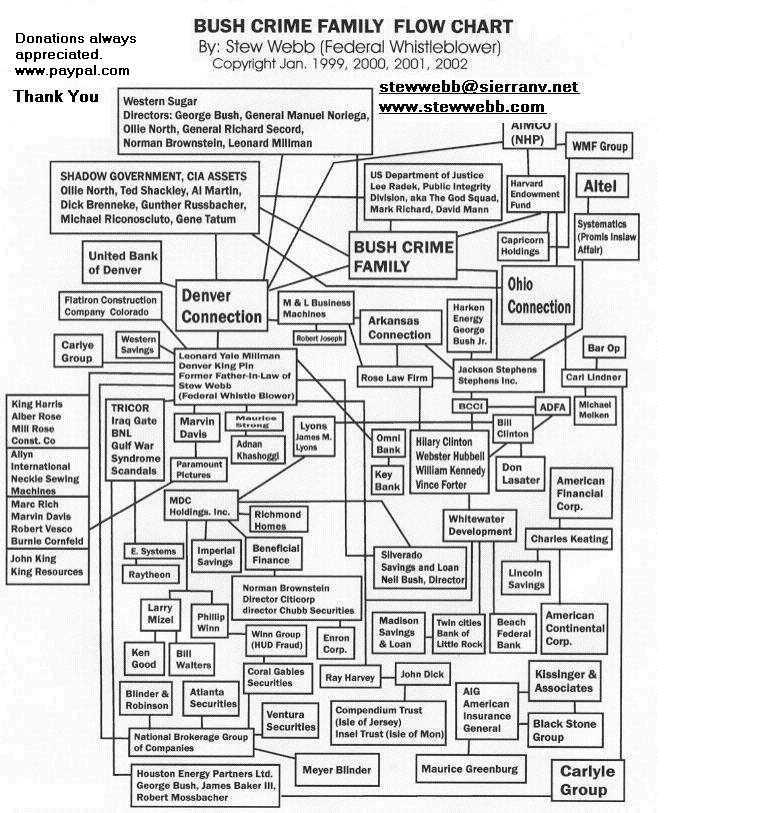

Larry Mizel Financial Terrorist Personal Trusts

October 31, 2019

By stew Webb

US Federal Whistle blower

federalwhistleblower@gmail.com

Stew Webb US Federal Whistle blower Grand Jury Demand against Larry Mizel

http://www.stewwebb.com/2015/01/05/stew-webb-grand-jury-demand-

kerre-millman-attempted-murder/

MDC / M.D.C. Holdings, Inc. / MIZEL LARRY A – SCHEDULE 13D/A Activist

Investment

Security MDC / M.D.C. Holdings, Inc. (552676108)

Form Type SC 13D/A

File Date 2019-03-15

Related Securities 5526J0AB4 / M D C Holdings Inc 5.375% Notes 07/01/2015

5526J0AA6 / M D C Holdings Inc 5.375% Notes 12/15/2014

552676AP3 / M.d.c. Holdings, Inc. 5.625% Senior Notes 02/01/20

552676AQ1 / M.d.c. Holdings, Inc. 6.00% 01/15/43

Related Documents

2019-03-15 SC 13D/A MDC / M.D.C. Holdings, Inc. / MANDARICH DAVID D

- SCHEDULE 13D/A Activist Investment

2019-03-15 SC 13D/A MDC / M.D.C. Holdings, Inc. / MIZEL LARRY A –

SCHEDULE 13D/A Activist Investment

2019-03-15 SC 13D/A MDC / M.D.C. Holdings, Inc. / MANDARICH DAVID D

- SCHEDULE 13D/A Activist Investment

2019-03-15 SC 13D/A MDC / M.D.C. Holdings, Inc. / MIZEL LARRY A –

SCHEDULE 13D/A Activist Investment

2018-02-07 SC 13D/A MDC / M.D.C. Holdings, Inc. / MIZEL LARRY A –

SCHEDULE 13D/A Activist Investment

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 2)*

M.D.C. HOLDINGS, INC.

(Name of Issuer)

Common Stock, $0.01 Per Share

(Title of Class of Securities)

552676 108

(CUSIP Number)

Larry A. Mizel, 4350 S. Monaco St., Suite 500, Denver, CO 80237

(303) 773-1100

(Name, Address and Telephone Number of Person Authorized to Receive Notices and

Communications)

March 15, 2019

(Date of Event which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report

the acquisition which is the subject of this Schedule 13D, and is filing this

schedule because of Rule 13d-1 (e), 13d-1(f) or 13d-1(g), check the following

box [ ].

*

The remainder of this cover page shall be filled out for a reporting person’s

initial filing on this form with respect to the subject class of securities,

and for any subsequent amendment containing information which would alter

disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be

deemed to be “filed” for the purposes of Section 18 of the Securities Exchange

Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of

the Act but shall be subject to all other provisions of the Act (however, see

the Notes).

Page 1 of 4

CUSIP NO. 552676 108

(1) NAME OF REPORTING PERSON

Larry A. Mizel

(2) CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (a) [ ]

Not Applicable (b) [ ]

(3) SEC USE ONLY

(4) SOURCE OF FUNDS

OO

(5) CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO

ITEMS 2(d) or 2 (e) [ ]

Not Applicable

(6) CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America

(7) SOLE VOTING POWER

2,409,275Number of

Shares (8) SHARED VOTING POWER

Beneficially 7,939,549

Owned by

Each (9) SOLE DISPOSITIVE POWER

Reporting 2,409,275

Person with

(10) SHARED DISPOSITIVE POWER

7,939,549

(11) AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

10,348,824

(12) CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

[ ]

Not Applicable (13) PERCENT OF CLASS REPRESENTED BY THE AMOUNT IN ROW (11)

16.3%

(14) TYPE OF REPORTING PERSON

IN

Page 2 of 4

EXPLANATORY NOTE: This is a voluntary filing to reflect changes in Reporting

Person’s holdings over the prior year. This amendment amends and supplements

only information that has changed since the filing of the previous amendment.

All share amounts have been adjusted to reflect the distribution of an eight

percent (8%) stock dividend on February 28, 2019.

The Reporting Person, Larry A. Mizel, hereby amends his Schedule 13D relating

to the Common Stock, par value $0.01, of M.D.C. Holdings, Inc. (the “Company”).

Item 5.

Interest in Securities of the Issuer

(a)

Mr. Mizel beneficially owns an aggregate of 10,348,824 shares of Common Stock,

representing approximately 16.3% of the outstanding Common Stock of the

Company. The ownership percentage set forth above is based upon 61,338,701

shares of Common Stock of the Company outstanding, as reported in the Company’s

Schedule 14A filed on March 4, 2019, plus an additional 2,277,976 shares which

Mr. Mizel has the right to acquire upon the exercise of stock options that are

fully vested.

(b)

Mr. Mizel has the:

(i)

Sole power to vote or direct the vote of 2,409,275 shares. This consists of

2,277,976 shares issuable upon the exercise of stock options granted under the

Company’s equity incentive plans, 125,958 shares of restricted stock granted

under the Company’s equity incentive plans, and 5,341 unitized shares held in a

stock fund in the Company’s 401(k) Savings Plan, which changes on a daily

basis.

(ii)

Shared power to vote or direct the vote of 7,939,549 shares.

The amount in Item 5(b)(ii) includes 3,821,319 shares held by Ari Capital

Partners, LLLP (“Ari Capital”) of which Mr. Mizel may be deemed to have

beneficial ownership. The sole general partner of Ari Capital is CVentures,

Inc. (“CVentures”). Mr. Mizel and family members are the beneficiaries of

various trusts which own approximately 50.7% of the stock of CVentures. Also,

Mr. Mizel is a director and chairman of the board of CVentures and may be

deemed to control the other approximately 49.3% of the common stock of

CVentures. A trust, of which the Mr. Mizel is the sole beneficiary, is the sole

limited partner of Ari Capital, and has approximately a 99% partnership

interest in Ari Capital. Mr. Mizel and Mr. Mizel’s spouse are trustees of the

trust.

The amount in Item 5(b)(ii) includes 2,449,440 shares held by Cascia Holdings

LLC (“Cascia”). Mr. Mizel may be deemed to have beneficial ownership of the

shares held by Cascia. Two trusts hold 99% of the total outstanding LLC units

in Cascia. Mr. Mizel’s spouse is a trustee of each of the trusts and Mr.

Mizel’s family members are the beneficiaries of these trusts. Mr. Mizel’s

spouse, who is the sole manager of Cascia, holds all of the voting LLC units in

Cascia, which constitutes 1% of the total outstanding LLC units.

The amount in Item 5(b)(ii) includes 1,668,328 shares held by CGM Capital LLLP

(“CGM Capital”) of which Mr. Mizel may be deemed to have beneficial ownership.

The general partner of CGM Capital is CVentures. A trust, of which Mr. Mizel’s

spouse is the sole beneficiary, is the limited partner of CGM Capital, and has

a 99% partnership interest in CGM Capital. Mr. Mizel is a trustee of this

trust.

The amount in Item 5(b)(ii) includes 462 shares held by a trust of which Mr.

Mizel may be deemed to have beneficial ownership although Mr. Mizel has no

pecuniary interest in such shares. Mr. Mizel is a trustee of this trust and a

director of the two foundations which are the beneficiaries of such trust.

Page 3 of 4

(iii)

Sole power to dispose or direct the disposition of 2,409,275 shares. This

consists of the shares described in response to Item 5(b)(i) above.

(iv)

Shared power to dispose or direct the disposition of 7,939,549 shares. This

consists of the shares described in response to Item 5(b)(ii) above.

(c)

On February 1, 2019, Mr. Mizel was granted 32,895 shares of restricted stock

under the Company’s 2011 Equity Incentive Plan.

(d)

Other than as described in Item 5(b) above, no other person is known to have

the right to receive or the power to direct the receipt of dividends from, or

the proceeds from the sale of, the shares of Common Stock of the Company

reported herein.

(e)

Not applicable.

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify

that the information set forth in this statement is true, complete and correct.

Date: March 15, 2019

Signature: /s/ Larry A. Mizel

Name: Larry A. Mizel

Contributions by mail:

Stew Webb

10607 E. Sheley Rd.

Independence, MO 64052

Contact Stew Webb

(Cell) 816-492-9809

federalwhistleblower@gmail.com

.jpg)